Tax Preparation Contract Template Form

What is the Tax Preparation Contract Template

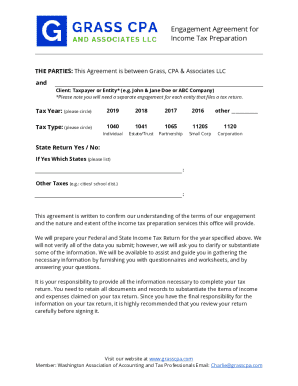

The tax preparer agreement form is a crucial document that outlines the relationship between a tax preparer and their client. This form serves as a formal contract, detailing the services provided, fees, and the responsibilities of both parties. It is essential for ensuring clarity and legal protection during the tax preparation process. By using this template, tax preparers can establish a professional framework that governs their interactions with clients, ensuring compliance with relevant regulations and standards.

Key Elements of the Tax Preparation Contract Template

A comprehensive tax preparer contract should include several key elements to ensure it is effective and legally binding. These elements typically consist of:

- Contact Information: Names, addresses, and contact details of both the tax preparer and the client.

- Scope of Services: A detailed description of the services to be provided, such as tax return preparation, consultation, and filing.

- Fees and Payment Terms: Clear information on the fees for services rendered, payment methods, and due dates.

- Confidentiality Clause: Provisions to protect the client's sensitive financial information.

- Termination Conditions: Terms under which either party can terminate the agreement.

Steps to Complete the Tax Preparation Contract Template

Completing the tax preparer agreement form involves several straightforward steps. First, gather all necessary information, including personal details and financial data. Next, fill out the template with accurate information, ensuring that all sections are completed. After completing the form, both parties should review it for accuracy and clarity. Once satisfied, both the tax preparer and the client should sign the document, either physically or electronically, to finalize the agreement.

Legal Use of the Tax Preparation Contract Template

The legal use of the tax preparer contract is governed by specific regulations that ensure its validity. In the United States, eSignatures are recognized under the ESIGN and UETA acts, making electronic agreements legally binding, provided they meet certain criteria. This includes ensuring that both parties consent to use electronic signatures and that the document is stored securely. By adhering to these legal standards, tax preparers can confidently utilize the tax preparer agreement form in their practice.

IRS Guidelines

When preparing taxes, it is essential to follow IRS guidelines to ensure compliance and avoid penalties. The IRS provides specific instructions regarding the responsibilities of tax preparers, including the requirement to obtain a Preparer Tax Identification Number (PTIN). Additionally, tax preparers must adhere to ethical standards and maintain client confidentiality. Familiarity with IRS guidelines helps tax preparers provide accurate services and fosters trust with clients.

Filing Deadlines / Important Dates

Understanding filing deadlines is critical for both tax preparers and their clients. Typically, individual tax returns are due on April 15 each year, although this date may vary slightly depending on weekends or holidays. Extensions can be requested, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties. Staying informed about these important dates ensures timely filing and compliance with tax obligations.

Quick guide on how to complete tax preparation contract template

Effortlessly Prepare Tax Preparation Contract Template on Any Device

The management of online documents has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Manage Tax Preparation Contract Template on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related procedure today.

The easiest way to modify and electronically sign Tax Preparation Contract Template effortlessly

- Find Tax Preparation Contract Template and click on Get Form to begin.

- Utilize the features available to complete your document.

- Emphasize important sections of the documents or redact sensitive details with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device of your choice. Modify and electronically sign Tax Preparation Contract Template to ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax preparation contract template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax preparer agreement form?

A tax preparer agreement form is a legal document that outlines the relationship between a tax preparer and their client. This form specifies the scope of work, fees, and responsibilities involved in the preparation of tax returns. Using airSlate SignNow, you can easily create, send, and eSign your tax preparer agreement form to ensure all parties are on the same page.

-

How can airSlate SignNow help with tax preparer agreement forms?

airSlate SignNow simplifies the process of managing your tax preparer agreement forms by providing a user-friendly platform for document creation and electronic signatures. With our solution, you can quickly draft, send, and securely sign your forms, ensuring compliance and efficiency in your tax preparation services. It's an all-in-one solution catering to your document needs.

-

What features does airSlate SignNow offer for tax preparer agreement forms?

airSlate SignNow offers a range of features for creating tax preparer agreement forms, including customizable templates, secure electronic signatures, and cloud storage. Additionally, our platform integrates seamlessly with popular business tools, making document management effortless. You can also track the status of your forms in real-time.

-

Is there a cost associated with using airSlate SignNow for tax preparer agreement forms?

Yes, using airSlate SignNow for your tax preparer agreement forms comes with a subscription cost, which varies based on the plan you select. The pricing is competitive, offering different tiers that cater to varying business needs. It's a cost-effective solution for streamlining your document signing processes.

-

Can I integrate airSlate SignNow with other applications for managing tax preparer agreement forms?

Absolutely! airSlate SignNow provides integrations with various popular applications, allowing you to manage your tax preparer agreement forms and other documents seamlessly. Whether you use CRM systems, file storage solutions, or project management tools, our integrations enable smooth workflows and data synchronization.

-

What are the benefits of using airSlate SignNow for tax preparer agreement forms?

The benefits of using airSlate SignNow for tax preparer agreement forms include increased efficiency, reduced turnaround time, and enhanced document security. By digitizing your process, you eliminate the hassles of paper-based agreements, ensuring a faster and more reliable service for your clients. Additionally, you can access your forms anytime, anywhere.

-

How secure is the airSlate SignNow platform for tax preparer agreement forms?

airSlate SignNow prioritizes the security of your tax preparer agreement forms and related documents. We employ advanced encryption technologies and comply with industry standards to protect your data throughout the signing process. With our platform, you can confidently manage your sensitive documents without worrying about unauthorized access.

Get more for Tax Preparation Contract Template

Find out other Tax Preparation Contract Template

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement