California Ftb Form 4925

What is the California FTB Form 4925

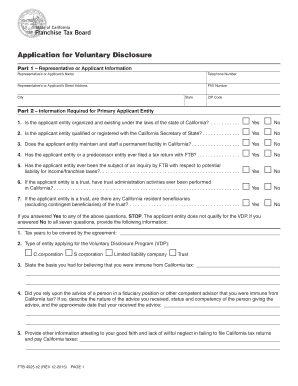

The California FTB Form 4925 is a tax form used by individuals and entities to report certain types of income and deductions to the California Franchise Tax Board (FTB). This form is primarily utilized for reporting income from sources such as partnerships, S corporations, and trusts. It is essential for ensuring compliance with California tax laws and accurately reflecting income on state tax returns.

How to use the California FTB Form 4925

Using the California FTB Form 4925 involves several steps. First, gather all necessary financial documents, including income statements and prior tax returns. Next, fill out the form with accurate information regarding your income sources and any applicable deductions. After completing the form, review it for accuracy before submission to the FTB. This ensures that all reported information is correct and minimizes the risk of errors that could lead to penalties.

Steps to complete the California FTB Form 4925

Completing the California FTB Form 4925 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the California FTB website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income, such as wages, dividends, and rental income.

- Include any deductions you are eligible for, such as business expenses or contributions to retirement accounts.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submitting it to the FTB.

Legal use of the California FTB Form 4925

The California FTB Form 4925 is legally binding when filled out and submitted correctly. It must adhere to the guidelines set forth by the California Franchise Tax Board. To ensure its legal standing, it is important to provide accurate information and maintain compliance with all relevant tax laws. Failure to do so may result in penalties or legal consequences.

Key elements of the California FTB Form 4925

Key elements of the California FTB Form 4925 include:

- Personal identification information, such as name and Social Security number.

- Income reporting sections that detail various income sources.

- Deductions that can be claimed, which may reduce taxable income.

- Signature line for the taxpayer to affirm the accuracy of the information provided.

Form Submission Methods

The California FTB Form 4925 can be submitted through various methods. Taxpayers have the option to file the form online through the California FTB website, which is often the quickest method. Alternatively, the form can be mailed to the appropriate FTB address or submitted in person at designated FTB offices. Each submission method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete california ftb form 4925

Easily Prepare california ftb form 4925 on Any Device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without complications. Manage california ftb form 4925 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Modify and eSign california ftb form 4925 Effortlessly

- Obtain california ftb form 4925 and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and then click the Done button to store your changes.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and eSign california ftb form 4925 to ensure exceptional communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to california ftb form 4925

Create this form in 5 minutes!

How to create an eSignature for the california ftb form 4925

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask california ftb form 4925

-

What is the California FTB Form 4925?

The California FTB Form 4925 is a tax form utilized by businesses operating in California to report certain taxable transactions. Understanding this form is essential for correct tax compliance and ensuring all relevant income is reported accurately. Using airSlate SignNow can simplify the signing process for this form.

-

How can I fill out the California FTB Form 4925 using airSlate SignNow?

With airSlate SignNow, you can easily fill out the California FTB Form 4925 online. The platform allows you to create templates, enter necessary information, and securely eSign the form directly within the application. This streamlines your workflow and saves time.

-

Is there a cost associated with using airSlate SignNow for California FTB Form 4925?

Yes, airSlate SignNow offers various pricing plans that can accommodate different business needs. The pricing is competitive, and the value provided through document automation and eSign capabilities can help save costs in the long run, especially when dealing with forms like the California FTB Form 4925.

-

What features does airSlate SignNow offer for managing the California FTB Form 4925?

airSlate SignNow provides several features to assist with the California FTB Form 4925, including customizable templates, automated workflows, and advanced security measures. Additionally, you can track the status of the document and receive notifications when it has been signed, ensuring compliance and timely submission.

-

Can I integrate airSlate SignNow with other applications for handling the California FTB Form 4925?

Absolutely! airSlate SignNow supports numerous integrations with popular applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to easily import and export your California FTB Form 4925 and streamline your overall document management process.

-

What are the benefits of eSigning the California FTB Form 4925 with airSlate SignNow?

eSigning the California FTB Form 4925 with airSlate SignNow offers numerous benefits, including speed, security, and convenience. Digital signatures are legally binding, which means you can submit your tax documents quickly and confidently, ensuring compliance with California regulations.

-

Is airSlate SignNow user-friendly for completing forms like the California FTB Form 4925?

Yes, airSlate SignNow is designed with user experience in mind, making it accessible for users of all skill levels. The intuitive interface facilitates easy navigation and the completion of forms like the California FTB Form 4925 without hassle, even for those unfamiliar with digital document solutions.

Get more for california ftb form 4925

- Childcarelicensingutahgovformsallhealth and safety plan child care licensing

- Office of enrollment management lsuedu form

- Exchange transfer number plates form

- Wwwmbleorgada accommodations requestmissouri board of law examiners ada accommodations request form

- Oregon lottery winner form

- Graduate legal intern agreement indiana board of law form

- Alabama packet 575713498 form

- Ohio motion record form

Find out other california ftb form 4925

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document