Property Tax Form Download

Understanding the Property Tax Form Download

The property tax form download is an essential document for property owners in the United States. This form allows individuals to report their property value and calculate the taxes owed to local municipalities. It is crucial for ensuring compliance with local tax laws and for determining the amount of property tax that will be assessed. Property owners can typically find their specific property tax form on their local government or tax assessor's website, which provides the most accurate and relevant version for their area.

Steps to Complete the Property Tax Form Download

Filling out the property tax form requires careful attention to detail. Here are the steps to ensure accurate completion:

- Download the appropriate property tax form from your local tax authority’s website.

- Gather necessary documentation, such as property deeds, previous tax returns, and any relevant financial statements.

- Fill in your personal information, including your name, address, and contact details.

- Provide details about the property, including its location, size, and any improvements made.

- Calculate the property value based on current market conditions and local assessments.

- Review the completed form for accuracy before submission.

Legal Use of the Property Tax Form Download

The property tax form serves as a legally binding document when submitted to the appropriate authorities. To ensure its legal validity, it must be completed accurately and submitted within the designated deadlines set by local tax offices. Additionally, using a reliable electronic signature platform can enhance the legal standing of the document, ensuring compliance with eSignature laws such as ESIGN and UETA. This is particularly important for electronic submissions, as proper authentication can prevent disputes regarding the authenticity of the submitted information.

Required Documents for the Property Tax Form Download

When preparing to fill out the property tax form, specific documents are typically required to support your claims and calculations. These may include:

- Property deed or title to confirm ownership.

- Previous year’s property tax statement for reference.

- Receipts or invoices for any recent renovations or improvements.

- Financial statements if applicable, especially for rental properties.

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is accurately reported.

Form Submission Methods

Once the property tax form is completed, it can be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission via the local tax authority's website, often the fastest and most efficient option.

- Mailing a physical copy of the form to the designated tax office address.

- In-person submission at local government offices, which may be required in some jurisdictions.

It is important to check local guidelines to determine the preferred submission method and any associated deadlines to avoid penalties.

Filing Deadlines and Important Dates

Each state and local jurisdiction has specific deadlines for submitting property tax forms. Typically, these deadlines align with the annual tax cycle. It is essential to be aware of these dates to ensure timely filing. Missing a deadline can result in penalties or interest charges on unpaid taxes. Property owners should consult their local tax authority’s website for the most accurate and up-to-date information regarding filing deadlines.

Quick guide on how to complete property tax form download

Easily Prepare Property Tax Form Download on Any Device

Managing documents online has gained popularity among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Handle Property Tax Form Download on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign Property Tax Form Download

- Locate Property Tax Form Download and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Property Tax Form Download to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax form download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

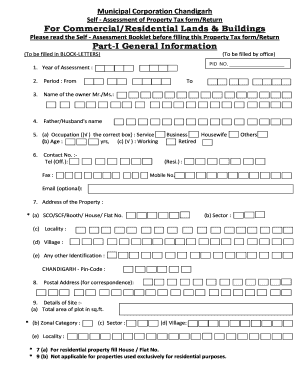

What is the Chandigarh property tax form?

The Chandigarh property tax form is a document that property owners in Chandigarh must fill out and submit to assess their property tax obligations. This form includes details about the property, such as its size, location, and usage. Proper completion of the Chandigarh property tax form is essential to ensure accurate tax assessment and compliance with local regulations.

-

How can I obtain the Chandigarh property tax form?

You can obtain the Chandigarh property tax form from the official Chandigarh municipal corporation website or visit their local office. Additionally, airSlate SignNow can simplify the process by allowing you to fill out and eSign the form digitally, saving you time and effort. Ensure you're using the latest version of the Chandigarh property tax form for accuracy.

-

What information do I need to fill out the Chandigarh property tax form?

To fill out the Chandigarh property tax form, you will need details such as your property address, ownership details, and property use type. Other necessary information may include dimensions, property identification numbers, and previous tax assessment data. Having all the required information handy will help streamline your experience with the Chandigarh property tax form.

-

Can I submit the Chandigarh property tax form online?

Yes, you can submit the Chandigarh property tax form online through the official municipal corporation website. Additionally, using airSlate SignNow allows you to complete and eSign the form digitally, ensuring a hassle-free submission process. Online submission is not only faster but also helps in reducing paperwork.

-

Is there a fee associated with submitting the Chandigarh property tax form?

There may be fees associated with filing the Chandigarh property tax form, depending on your property's assessment or usage. It's essential to check the latest guidelines from the Chandigarh municipal corporation for any applicable fees. airSlate SignNow can help you manage your documents and understand any costs involved efficiently.

-

What are the benefits of using airSlate SignNow for the Chandigarh property tax form?

Using airSlate SignNow for the Chandigarh property tax form offers numerous benefits, including ease of use, the ability to eSign documents quickly, and reduced paperwork. It also allows for better organization and storage of your tax documents. With airSlate SignNow, you can ensure a seamless experience while managing your property tax obligations.

-

What happens if I submit the Chandigarh property tax form late?

Submitting the Chandigarh property tax form late can result in penalties, fines, or increased interest on owed taxes. It's crucial to file on time to avoid these financial implications. airSlate SignNow can help you set reminders and track your submissions, making it easier to meet deadlines.

Get more for Property Tax Form Download

Find out other Property Tax Form Download

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile