Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable

What is the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable

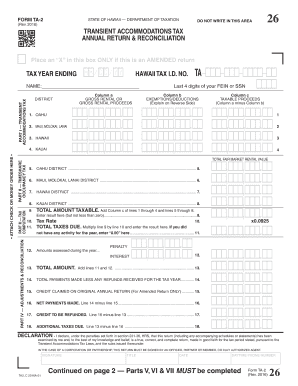

The Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable is a tax document used in the United States for reporting transient accommodations taxes. This form is typically required by local or state governments from businesses that provide short-term lodging services, such as hotels, motels, or vacation rentals. The information collected on this form helps authorities assess and collect taxes on transient accommodations, ensuring compliance with local tax laws.

How to use the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable

Using the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable involves several steps. First, ensure that you have the correct version of the form, as updates may occur. Next, gather all necessary information regarding your accommodations, including total rental income and the number of nights rented. Carefully fill out the form, providing accurate details to avoid any discrepancies. Once completed, submit the form according to your local tax authority's guidelines, which may include online submission or mailing a physical copy.

Steps to complete the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable

Completing the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable requires attention to detail. Follow these steps:

- Obtain the latest version of the form from your local tax authority.

- Collect all relevant financial information, including total income from transient accommodations.

- Fill in your business information, including your name, address, and tax identification number.

- Report the total number of rental nights and the total amount collected in transient accommodations taxes.

- Review the form for accuracy before submission.

Legal use of the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable

The legal use of the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable is crucial for compliance with tax regulations. This form must be filled out accurately and submitted on time to avoid penalties. It serves as a formal declaration of your tax obligations related to transient accommodations, and failure to submit it can result in legal consequences, including fines or audits. Ensuring that the form is completed in accordance with local laws is essential for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable vary by jurisdiction. It is important to check with your local tax authority for specific due dates. Generally, these forms are due on a monthly or quarterly basis, depending on the volume of your rental activity. Missing a deadline can lead to late fees or penalties, so keeping track of important dates is essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

The Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website, if available.

- Mailing a physical copy of the completed form to the designated tax office.

- Delivering the form in person to the local tax office, which may provide immediate confirmation of receipt.

Quick guide on how to complete form ta 1 rev transient accommodations tax return form handwritable

Complete Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents promptly without delays. Handle Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable with ease

- Locate Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ta 1 rev transient accommodations tax return form handwritable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable?

The Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable is a document used for reporting transient accommodations tax in a handwritable format. This form is essential for businesses in the accommodations sector to comply with tax regulations efficiently. Understanding its requirements ensures accurate submissions and avoids penalties.

-

How can airSlate SignNow help with the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable?

airSlate SignNow provides businesses with efficient digital tools to fill out and manage the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable. Our user-friendly interface allows for quick document completion, ensuring you meet deadlines while maintaining accuracy in your tax submissions.

-

What are the pricing options for using airSlate SignNow with the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable?

airSlate SignNow offers various pricing plans tailored to suit different business needs, making it easy to handle the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable affordably. Our plans include essential features like e-signature capabilities and secure cloud storage. You can choose a plan that fits your budget while ensuring compliance with tax obligations.

-

Is it easy to sign the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable using airSlate SignNow?

Absolutely! airSlate SignNow simplifies the signing process for the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable with its intuitive interface. Users can quickly add signatures and send the form for additional approvals. This streamlines record-keeping and keeps your tax documentation organized.

-

What features does airSlate SignNow offer for managing tax returns like the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable?

airSlate SignNow includes a variety of features specifically designed to manage tax returns, such as templates, automated workflows, and tracking options. These features ensure that the completion and submission of the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable are efficient and hassle-free. With our solution, you reduce the risk of errors and ensure compliance.

-

How can I ensure compliance when using the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable?

Using airSlate SignNow helps ensure compliance by providing a structured process for completing the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable. Our platform allows you to review entries, store completed forms securely, and maintain an audit trail for reference. This reduces the likelihood of submitting erroneous information.

-

Can I integrate airSlate SignNow with other business applications for handling the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing the management of the Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable. This includes compatibility with CRM systems, accounting software, and more. Integrating these tools streamlines your overall business operations and improves workflow efficiency.

Get more for Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable

- Limited power of attorney for stock transactions and corporate powers florida form

- Special durable power of attorney for bank account matters florida form

- Florida small business startup package florida form

- Florida property 497303434 form

- Florida annual corporation form

- Bylaws 497303437 form

- Sample records form

- Florida minutes form

Find out other Form TA 1, Rev , Transient Accommodations Tax Return Form Handwritable

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document