Np 20a Form

What is the NP 20a?

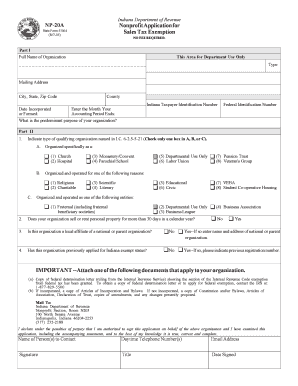

The NP 20a is a specific form used in the state of Indiana, primarily for legal and administrative purposes. It is often required in various transactions or applications where official documentation is necessary. Understanding the NP 20a is crucial for ensuring compliance with state regulations and for facilitating smooth processes in legal matters.

How to Use the NP 20a

Using the NP 20a involves several steps to ensure that the form is completed accurately and submitted correctly. First, gather all required information and documents needed to fill out the form. Next, carefully complete each section of the NP 20a, ensuring that all details are accurate and up to date. Once the form is filled out, it can be submitted either electronically or via traditional mail, depending on the specific requirements associated with the form.

Steps to Complete the NP 20a

Completing the NP 20a requires attention to detail. Follow these steps for effective completion:

- Review the instructions provided with the form to understand all requirements.

- Gather necessary documents, such as identification and any supporting materials.

- Fill out each section of the NP 20a, ensuring clarity and accuracy.

- Double-check all entries for any errors or omissions.

- Sign and date the form as required.

- Submit the form according to the specified submission methods.

Legal Use of the NP 20a

The NP 20a is legally binding when completed and submitted in accordance with Indiana state laws. It is essential to ensure that the form complies with relevant regulations to avoid any legal complications. Utilizing a reliable electronic signature platform can enhance the legal standing of the NP 20a by providing necessary authentication and security measures.

Required Documents

When completing the NP 20a, certain documents may be required to support the information provided. Commonly required documents include:

- Proof of identity, such as a driver's license or state ID.

- Any previous versions of the NP form, if applicable.

- Supporting documents that validate the purpose of the NP 20a.

Form Submission Methods

The NP 20a can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through designated state portals.

- Mailing the completed form to the appropriate office.

- In-person submission at designated government offices.

Quick guide on how to complete np 20a

Manage Np 20a effortlessly on any device

Web-based document handling has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents swiftly without delays. Handle Np 20a on any system with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Np 20a effortlessly

- Locate Np 20a and click on Obtain Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark important sections of the documents or obscure private information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Complete button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and eSign Np 20a and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the np 20a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form np 20a and how is it used?

The form np 20a is a specific type of document used for various purposes in businesses and legal settings. It is commonly needed for submissions that require electronic signatures and is fully supported by airSlate SignNow's platform, enhancing the efficiency of document workflows.

-

How does airSlate SignNow simplify the process of filling out the form np 20a?

airSlate SignNow streamlines the process of completing the form np 20a by providing a user-friendly interface and customizable templates. Users can easily input necessary information, set signing rules, and send the document for signatures, which saves time and reduces errors.

-

Is there a cost associated with using airSlate SignNow for the form np 20a?

Yes, there are various pricing plans available for using airSlate SignNow, all designed to be cost-effective and scalable. By selecting a plan that fits your needs, you can easily manage and eSign the form np 20a without compromising on features.

-

What features does airSlate SignNow offer for managing the form np 20a?

airSlate SignNow offers features such as document sharing, cloud storage, and real-time tracking for the form np 20a. These tools enable users to manage their documents efficiently and track the signing process from start to finish.

-

Can I access my form np 20a from different devices?

Absolutely! airSlate SignNow is a cloud-based solution, allowing you to access your form np 20a from any device, whether it's a desktop, tablet, or smartphone. This flexibility ensures that you can manage and sign documents on the go, enhancing productivity.

-

Does airSlate SignNow integrate with other applications for the form np 20a?

Yes, airSlate SignNow offers numerous integrations with popular applications, enhancing the function of the form np 20a. Whether you use CRM software or project management tools, these integrations can streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for the form np 20a?

The primary benefits of using airSlate SignNow for the form np 20a include increased efficiency, reduced turnaround time, and lower mistakes. Its intuitive design and strong security features ensure that your documents are handled safely and professionally.

Get more for Np 20a

Find out other Np 20a

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile