Form 14234 Rev 8 Compliance Assurance Process CAP Application 2024-2026

What is the Form 14234 Rev 8 Compliance Assurance Process CAP Application

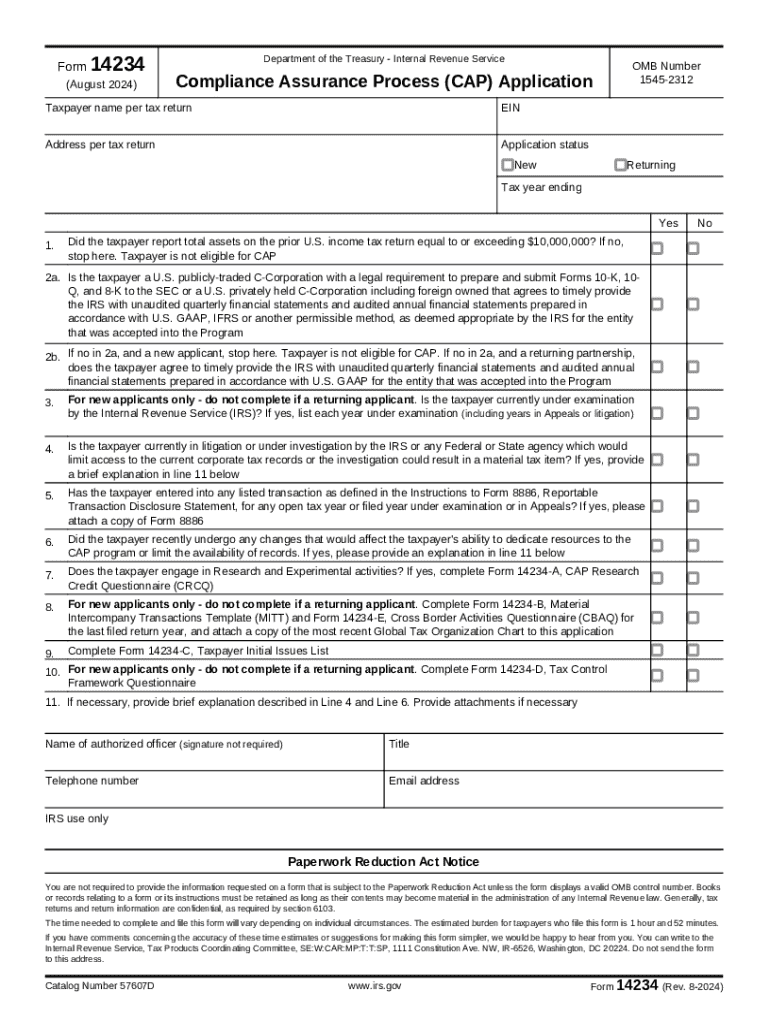

The Form 14234 Rev 8, known as the Compliance Assurance Process (CAP) Application, is a document used by businesses to request participation in the IRS's Compliance Assurance Process. This program is designed to provide large corporations with a proactive approach to tax compliance, allowing them to resolve issues before they become significant problems. The form is essential for organizations seeking to establish a cooperative relationship with the IRS, ensuring that their tax positions are understood and accepted prior to filing.

How to use the Form 14234 Rev 8 Compliance Assurance Process CAP Application

Using the Form 14234 Rev 8 involves several steps. First, businesses must download the form in PDF format from the IRS website or other authorized sources. Once obtained, the form should be filled out with accurate and complete information regarding the business's tax history and operations. After completing the form, it must be submitted to the IRS for review. Engaging with a tax professional during this process can enhance the accuracy of the application and ensure compliance with IRS requirements.

Steps to complete the Form 14234 Rev 8 Compliance Assurance Process CAP Application

Completing the Form 14234 Rev 8 requires careful attention to detail. Follow these steps:

- Download the form from an authorized source.

- Provide accurate business information, including the legal name, address, and employer identification number (EIN).

- Detail the business's tax history and any prior interactions with the IRS.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the completed form to the appropriate IRS office, following any specific submission guidelines.

Legal use of the Form 14234 Rev 8 Compliance Assurance Process CAP Application

The Form 14234 Rev 8 is legally recognized as a formal application to participate in the Compliance Assurance Process. Its use is governed by IRS regulations, and accurate completion is critical to ensure compliance with federal tax laws. Businesses must understand that submitting this form does not guarantee acceptance into the program, and they must adhere to all IRS guidelines throughout the process.

Key elements of the Form 14234 Rev 8 Compliance Assurance Process CAP Application

Key elements of the Form 14234 Rev 8 include:

- Business Information: Essential details about the entity, including its structure and tax identification.

- Tax History: A comprehensive overview of the business's past tax filings and any issues encountered.

- Compliance Goals: A statement outlining the business's objectives in seeking participation in the CAP.

- Signature Section: Required signatures from authorized representatives of the business.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 14234 Rev 8. It is crucial for businesses to familiarize themselves with these guidelines to ensure compliance. The IRS outlines eligibility criteria, required documentation, and submission methods, which can be found in the instructions accompanying the form. Adhering to these guidelines helps facilitate a smoother application process and enhances the likelihood of acceptance into the CAP.

Create this form in 5 minutes or less

Find and fill out the correct form 14234 rev 8 compliance assurance process cap application

Create this form in 5 minutes!

How to create an eSignature for the form 14234 rev 8 compliance assurance process cap application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form cap application pdf?

A form cap application pdf is a digital document that allows users to fill out and submit applications electronically. With airSlate SignNow, you can easily create, edit, and manage these forms, streamlining your application process.

-

How can I create a form cap application pdf using airSlate SignNow?

Creating a form cap application pdf with airSlate SignNow is simple. You can start by uploading your existing PDF document, then use our intuitive editor to add fields for signatures, dates, and other necessary information, making it easy for users to complete the application.

-

What are the pricing options for using airSlate SignNow for form cap application pdfs?

airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features for creating and managing form cap application pdfs, ensuring you have the right tools at an affordable price.

-

What features does airSlate SignNow offer for form cap application pdfs?

airSlate SignNow provides a range of features for form cap application pdfs, including customizable templates, electronic signatures, and real-time tracking. These features enhance the efficiency of your document management process.

-

Can I integrate airSlate SignNow with other applications for form cap application pdfs?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to enhance your workflow for form cap application pdfs. You can connect with tools like Google Drive, Salesforce, and more to streamline your document processes.

-

What are the benefits of using airSlate SignNow for form cap application pdfs?

Using airSlate SignNow for form cap application pdfs offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. By digitizing your application process, you can save time and resources while ensuring compliance.

-

Is it secure to use airSlate SignNow for form cap application pdfs?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your form cap application pdfs. You can trust that your sensitive information is safe and secure throughout the signing process.

Get more for Form 14234 Rev 8 Compliance Assurance Process CAP Application

- Limited liability company llc operating agreement west virginia form

- Single member limited liability company llc operating agreement west virginia form

- Renunciation and disclaimer of property from will by testate west virginia form

- Notice of mechanics lien by contractor individual west virginia form

- Quitclaim deed from individual to husband and wife west virginia form

- Warranty deed from individual to husband and wife west virginia form

- Quitclaim deed from corporation to husband and wife west virginia form

- Warranty deed from corporation to husband and wife west virginia form

Find out other Form 14234 Rev 8 Compliance Assurance Process CAP Application

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation