Withdrawal Partnership Form

What is the withdrawal partnership?

The withdrawal partnership refers to the formal process by which a partner exits a business partnership. This action can be voluntary or involuntary and typically requires the completion of a withdrawal partnership agreement. This document outlines the terms and conditions under which a partner can withdraw, ensuring that all parties understand their rights and obligations. It is essential for maintaining the integrity of the partnership and protecting the interests of both the departing partner and the remaining partners.

Steps to complete the withdrawal partnership

Completing the withdrawal partnership involves several key steps to ensure that the process is legally binding and clear. Here are the essential steps:

- Review the partnership agreement to understand the terms of withdrawal.

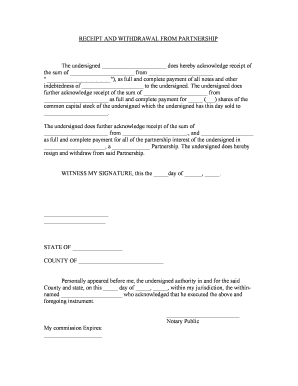

- Draft a withdrawal partnership form that includes details such as the date of withdrawal, reasons for leaving, and any financial settlements.

- Obtain signatures from all partners to acknowledge the withdrawal.

- File the completed form with the appropriate state authorities if required.

- Update any business licenses or registrations to reflect the change in partnership structure.

Legal use of the withdrawal partnership

The legal use of the withdrawal partnership is governed by state laws and the original partnership agreement. For a withdrawal to be considered valid, it must comply with relevant legal frameworks, including the Uniform Partnership Act. This ensures that the withdrawal does not adversely affect the remaining partners or the business's operations. Additionally, it is crucial to document the withdrawal properly to avoid potential disputes or misunderstandings in the future.

Required documents for withdrawal partnership

To facilitate a smooth withdrawal from a partnership, specific documents are necessary. These typically include:

- Withdrawal partnership agreement or form.

- Updated partnership agreement reflecting the changes.

- Financial statements or settlement documents if applicable.

- Any state-specific forms required for filing.

Having these documents prepared and organized can help streamline the withdrawal process and ensure compliance with legal requirements.

Examples of using the withdrawal partnership

Examples of situations that may necessitate a withdrawal partnership include:

- A partner wishing to retire from the business.

- A partner relocating and unable to continue their involvement.

- Disagreements among partners leading to a voluntary exit.

- Financial difficulties prompting a partner to withdraw.

Each scenario requires careful consideration of the partnership agreement and the legal implications of withdrawal.

State-specific rules for the withdrawal partnership

State-specific rules can significantly impact the withdrawal partnership process. Each state may have different regulations regarding how a partner can withdraw, the notice period required, and the documentation needed. It is essential for partners to familiarize themselves with their state's laws to ensure compliance and avoid potential legal issues. Consulting with a legal professional can provide valuable guidance tailored to the specific jurisdiction.

Quick guide on how to complete withdrawal partnership

Effortlessly handle Withdrawal Partnership on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without holdups. Manage Withdrawal Partnership on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to edit and electronically sign Withdrawal Partnership effortlessly

- Find Withdrawal Partnership and select Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize critical sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your documentation management needs in just a few clicks from any device you prefer. Edit and electronically sign Withdrawal Partnership and ensure excellent communication throughout every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a withdrawal partnership in the context of airSlate SignNow?

A withdrawal partnership refers to a specific agreement where businesses can easily manage the electronic signing and documentation processes for partnerships, including handling withdrawals efficiently. With airSlate SignNow, this feature allows organizations to streamline their document workflows while ensuring compliance and security in their transactions.

-

How can a withdrawal partnership benefit my business?

Utilizing a withdrawal partnership with airSlate SignNow can signNowly reduce the time it takes to process important documents. By automating the signing process, businesses can enhance productivity, minimize errors, and ensure that all stakeholders are aligned on contractual agreements and withdrawals.

-

Is there a pricing plan specifically for withdrawal partnerships?

airSlate SignNow offers flexible pricing plans that can be tailored to meet the needs of businesses looking to leverage withdrawal partnerships. These plans provide access to features that cater specifically to managing documents associated with withdrawals, allowing firms to choose the option that best fits their budget and requirements.

-

What features are included in the withdrawal partnership functionality?

The withdrawal partnership functionality within airSlate SignNow includes features like customizable templates, automated workflows, and secure digital signing. These tools ensure that businesses can create, send, and manage withdrawal documents seamlessly and efficiently.

-

Can I integrate airSlate SignNow with other tools for my withdrawal partnership?

Yes, airSlate SignNow offers integrations with a variety of third-party applications that can enhance your withdrawal partnership operations. By connecting with CRM systems, cloud storage, and other essential software, businesses can create a cohesive process that supports their documentation needs.

-

What security measures are in place for withdrawal partnerships?

Security is a top priority for airSlate SignNow, especially when managing withdrawal partnerships. The platform employs robust encryption, secure login protocols, and compliance with industry standards to protect sensitive information during the signing process.

-

How can I track document status in a withdrawal partnership?

With airSlate SignNow, businesses can easily track the status of documents involved in withdrawal partnerships in real-time. The platform provides notifications and updates, allowing users to see when a document is viewed, signed, or completed, thus ensuring transparency throughout the process.

Get more for Withdrawal Partnership

- Letter from landlord to tenant as notice to remove unauthorized inhabitants iowa form

- Utility off notice form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat iowa form

- Notice to primary contractor of furnishing by corporation or llc iowa form

- Waiver of lien by individual iowa form

- Ia lien 497304987 form

- Conditional waiver and release of lien upon progress payment iowa form

- Notice non compliance 497304990 form

Find out other Withdrawal Partnership

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History