Payroll Tax Return Form

What is the Payroll Tax Return

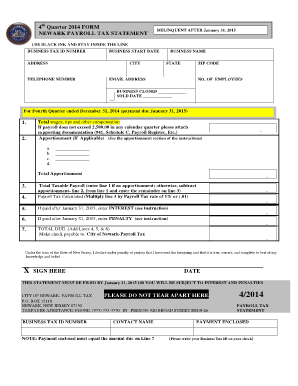

The payroll tax return is a critical document that businesses in the City of Newark must complete to report their payroll tax obligations. This form details the wages paid to employees and the corresponding taxes withheld. It serves as a record for both employers and tax authorities, ensuring compliance with local tax regulations. Understanding this form is essential for accurate reporting and avoiding potential penalties.

Steps to Complete the Payroll Tax Return

Completing the payroll tax return involves several key steps to ensure accuracy and compliance. Follow these guidelines:

- Gather employee wage information: Collect data on all employees, including their total wages and any deductions.

- Calculate payroll taxes: Determine the total payroll taxes owed based on the applicable rates for the City of Newark.

- Fill out the form: Use the city of Newark payroll tax forms fillable option to enter the collected information accurately.

- Review for accuracy: Double-check all entries to ensure there are no mistakes that could lead to penalties.

- Submit the form: File the completed payroll tax return by the designated deadline, either online or via mail.

Legal Use of the Payroll Tax Return

The payroll tax return is not just a formality; it has legal implications. When filled out correctly, it serves as a legally binding document that reflects the employer's compliance with tax laws. To ensure its legal standing, the form must be signed and submitted according to the regulations set forth by the City of Newark. Using a reliable digital solution can enhance the legal validity of the document by providing a secure eSignature and maintaining compliance with federal eSignature laws.

Required Documents

To complete the payroll tax return, certain documents are necessary. These include:

- Employee wage records: Detailed accounts of all wages paid during the reporting period.

- Tax withholding records: Documentation of all taxes withheld from employee wages.

- Previous payroll tax returns: Past filings can provide a reference for current submissions.

- Identification numbers: Employer Identification Number (EIN) and any relevant state tax identification numbers.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for compliance. For the City of Newark, payroll tax returns must typically be filed quarterly or annually, depending on the business's size and tax obligations. Mark your calendar with these important dates to avoid late penalties:

- Quarterly filings: Due on the last day of the month following the end of each quarter.

- Annual filings: Generally due by January 31 of the following year.

Form Submission Methods (Online / Mail / In-Person)

Employers in Newark have several options for submitting their payroll tax returns. These methods include:

- Online submission: Many businesses prefer this method for its speed and convenience.

- Mail: Completed forms can be sent to the appropriate tax authority address.

- In-person filing: Some employers may choose to submit their forms directly at local tax offices.

Quick guide on how to complete payroll tax return

Finalize Payroll Tax Return seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly and without interruptions. Handle Payroll Tax Return on any device with airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to amend and eSign Payroll Tax Return effortlessly

- Find Payroll Tax Return and then click Retrieve Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Finish button to secure your modifications.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Payroll Tax Return to ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the city of Newark payroll tax forms fillable options available on airSlate SignNow?

airSlate SignNow offers a range of city of Newark payroll tax forms fillable options that are easily accessible and customizable. Users can fill out these forms digitally, ensuring compliance and accuracy. The platform simplifies the process, allowing you to complete your payroll tax forms with ease.

-

How can I access the city of Newark payroll tax forms fillable on airSlate SignNow?

You can access the city of Newark payroll tax forms fillable directly through our user-friendly interface. Simply log in to your account, navigate to the forms section, and select the relevant payroll tax forms. This streamlined access makes it easy for businesses to meet their payroll requirements.

-

Are there any costs associated with using the city of Newark payroll tax forms fillable?

Yes, there is a subscription fee for utilizing airSlate SignNow's services, which includes access to city of Newark payroll tax forms fillable. We offer various pricing plans to suit businesses of all sizes, ensuring you find an option that meets your needs without breaking the bank.

-

Can I integrate my accounting software with the city of Newark payroll tax forms fillable?

Absolutely! airSlate SignNow allows seamless integration with various accounting software to enhance your payroll processes. This feature simplifies the management of your city of Newark payroll tax forms fillable, making it easier to track and file your taxes efficiently.

-

What features make airSlate SignNow the best option for city of Newark payroll tax forms fillable?

airSlate SignNow provides features such as easy eSignature capabilities, secure document storage, and real-time tracking. These features are essential for efficiently handling city of Newark payroll tax forms fillable, fostering a more organized and compliant payroll system.

-

Is it easy to fill out the city of Newark payroll tax forms fillable on airSlate SignNow?

Yes, filling out the city of Newark payroll tax forms fillable on airSlate SignNow is incredibly user-friendly. The platform offers step-by-step guidance, making it straightforward for users to fill in required information accurately and efficiently.

-

What benefits do I get from using airSlate SignNow for city of Newark payroll tax forms fillable?

Using airSlate SignNow for your city of Newark payroll tax forms fillable provides numerous benefits, including increased efficiency and reduced errors. Businesses can save time and resources while ensuring their payroll tax forms are compliant with local regulations.

Get more for Payroll Tax Return

Find out other Payroll Tax Return

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter