Pa 40 Schedule C Form

What is the PA-40 Schedule C?

The PA-40 Schedule C is a tax form used by self-employed individuals and business owners in Pennsylvania to report income and expenses from their business activities. This form is part of the Pennsylvania personal income tax return, which allows taxpayers to detail their earnings from sole proprietorships. Understanding this form is essential for accurately reporting income and ensuring compliance with state tax regulations.

How to Use the PA-40 Schedule C

To effectively use the PA-40 Schedule C, individuals must gather all necessary financial records, including income statements and expense receipts. The form requires detailed information about the business, such as the type of business, gross income, and various deductible expenses. Accurate completion of this form is crucial for calculating the correct tax liability and ensuring that all eligible deductions are claimed.

Steps to Complete the PA-40 Schedule C

Completing the PA-40 Schedule C involves several key steps:

- Gather all relevant financial documents, including income and expense records.

- Fill in the business information section, providing details about the nature of the business.

- Report gross income earned from the business.

- List all allowable business expenses, ensuring to categorize them correctly.

- Calculate the net profit or loss by subtracting total expenses from gross income.

- Transfer the net profit or loss amount to the main PA-40 tax form.

Legal Use of the PA-40 Schedule C

The PA-40 Schedule C is legally binding when completed accurately and submitted on time. It is essential for taxpayers to ensure that all information provided is truthful and substantiated by proper documentation. Misrepresentation or failure to file can result in penalties, including fines or legal action. Understanding the legal implications of this form can help individuals avoid potential issues with the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the PA-40 Schedule C. Typically, the deadline for submitting the PA-40 tax return, including the Schedule C, aligns with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Staying informed about these dates is crucial for timely submission and avoiding late fees.

Required Documents

To complete the PA-40 Schedule C, individuals need to provide several documents, including:

- Income statements, such as 1099 forms or sales records.

- Receipts for business expenses, including supplies, utilities, and other operational costs.

- Records of any asset purchases or depreciation schedules, if applicable.

Having these documents readily available can streamline the process of filling out the form and ensure accuracy.

Examples of Using the PA-40 Schedule C

Common scenarios for using the PA-40 Schedule C include freelancers, independent contractors, and small business owners. For instance, a graphic designer earning income from multiple clients would report their total earnings on this form, along with any related expenses, such as software subscriptions and marketing costs. Each example highlights the importance of accurately documenting income and expenses to reflect the true financial picture of the business.

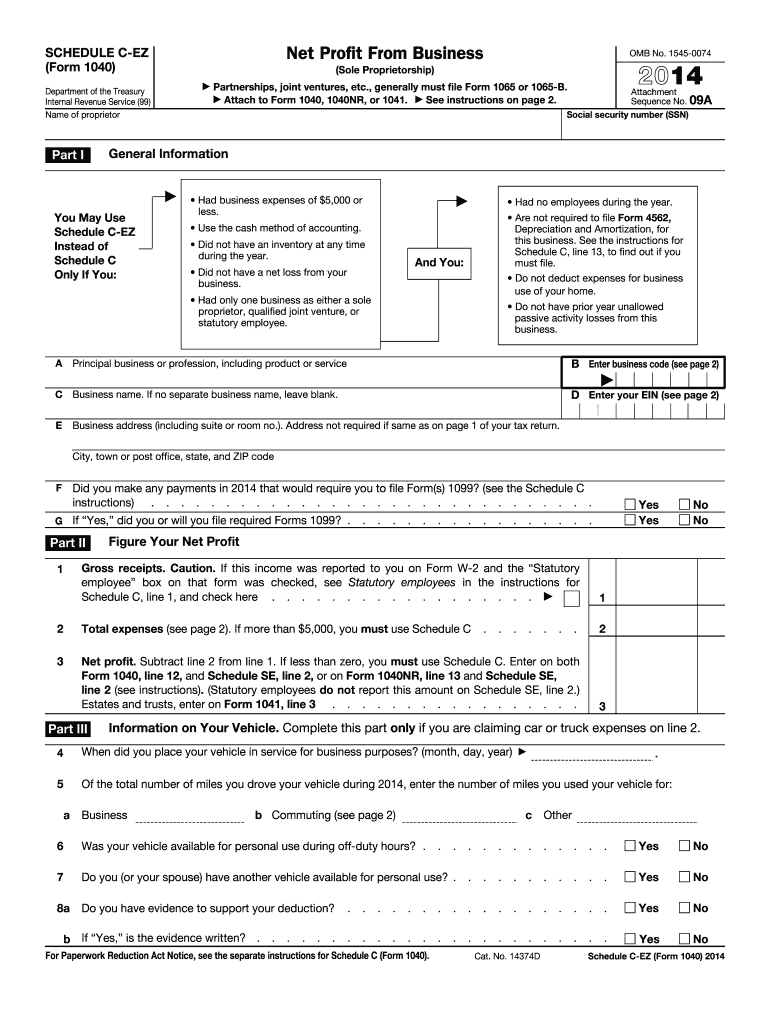

Quick guide on how to complete pa 40 schedule c ez form

Effortlessly Prepare Pa 40 Schedule C on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Pa 40 Schedule C on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to Modify and Electronically Sign Pa 40 Schedule C with Ease

- Obtain Pa 40 Schedule C and select Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Pa 40 Schedule C to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

-

The IRS sent me a form 1065, but I am a sole proprietor. Do I ignore this form and fill out a schedule C?

I would assume that you applied for an employer identification number and checked the partnership box by mistake instead of sole proprietor. If this is the case, this requires you to obtain a new EIN.If you properly filled out the application for an EIN, you can ignore the 1065 notice.Your EIN acknowledgement letter from the IRS will state what type of return they expect you to file under the EIN.

-

When filing a 1040 Schedule C-EZ form does it matter what my job description is (Part 1, Line A)? How accurate or descriptive should it be?

The job description on the tax return is apparently not very important. A word or two is sufficient - like manager, physician, route sales, clerical services or whatever is appropriate is all that is needed on that form. Include enough that the IRS can see the relationship to any signNow expenses you have, like a lot of mileage. But if you have such signNow expenses you would be filing Schedule C. We do not always include the business code and have had no issues with that from the IRS.If you have an EIN for your business you should include that so the IRS knows the business return has been filed.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the pa 40 schedule c ez form

How to generate an electronic signature for your Pa 40 Schedule C Ez Form in the online mode

How to make an eSignature for the Pa 40 Schedule C Ez Form in Google Chrome

How to generate an eSignature for putting it on the Pa 40 Schedule C Ez Form in Gmail

How to generate an electronic signature for the Pa 40 Schedule C Ez Form from your smartphone

How to create an electronic signature for the Pa 40 Schedule C Ez Form on iOS

How to make an eSignature for the Pa 40 Schedule C Ez Form on Android devices

People also ask

-

What is Schedule C EZ in relation to airSlate SignNow?

Schedule C EZ is a streamlined version of the standard Schedule C form used by self-employed individuals to report income and expenses on their tax return. Using airSlate SignNow, you can easily fill out and eSign your Schedule C EZ forms, ensuring a hassle-free filing process.

-

How does airSlate SignNow simplify the completion of Schedule C EZ forms?

AirSlate SignNow offers a user-friendly interface that simplifies the process of filling out Schedule C EZ forms. With features like templates and electronic signatures, you can complete and send your forms quickly and securely, saving you valuable time.

-

Is there a free trial available for airSlate SignNow to use with Schedule C EZ?

Yes, airSlate SignNow provides a free trial that allows users to explore its features, including those related to Schedule C EZ forms. This enables you to test the platform's capabilities and see how it can enhance your document management and eSigning processes.

-

What are the pricing options for using airSlate SignNow with Schedule C EZ?

AirSlate SignNow offers competitive pricing plans that suit various business needs. Depending on your usage requirements for managing Schedule C EZ forms, you can choose a plan that fits your budget while enjoying powerful features for document eSigning.

-

Can airSlate SignNow integrate with other accounting software for Schedule C EZ?

Absolutely! AirSlate SignNow can integrate with various accounting software solutions to streamline your workflows. This means you can easily sync your Schedule C EZ data across platforms, making tax preparation smoother and more efficient.

-

What benefits does using airSlate SignNow for Schedule C EZ forms provide?

Using airSlate SignNow for your Schedule C EZ forms offers numerous benefits, including convenience, security, and speed. You can eSign documents from anywhere, reduce paper usage, and speed up your filing process, ensuring compliance and peace of mind.

-

Are there any mobile capabilities for completing Schedule C EZ with airSlate SignNow?

Yes, airSlate SignNow provides mobile capabilities, allowing you to complete and eSign your Schedule C EZ forms on the go. Whether you’re using a smartphone or tablet, you can manage your documents anytime, anywhere, enhancing your flexibility.

Get more for Pa 40 Schedule C

- Mold hold harmless form 238957706

- Exhibit cover sheet template 33051837 form

- Kampeer checklist form

- Motion and order to set aside judgment forms and instructions courts oregon

- Maternal amp fetal care referral form barnes jewish hospital barnesjewish

- Sars patient contact log tool for logging health care staff caring for sars patients health ny form

- Cpap competency test scenarios form

- Tpcastt 74781802 form

Find out other Pa 40 Schedule C

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors