Terrible Credit Payday Loans Form

What is the terrible credit payday loan?

The terrible credit payday loan is a short-term financial product designed for individuals with poor credit histories. These loans typically offer quick access to cash, often without the extensive credit checks that traditional lenders require. Borrowers can use these loans to cover urgent expenses, such as medical bills or car repairs. However, they often come with high interest rates and fees, which can lead to a cycle of debt if not managed carefully.

How to obtain the terrible credit payday loan

To obtain a terrible credit payday loan, individuals usually need to follow a straightforward process. First, they should research various lenders that specialize in loans for those with poor credit. Next, applicants typically need to provide personal information, including proof of income and identification. Many lenders offer online applications, allowing borrowers to apply from the comfort of their homes. Once approved, funds are often deposited directly into the borrower's bank account, sometimes within a single business day.

Steps to complete the terrible credit payday loan application

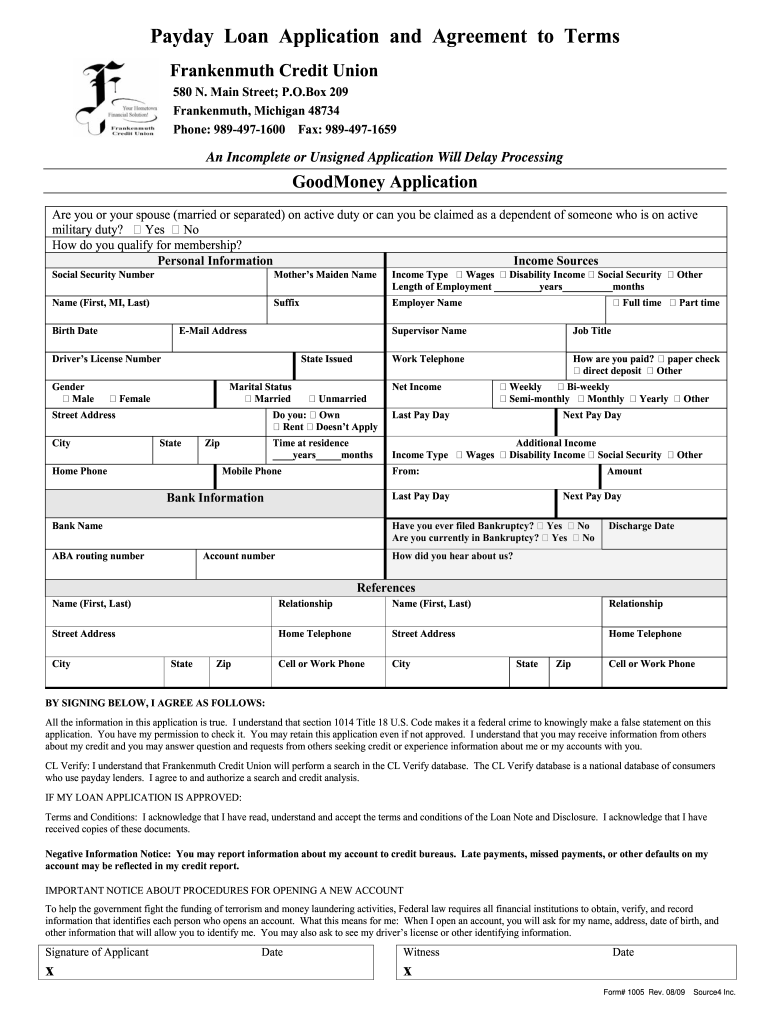

Completing the application for a terrible credit payday loan involves several key steps:

- Gather necessary documentation, such as proof of income and identification.

- Visit the lender's website or physical location to start the application.

- Fill out the application form with accurate personal and financial information.

- Submit the application and wait for approval, which can be instantaneous in many cases.

- Review the loan agreement carefully before accepting the terms.

Legal use of the terrible credit payday loan

The legal use of a terrible credit payday loan is primarily for personal financial needs. Borrowers should ensure that they comply with state regulations governing payday loans, as these laws can vary significantly. It is essential to understand the terms of the loan, including repayment schedules and interest rates, to avoid potential legal issues. Failure to repay the loan on time may result in additional fees or legal consequences.

Eligibility criteria for the terrible credit payday loan

Eligibility for a terrible credit payday loan generally includes the following criteria:

- Must be at least eighteen years old.

- Must have a steady source of income, such as employment or government benefits.

- Must possess a valid identification document, like a driver's license or state ID.

- Must have an active checking account to receive funds and facilitate repayments.

Key elements of the terrible credit payday loan

When considering a terrible credit payday loan, several key elements should be taken into account:

- Interest Rates: These loans often have high-interest rates, which can lead to significant repayment amounts.

- Loan Amount: Borrowers can typically access small amounts, ranging from a few hundred to a couple of thousand dollars.

- Repayment Terms: Loans are usually due on the borrower's next payday, creating a short repayment window.

- Fees: Additional fees may apply, including late payment penalties and origination fees.

Quick guide on how to complete terrible credit payday loans

Prepare Terrible Credit Payday Loans effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents swiftly without interruptions. Manage Terrible Credit Payday Loans on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Terrible Credit Payday Loans with ease

- Find Terrible Credit Payday Loans and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Terrible Credit Payday Loans and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the terrible credit payday loans

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are terrible credit payday loans and how do they work?

Terrible credit payday loans are short-term, high-interest loans designed for individuals with poor credit histories. These loans typically require you to repay the borrowed amount, plus interest and fees, by your next payday. They provide quick access to cash but come with signNow risks and costs.

-

What features should I look for in terrible credit payday loans?

When considering terrible credit payday loans, it’s essential to look for transparent terms and fees, quick approval processes, and flexible repayment options. Additionally, check if the lender reports to credit bureaus, as this can help improve your credit score over time. Always compare multiple lenders to find the best features for your needs.

-

Are there benefits to using terrible credit payday loans?

Yes, terrible credit payday loans can offer immediate financial relief to those in urgent need of cash. They require minimal documentation and can be accessed quickly, making them a viable option for unexpected expenses like medical bills or car repairs. However, it's crucial to use them responsibly to avoid falling into a debt cycle.

-

What are the typical costs associated with terrible credit payday loans?

The costs of terrible credit payday loans can vary signNowly, but they usually include high-interest rates and various fees. It's not uncommon for APRs to exceed 400%, depending on the lender and your circumstances. Always review the total repayment amount before committing to ensure you understand the costs involved.

-

Can I apply for terrible credit payday loans online?

Absolutely, many lenders offer online applications for terrible credit payday loans, making the process quick and convenient. You can usually complete the application from the comfort of your home and receive instant approval decisions. Just ensure you choose reputable lenders to protect your personal information.

-

How long does it take to get approved for terrible credit payday loans?

The approval process for terrible credit payday loans is typically very fast, often taking just a few minutes to a few hours. Once approved, funds can be deposited into your bank account as soon as the next business day. This speedy turnaround is one reason why many individuals turn to payday loans in times of crisis.

-

Are terrible credit payday loans safe to use?

While terrible credit payday loans can be beneficial in emergencies, they come with inherent risks due to high fees and interest rates. It's crucial to research lenders thoroughly, read reviews, and confirm their legitimacy before applying. Always consider alternative options such as borrowing from friends or family or seeking credit counseling resources.

Get more for Terrible Credit Payday Loans

Find out other Terrible Credit Payday Loans

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online