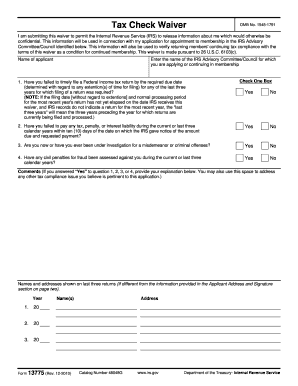

Irs Form 13775

What is the IRS Form 13775

The IRS Form 13775 is a document used by taxpayers to request a change in their tax return information. This form is particularly relevant for individuals who need to amend previously submitted tax returns or correct discrepancies in their tax records. Understanding the purpose of this form is crucial for ensuring accurate tax filings and compliance with IRS regulations.

How to use the IRS Form 13775

Using the IRS Form 13775 involves several steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website or other official sources. Next, fill out the form with accurate information regarding the changes you wish to make. It is essential to provide clear explanations for each amendment, as this will facilitate the review process by the IRS. Once completed, submit the form according to the instructions provided, either online or via mail.

Steps to complete the IRS Form 13775

Completing the IRS Form 13775 requires attention to detail. Follow these steps:

- Gather all relevant tax documents and previous returns.

- Download and print the IRS Form 13775.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly specify the changes you are requesting and provide any necessary explanations.

- Double-check your entries for accuracy and completeness.

- Sign and date the form before submitting it.

Legal use of the IRS Form 13775

The legal use of the IRS Form 13775 is governed by IRS guidelines, which stipulate that the form must be filled out truthfully and accurately. Submitting false information can lead to penalties, including fines or further legal action. It is important to ensure that all claims made on the form are supported by appropriate documentation and comply with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 13775 can vary depending on the type of amendment being requested. Generally, taxpayers should aim to submit the form as soon as they identify the need for a change. It is advisable to check the IRS website for specific deadlines related to the current tax year, as late submissions may result in complications or penalties.

Examples of using the IRS Form 13775

Common scenarios for using the IRS Form 13775 include correcting errors in reported income, adjusting deductions, or addressing discrepancies in tax credits. For instance, if a taxpayer realizes that they forgot to include a W-2 form in their original return, they can use this form to amend their filing and ensure that their tax obligations are accurately reflected.

Quick guide on how to complete irs form 13775

Finalize Irs Form 13775 effortlessly on any gadget

Digital document handling has become increasingly favored by businesses and individuals alike. It offers a superb environmentally-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 13775 on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Irs Form 13775 without hassle

- Obtain Irs Form 13775 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the data and click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Put an end to the worry of missing or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Form 13775 and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 13775

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 13775 and its purpose?

IRS Form 13775 is a form used for specific tax filings and compliance. It helps taxpayers report certain financial information essential for tax calculations. Proper utilization of IRS Form 13775 ensures that businesses remain compliant with federal tax regulations.

-

How can airSlate SignNow assist with IRS Form 13775?

airSlate SignNow streamlines the e-signing process for IRS Form 13775, making it easy to send, sign, and manage your documents securely. Our platform is user-friendly and provides a cost-effective solution for handling all your paperwork digital needs. By using airSlate SignNow, you can ensure that your IRS Form 13775 is handled efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Form 13775?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs, including features designed specifically for managing IRS Form 13775. Our pricing is competitive and designed to provide value through a comprehensive e-signature solution. You can choose a plan that fits your requirements without breaking the bank.

-

What are the key features of airSlate SignNow related to IRS Form 13775?

Key features of airSlate SignNow include secure e-signing, document tracking, and customizable workflows specifically for IRS Form 13775. Our platform also allows for collaboration between multiple users, which can be invaluable for completing required filings efficiently. Additionally, our integration capabilities streamline the process further.

-

How does airSlate SignNow ensure security for IRS Form 13775?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents such as IRS Form 13775. We utilize encryption protocols and secure cloud storage to protect your data. Our compliance with industry standards ensures that your documents are handled with the utmost care.

-

Can airSlate SignNow integrate with other software for managing IRS Form 13775?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow when managing IRS Form 13775. Our integration options allow you to connect with CRMs, accounting software, and more to ensure smooth data transfer and document management. This flexibility helps improve your operational efficiency.

-

What benefits does using airSlate SignNow provide for IRS Form 13775?

Using airSlate SignNow for IRS Form 13775 offers several benefits, including increased efficiency, reduced turnaround time for document signing, and enhanced compliance management. Our platform simplifies the entire process, allowing you to focus more on your business rather than paperwork. By leveraging our solution, you can quickly and securely complete your tax filings.

Get more for Irs Form 13775

Find out other Irs Form 13775

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online