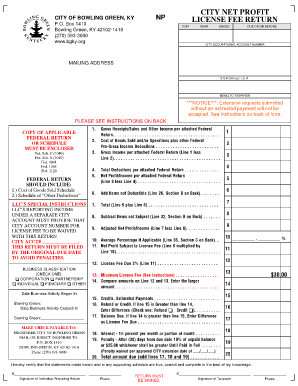

City of Bowling Green Net Profit License Fee Return Form

What is the City of Bowling Green Net Profit License Fee Return

The City of Bowling Green Net Profit License Fee Return is a form that businesses operating within the city must complete to report their net profits for tax purposes. This form is essential for ensuring compliance with local tax regulations, allowing the city to assess the appropriate license fees based on a business's earnings. It serves as a crucial tool for the local government to collect revenue necessary for public services and infrastructure.

Steps to Complete the City of Bowling Green Net Profit License Fee Return

Completing the City of Bowling Green Net Profit License Fee Return involves several important steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements and expense reports, to accurately report your net profit.

- Fill Out the Form: Enter your business details, including the name, address, and tax identification number, along with the calculated net profit.

- Review for Accuracy: Double-check all entries to ensure that the information is correct and complete.

- Sign and Date: Provide your signature and the date to validate the form, confirming that the information is true and accurate.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the City of Bowling Green Net Profit License Fee Return

The City of Bowling Green Net Profit License Fee Return is legally binding when completed accurately and submitted on time. Compliance with local tax laws is crucial, as failure to submit this form can result in penalties. The form must be signed by an authorized representative of the business, ensuring that the information provided is verified and legitimate. Understanding the legal implications of this form helps businesses maintain good standing with the city and avoid potential legal issues.

Form Submission Methods

Businesses have several options for submitting the City of Bowling Green Net Profit License Fee Return:

- Online Submission: Many businesses prefer to submit the form electronically for convenience and speed.

- Mail: The completed form can be printed and mailed to the appropriate city office.

- In-Person: Businesses may also choose to deliver the form in person at designated city offices.

Penalties for Non-Compliance

Failure to file the City of Bowling Green Net Profit License Fee Return on time can lead to significant penalties. These may include late fees, interest on unpaid amounts, and potential legal action. It is important for businesses to be aware of the deadlines associated with this form to avoid these consequences. Regular reminders and tracking of submission dates can help ensure compliance.

Required Documents

To complete the City of Bowling Green Net Profit License Fee Return, businesses must prepare several key documents:

- Income Statements: Detailed records of revenue generated during the reporting period.

- Expense Reports: Documentation of all business expenses incurred, which will help determine the net profit.

- Tax Identification Number: A unique identifier assigned to the business for tax purposes.

Quick guide on how to complete city of bowling green net profit license fee return

Complete City Of Bowling Green Net Profit License Fee Return effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle City Of Bowling Green Net Profit License Fee Return on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest method to edit and eSign City Of Bowling Green Net Profit License Fee Return without effort

- Locate City Of Bowling Green Net Profit License Fee Return and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select your preferred method for submitting your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign City Of Bowling Green Net Profit License Fee Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of bowling green net profit license fee return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Bowling Green net profit license fee return?

The city of Bowling Green net profit license fee return is a document required by local authorities for businesses operating in the city. It serves to report the net profits and determine the corresponding license fees owed to the city. Ensuring accurate completion of this return is essential for compliance and avoiding penalties.

-

How can airSlate SignNow help with the city of Bowling Green net profit license fee return?

airSlate SignNow simplifies the process of completing and submitting the city of Bowling Green net profit license fee return. Our platform allows you to easily eSign and send documents securely, streamlining the submission to local authorities. This efficiency helps businesses save time and enhance accuracy.

-

What features does airSlate SignNow offer for managing the city of Bowling Green net profit license fee return?

With airSlate SignNow, you can enjoy features like customizable templates, secure cloud storage, and automated workflows, specifically tailored for the city of Bowling Green net profit license fee return. These features help ensure that businesses can quickly prepare and submit their returns without any hassle.

-

Is airSlate SignNow cost-effective for filing the city of Bowling Green net profit license fee return?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing the city of Bowling Green net profit license fee return. Our competitive pricing plans cater to various business sizes and needs, making it an affordable choice while still offering essential features for document management.

-

Can airSlate SignNow integrate with other accounting software for the city of Bowling Green net profit license fee return?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to import your financial data directly into the city of Bowling Green net profit license fee return. This integration minimizes errors and simplifies the documentation process, streamlining your overall workflow.

-

What are the benefits of using airSlate SignNow for the city of Bowling Green net profit license fee return?

Using airSlate SignNow for your city of Bowling Green net profit license fee return brings multiple benefits, including improved accuracy, reduced paperwork, and faster submission times. By digitizing the process, businesses can enhance their compliance and focus more on their core operations, rather than getting bogged down by paperwork.

-

How secure is airSlate SignNow when handling the city of Bowling Green net profit license fee return?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption and compliance standards to ensure that your documents related to the city of Bowling Green net profit license fee return are safe and secure. Businesses can trust that their sensitive information remains protected during the entire process.

Get more for City Of Bowling Green Net Profit License Fee Return

- Lead based paint disclosure for rental transaction mississippi form

- Notice of lease for recording mississippi form

- Sample cover letter for filing of llc articles or certificate with secretary of state mississippi form

- Supplemental residential lease forms package mississippi

- Ms landlord 497315634 form

- Subpoena duces form

- Name change form 497315638

- Name change instructions and forms package for a minor mississippi

Find out other City Of Bowling Green Net Profit License Fee Return

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple