8946 Form

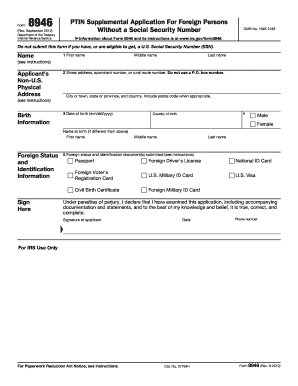

What is the 8946?

The 8946 form, officially known as the "Claim for Refund of Excess Tax Withheld," is utilized by taxpayers in the United States to request a refund for any excess amounts withheld from their income. This form is particularly relevant for individuals who have had too much tax withheld from their paychecks or other income sources throughout the year. Understanding the purpose and function of the 8946 form is essential for ensuring that taxpayers can effectively reclaim their rightful funds.

How to use the 8946

Using the 8946 form involves a straightforward process. Taxpayers must first gather all relevant documentation, including W-2s and 1099s, which detail the amounts withheld. After filling out the form with accurate information regarding income and withholding amounts, it is crucial to double-check for any errors. Once completed, the form can be submitted to the appropriate tax authority, ensuring that all necessary attachments are included to support the refund claim.

Steps to complete the 8946

Completing the 8946 form requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including W-2s and 1099s.

- Fill out your personal information accurately, including your name, address, and Social Security number.

- Report your total income and the amount of tax withheld.

- Calculate the excess amount withheld that you are claiming as a refund.

- Sign and date the form to certify its accuracy.

- Submit the form to the IRS, either electronically or by mail, along with any required documentation.

Legal use of the 8946

The legal use of the 8946 form is governed by IRS regulations, which stipulate that taxpayers must accurately report their income and withholding amounts. Submitting this form is a formal request for a refund, and it must be completed correctly to avoid delays or rejections. Compliance with IRS guidelines is essential to ensure that the claim is processed without issues.

Filing Deadlines / Important Dates

Timely filing of the 8946 form is crucial for taxpayers seeking refunds. Generally, the form should be submitted by the tax filing deadline, which is typically April 15 for most individuals. However, if you are claiming a refund for a previous tax year, specific deadlines may apply based on the year in question. It is advisable to check the IRS website for the most current information regarding deadlines.

Who Issues the Form

The 8946 form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. Taxpayers can obtain the form directly from the IRS website or through various tax preparation software that includes IRS forms. Ensuring that you have the correct version of the form is vital for compliance and accurate filing.

Quick guide on how to complete 8946

Complete 8946 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle 8946 on any device with the airSlate SignNow applications for Android or iOS and simplify any document-based task today.

The easiest way to alter and eSign 8946 without hassle

- Obtain 8946 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 8946 and ensure efficient communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8946

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8946 and how does airSlate SignNow support it?

Form 8946 is used for reporting certain tax credits and needs a reliable e-signature platform for secure submission. airSlate SignNow provides an intuitive interface that simplifies the signing process for form 8946, ensuring compliance and security. Our platform allows users to fill out and send form 8946 with ease, streamlining your workflow.

-

Is there a cost associated with using airSlate SignNow for form 8946?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business sizes. Our plans are designed to deliver cost-effective solutions for managing documents like form 8946. You can choose a plan that fits your budget while enjoying robust features for document management and e-signatures.

-

What features does airSlate SignNow offer for managing form 8946?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure storage, making it ideal for form 8946. Users can easily create, send, and sign the document, ensuring a smooth and efficient process. The platform guarantees that your form 8946 is handled with the utmost security and compliance.

-

How can I integrate airSlate SignNow with my existing systems for form 8946?

airSlate SignNow offers seamless integrations with popular platforms like Google Drive, Salesforce, and more for managing form 8946. This allows you to easily incorporate e-signatures and document workflows into your existing software. Our API and integration capabilities make it convenient to automate processes involving form 8946.

-

What are the benefits of using airSlate SignNow for form 8946?

Using airSlate SignNow for form 8946 provides numerous benefits, including improved workflow efficiency and reduced turnaround times. The platform enhances document security and compliance, ensuring that sensitive information is protected. Additionally, our easy-to-use interface empowers users to manage their forms quickly and effectively.

-

Is airSlate SignNow legally compliant for signing form 8946?

Absolutely! airSlate SignNow complies with e-signature laws such as ESIGN and UETA, ensuring that form 8946 signed through our platform is legally binding. This gives you peace of mind that your electronic signatures meet all regulatory requirements. You can confidently use our service to manage your form 8946 paperwork.

-

Can I track the status of my form 8946 using airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your form 8946. You'll receive real-time updates on when the form is viewed, signed, and completed, which helps keep your documentation process transparent. This feature ensures that you stay informed every step of the way.

Get more for 8946

- Living husband wife 497317130 form

- Nc widow form

- Living trust who form

- Living trust for husband and wife with one child north carolina form

- Living trust for husband and wife with minor and or adult children north carolina form

- Nc trust 497317135 form

- Living trust property record north carolina form

- Financial account transfer to living trust north carolina form

Find out other 8946

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement