480 6c 2011

What is the 480 6c

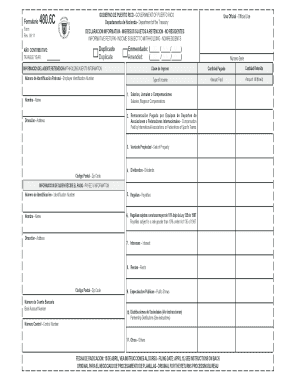

The 480 6c form is a tax document used in Puerto Rico to report income and calculate the corresponding tax obligations for individuals and businesses. This form is essential for those who are subject to Puerto Rican tax laws, as it helps ensure compliance with local regulations. The 480 6c specifically focuses on income earned from sources within Puerto Rico, making it crucial for residents and businesses operating in the territory.

How to use the 480 6c

Using the 480 6c form involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, fill out the form by entering your income details, ensuring that all figures are accurate. After completing the form, review it for any errors before submitting it to the appropriate tax authority. This process can be streamlined with digital tools that facilitate electronic signatures and secure document submission.

Steps to complete the 480 6c

Completing the 480 6c form requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, such as W-2s or 1099s.

- Access the 480 6c form, either digitally or in paper format.

- Fill in your personal information, including your name and tax identification number.

- Report your total income from Puerto Rican sources accurately.

- Include any applicable deductions or credits that may apply to your situation.

- Review the form thoroughly to ensure all information is correct.

- Submit the completed form to the Puerto Rico Department of Treasury by the specified deadline.

Legal use of the 480 6c

The legal use of the 480 6c form is governed by Puerto Rico's tax laws. It is important to understand that this form must be filled out accurately to avoid penalties. The form serves as an official record of income and tax obligations, and submitting false information can lead to legal consequences. Utilizing electronic filing methods can enhance compliance by providing secure and verifiable submissions.

Filing Deadlines / Important Dates

Filing deadlines for the 480 6c form are crucial to ensure compliance with tax regulations. Typically, the form must be submitted by the designated date set by the Puerto Rico Department of Treasury. It is important to stay informed about any changes to these deadlines, as late submissions may incur penalties or interest on unpaid taxes. Keeping a calendar with important tax dates can help manage this process effectively.

Who Issues the Form

The 480 6c form is issued by the Puerto Rico Department of Treasury, known as the Departamento de Hacienda. This government agency is responsible for tax collection and enforcement of tax laws in Puerto Rico. They provide the necessary forms and guidelines for taxpayers to ensure compliance with local tax regulations. Accessing the form through their official channels guarantees that you are using the most current version.

Quick guide on how to complete 480 6c

Effortlessly Prepare 480 6c on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 480 6c on any system using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign 480 6c with Ease

- Find 480 6c and select Get Form to begin.

- Utilize the tools we offer to finalize your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it onto your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 480 6c, ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 480 6c

Create this form in 5 minutes!

How to create an eSignature for the 480 6c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 480 6c in airSlate SignNow?

The '480 6c' in airSlate SignNow refers to a specific feature code that streamlines eSigning and document management. Understanding this code helps users leverage the full potential of our platform, ensuring efficient and accurate document handling.

-

How much does airSlate SignNow cost for 480 6c features?

Pricing for airSlate SignNow, particularly for features related to the 480 6c functionality, is competitive and tailored to suit various business needs. Monthly subscription plans start at a basic level, offering essential tools, while advanced features come at a higher tier. It's advisable to check our pricing page for the most accurate and up-to-date information.

-

What key features does airSlate SignNow offer for the 480 6c process?

airSlate SignNow provides a range of features optimized for the 480 6c process, including secure eSigning, customizable templates, and seamless document tracking. These capabilities help businesses manage their workflows more efficiently and enhance overall productivity.

-

Can airSlate SignNow integrate with other software for the 480 6c functionality?

Yes, airSlate SignNow can easily integrate with various popular software applications, enhancing the 480 6c functionality. This includes CRM tools, cloud storage solutions, and productivity software, allowing for a smooth and efficient document flow within your existing systems.

-

How does airSlate SignNow enhance business efficiency with 480 6c?

By utilizing the 480 6c capabilities, airSlate SignNow streamlines the document signing process, reducing turnaround times signNowly. This efficiency allows businesses to focus more on their core operations rather than getting bogged down by paperwork.

-

Is airSlate SignNow secure when handling 480 6c documents?

Absolutely, airSlate SignNow takes security seriously, especially concerning 480 6c documents. Our platform uses advanced encryption and complies with industry standards to ensure that all your documents are secure and protected from unauthorized access.

-

What benefits can businesses expect from using airSlate SignNow with 480 6c?

Businesses utilizing airSlate SignNow for the 480 6c process can expect improved productivity, reduced errors, and cost savings. The platform simplifies compliance and ensures a more organized and professional approach to document management.

Get more for 480 6c

- Warranty deed from husband and wife to husband and wife missouri form

- Missouri postnuptial agreement form

- Missouri postnuptial form

- Amendment to postnuptial property agreement missouri missouri form

- Missouri declaratory judgment 497313032 form

- Mo certificate title form

- Quitclaim deed from husband and wife to an individual missouri form

- Warranty deed husband wife form

Find out other 480 6c

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading