General Instructions Information Returns

What is the General Instructions Information Returns

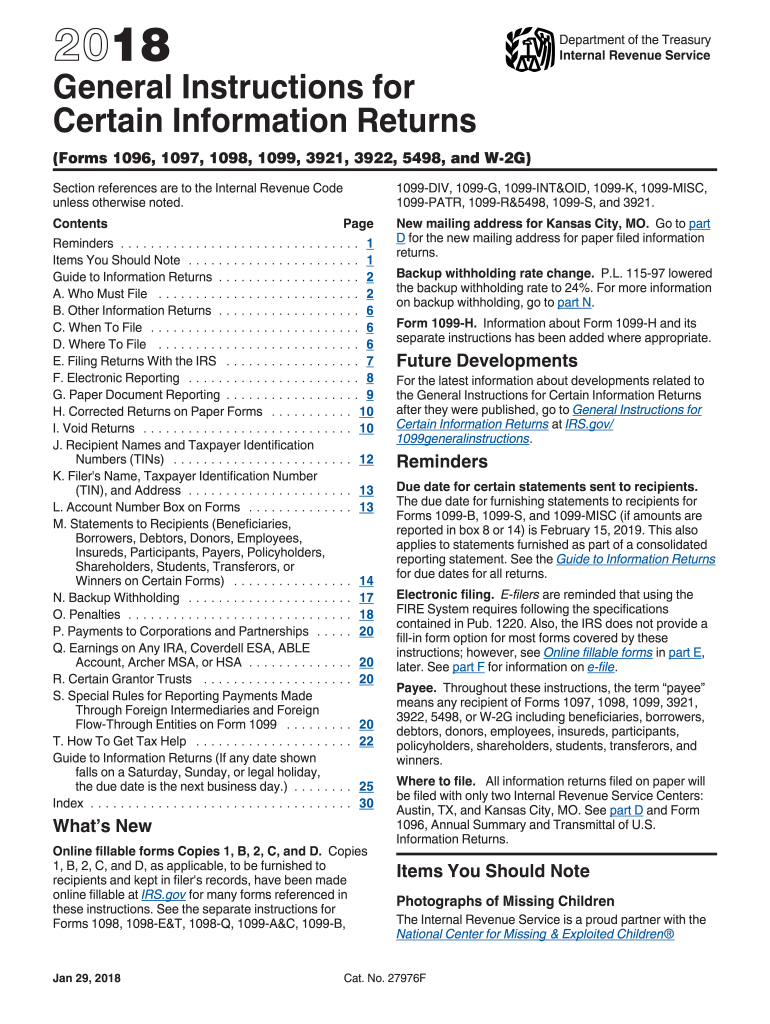

The General Instructions for certain information returns provide essential guidelines for taxpayers and businesses in the United States. These instructions outline the requirements for completing and submitting various forms, such as the W-2 and 1099 series. Understanding these guidelines is crucial for ensuring compliance with IRS regulations and avoiding potential penalties. The instructions typically cover who must file, what information is required, and the deadlines for submission.

Steps to complete the General Instructions Information Returns

Completing the General Instructions for certain information returns involves several key steps:

- Gather necessary information, including taxpayer identification numbers and financial details.

- Review the specific requirements outlined in the instructions for the relevant form.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check for accuracy to avoid errors that could lead to penalties.

- Submit the completed form by the designated deadline, either electronically or by mail.

Legal use of the General Instructions Information Returns

The legal use of the General Instructions for certain information returns is governed by IRS regulations. These instructions ensure that taxpayers provide accurate and complete information, which is essential for tax compliance. Forms submitted in accordance with these guidelines are considered legally binding. It is important to use a reliable eSignature solution, like signNow, to ensure that any electronically submitted documents meet legal standards under the ESIGN and UETA acts.

Filing Deadlines / Important Dates

Filing deadlines for the General Instructions for certain information returns vary depending on the specific form. Generally, most information returns must be filed by January thirty-first of the following year. For electronic submissions, the deadline may extend to March thirty-first. It is crucial to keep track of these dates to avoid late filing penalties and interest charges.

Required Documents

When completing the General Instructions for certain information returns, specific documents are required. These may include:

- Taxpayer identification numbers (TINs) for both the payer and payee.

- Financial records that support the information being reported.

- Previous year’s information returns for reference.

Having these documents ready will facilitate accurate and timely completion of the forms.

Examples of using the General Instructions Information Returns

Examples of using the General Instructions for certain information returns include:

- Employers using the W-2 form to report wages paid to employees.

- Businesses issuing 1099 forms to independent contractors for services rendered.

- Financial institutions providing 1099-INT forms for interest income to account holders.

These examples illustrate the practical application of the instructions in various financial scenarios.

Quick guide on how to complete 2015 general instructions for certain information

Easily Prepare General Instructions Information Returns on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage General Instructions Information Returns on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest method to edit and eSign General Instructions Information Returns effortlessly

- Obtain General Instructions Information Returns and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using features that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your PC.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign General Instructions Information Returns to ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

-

How can you instruct Excel to give a cell a particular fill color if a certain criterion is met?

Yes, you use conditional formatting.Use formulas with conditional formattingThis is very flexible, you can format the colour of the cell, and any formatting criteria based on the value of the cell.It is now on the toolbar which makes it extra easy to use.

-

How can I fill out an ITR for year 2015-16?

Try ClearTax, the easiest e-filing platform in India

-

How many students out of 1,79,602 students that appeared for CAT 2015 belong to general category?

Hey there…Its bit too late to answer this question I know,But let me tell you there are no such data to answer this & even if someone answers ,data cannot be verified UNLESS OFFICIALLY RELEASED BY CAT ADMISSION TEAM ,OFF COURSE.I will suggest you to overlook this figures for now, as everything could change in for the new class of MBA.The real competition in anyways will remain between 20–30k serious aspirant. For the year 2016 ,2.3 LAKH REGISTERED FOR THE EXAM & ALMOST 2 LAKH GAVE THE EXAM.If you are worried over percentile ,then stop here itself & get back to studies . Tracking data in no ways will help you. To really know the competition ,better check for percentiles in the mock exams you enroll for though mocks score really don’t matter on D-day .But if competition is the thing which keeps you pumped up. Then that’s the way to go for you .To know more about CAT & tips,tricks to crack it .Subscribe to Handa ka Funda newsletter .You can view Ravi’s Sir past FB live session to get to know more about it .All the best :)

-

What's the best way to get users to read a set of instructions for filling out a form?

Your question confuses me a bit. What's missing is "WHY are the instructions displayed?" What makes them so important? More to the point, what makes them so important to the user?You say it's a simple form, but also say they must read the instructions before filling it out. If it's simple, what are all the instructions for? I haven't seen the form and already I'm confused.People will do things if they understand (and agree with) the purpose for doing them. If they don't understand the need for the instructions (e.g. because the form appears to be simple), you'll have a hard time getting users to read them (they won't see the need).My suggestion would be to take a step back from the design a bit and look at the form's purpose. If the instructions are to minimize data entry errors, look for ways in your design to do that and eliminate an instruction or two. For example, do real-time validation of things like zip codes, phone numbers, usernames, and anything else your web page can do.If the instructions are to educate the user on some specific process, look at the process to see if it can be made simpler or more obvious such that it doesn't need any explanation.Finally, don't forget user testing--ask some potential (or representative) users what they think works for them.

-

How do I fill out the form for a national scholarship, being in the general category?

Hari om , you are asking a question as to : “How do I fill out the form for a national scholarship, being in the general category?.”All categories candidates are eligible for national scholarships.It is a purely merit based scholarship.Simply fill all the columns & submit the application to the concerned authorities within the due date.If you are meritorious among the eligible applicants , you will be awarded the scholarships.Best of luck. Hari om.

Create this form in 5 minutes!

How to create an eSignature for the 2015 general instructions for certain information

How to create an electronic signature for the 2015 General Instructions For Certain Information in the online mode

How to create an eSignature for your 2015 General Instructions For Certain Information in Google Chrome

How to make an eSignature for signing the 2015 General Instructions For Certain Information in Gmail

How to create an eSignature for the 2015 General Instructions For Certain Information from your smart phone

How to make an electronic signature for the 2015 General Instructions For Certain Information on iOS

How to create an electronic signature for the 2015 General Instructions For Certain Information on Android OS

People also ask

-

What are the General Instructions Information Returns provided by airSlate SignNow?

The General Instructions Information Returns by airSlate SignNow guide users on how to electronically sign and manage their documents effectively. This resource outlines the necessary steps for proper eSigning, ensuring compliance with regulatory requirements. With these instructions, you can confidently handle your information returns while optimizing your workflow.

-

How does airSlate SignNow simplify the General Instructions Information Returns process?

airSlate SignNow simplifies the General Instructions Information Returns process by offering an intuitive platform that streamlines document signing and management. Users can easily create, send, and eSign documents in just a few clicks, reducing the time spent on paperwork. This efficiency not only saves time but also enhances overall productivity for businesses.

-

What is the pricing structure for using airSlate SignNow related to General Instructions Information Returns?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different users, including those managing General Instructions Information Returns. With competitive rates, businesses can choose a plan that fits their budget while gaining access to essential features like unlimited eSigning and document templates. Check our pricing page for detailed options.

-

What features of airSlate SignNow support General Instructions Information Returns?

Key features of airSlate SignNow that support General Instructions Information Returns include customizable templates, real-time tracking, and secure cloud storage. These tools enable users to manage their returns efficiently while maintaining compliance with legal standards. Additionally, the platform's user-friendly interface makes it easy to navigate and utilize these features.

-

Can airSlate SignNow integrate with other software for handling General Instructions Information Returns?

Yes, airSlate SignNow offers seamless integration with various software applications that can help manage General Instructions Information Returns. Whether you use CRM systems, accounting software, or cloud storage solutions, our platform connects easily to enhance your document management process. This integration fosters a more streamlined workflow for your business.

-

What are the benefits of using airSlate SignNow for General Instructions Information Returns?

Using airSlate SignNow for General Instructions Information Returns provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform ensures that all documents are securely stored and easily retrievable, while its automated features minimize the risk of errors. Overall, it empowers businesses to operate more efficiently and effectively.

-

Is airSlate SignNow compliant with regulations for General Instructions Information Returns?

Absolutely, airSlate SignNow is designed to comply with regulations governing General Instructions Information Returns, ensuring all eSigned documents are legally binding. Our platform adheres to industry standards for data protection and electronic signatures, giving users peace of mind regarding compliance. This commitment to regulatory adherence helps businesses avoid potential legal issues.

Get more for General Instructions Information Returns

Find out other General Instructions Information Returns

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation