Massachusetts Department of Revenue Form M 4868 2021

What is the Massachusetts Department Of Revenue Form M-4868

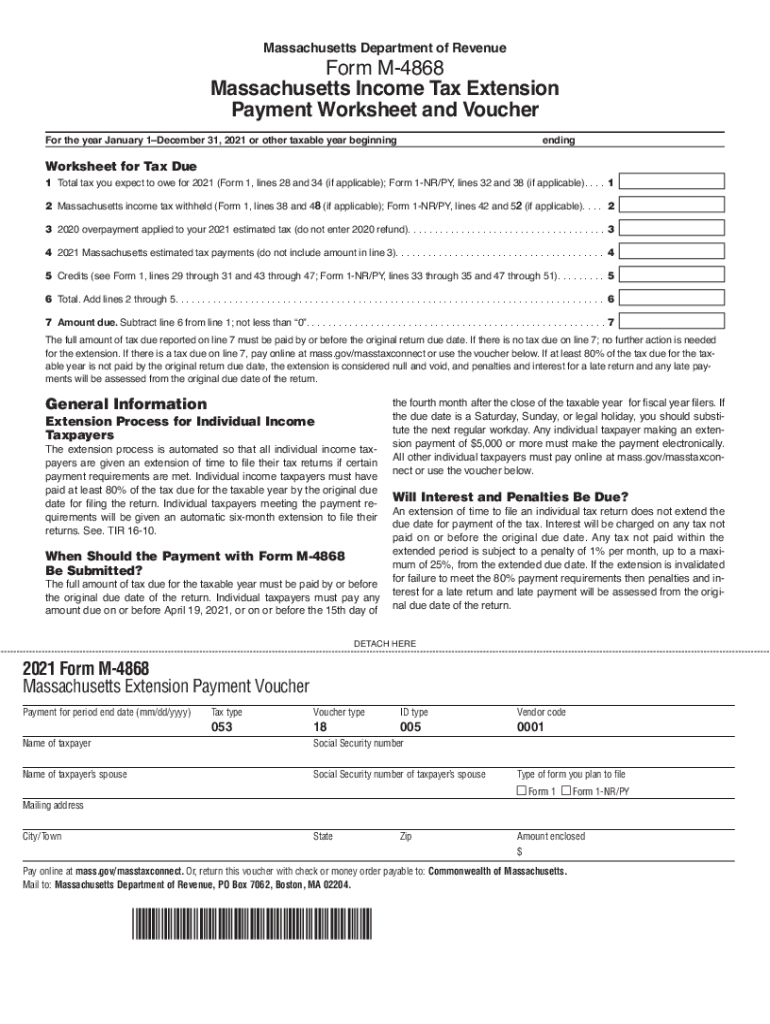

The Massachusetts Department of Revenue Form M-4868 is the official tax extension form for residents seeking additional time to file their state income tax returns. This form allows taxpayers to request an automatic six-month extension for filing their Massachusetts income tax return, which is particularly beneficial for individuals who may need extra time to gather necessary documents or complete their tax preparation. By submitting this form, taxpayers can avoid late filing penalties, provided they pay any taxes owed by the original due date.

Steps to complete the Massachusetts Department Of Revenue Form M-4868

Completing the Massachusetts Form M-4868 involves several straightforward steps:

- Gather your personal information, including your Social Security number and address.

- Determine your estimated tax liability for the year to ensure you pay any owed taxes by the due date.

- Fill out the form with your details, including the amount of tax you expect to owe and any payments already made.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to the Massachusetts Department of Revenue either electronically or via mail.

How to obtain the Massachusetts Department Of Revenue Form M-4868

The Massachusetts Form M-4868 can be obtained through several methods. Taxpayers can download the form directly from the Massachusetts Department of Revenue's official website. Additionally, printed copies may be available at local tax offices or public libraries. For those who prefer electronic submission, the form can also be completed and submitted online through authorized e-filing services.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Massachusetts tax extension. The original due date for filing personal income tax returns is typically April 15. By submitting Form M-4868 by this date, taxpayers can secure an automatic extension until October 15. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Legal use of the Massachusetts Department Of Revenue Form M-4868

The legal use of Form M-4868 is essential for ensuring compliance with Massachusetts tax laws. Submitting this form grants taxpayers an extension to file their returns without incurring late penalties, as long as they pay any estimated taxes owed by the initial deadline. It is important to note that this extension is solely for filing; it does not extend the time to pay taxes due.

Key elements of the Massachusetts Department Of Revenue Form M-4868

Several key elements must be included when completing the Massachusetts Form M-4868:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Estimated Tax Liability: An estimation of the total tax you expect to owe for the year.

- Payments Made: Any payments made towards your tax liability must be documented.

- Signature: The form must be signed and dated to validate the information provided.

Quick guide on how to complete massachusetts department of revenue form m 4868

Prepare Massachusetts Department Of Revenue Form M 4868 seamlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without any holdups. Manage Massachusetts Department Of Revenue Form M 4868 on any device using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

How to modify and eSign Massachusetts Department Of Revenue Form M 4868 with ease

- Find Massachusetts Department Of Revenue Form M 4868 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive data with tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review all details and click the Done button to save your updates.

- Choose how you wish to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign Massachusetts Department Of Revenue Form M 4868 and ensure outstanding communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct massachusetts department of revenue form m 4868

Create this form in 5 minutes!

People also ask

-

What is a Massachusetts tax extension?

A Massachusetts tax extension allows taxpayers to request additional time to file their state tax returns. By filing for a Massachusetts tax extension, you can avoid late fees and penalties while ensuring you have more time to gather necessary documents.

-

How can airSlate SignNow help with the Massachusetts tax extension process?

airSlate SignNow streamlines the Massachusetts tax extension process by allowing you to easily send and eSign the necessary documents online. With our user-friendly platform, you can expedite your extension request, ensuring compliance and reducing stress during tax season.

-

Is there a fee to file a Massachusetts tax extension with airSlate SignNow?

Using airSlate SignNow for filing a Massachusetts tax extension involves a subscription fee that varies based on the features you select. However, this cost is generally offset by the time savings and convenience our platform provides when managing your tax paperwork.

-

What documents do I need for a Massachusetts tax extension with airSlate SignNow?

To file a Massachusetts tax extension with airSlate SignNow, you'll need your completed extension form and any supporting documents. Our platform allows you to upload and securely eSign these documents, making the process straightforward and efficient.

-

Can I integrate airSlate SignNow with other tools for my Massachusetts tax extension?

Yes, airSlate SignNow offers integrations with various accounting software that can help manage your Massachusetts tax extension seamlessly. This connectivity enhances your workflow, enabling you to track and manage your tax-related documents from a single platform.

-

What are the benefits of using airSlate SignNow for Massachusetts tax extensions?

Using airSlate SignNow for your Massachusetts tax extension simplifies the process by allowing quick eSigning and document sharing. This ensures that your forms are submitted accurately and on time, minimizing the risk of errors and providing peace of mind.

-

How long does a Massachusetts tax extension last when filed through airSlate SignNow?

When you file a Massachusetts tax extension through airSlate SignNow, it typically grants you an additional six months to file your return. This extension is beneficial for taxpayers needing extra time to prepare their financial documents without incurring penalties.

Get more for Massachusetts Department Of Revenue Form M 4868

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase montana form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant montana form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase montana form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services montana form

- Temporary lease agreement to prospective buyer of residence prior to closing montana form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497316208 form

- Letter from landlord to tenant returning security deposit less deductions montana form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return montana form

Find out other Massachusetts Department Of Revenue Form M 4868

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe