Nc Trust Form

What is the Nc Trust

The Nc Trust is a legal arrangement designed to manage and protect assets for beneficiaries. It serves various purposes, including estate planning, asset protection, and tax efficiency. By establishing a trust, individuals can dictate how their assets are distributed after their passing, ensuring that their wishes are honored. The Nc Trust is particularly relevant for those looking to secure their family's financial future or manage complex assets.

How to use the Nc Trust

Using the Nc Trust involves several steps to ensure it functions as intended. First, individuals must identify the assets they wish to place in the trust, such as real estate, investments, or personal property. Next, they should appoint a trustee, who will manage the trust according to its terms. It is essential to draft a trust document that outlines the rules and guidelines for asset distribution. Once established, the trust must be funded, meaning assets are transferred into it, allowing the trustee to manage them on behalf of the beneficiaries.

Steps to complete the Nc Trust

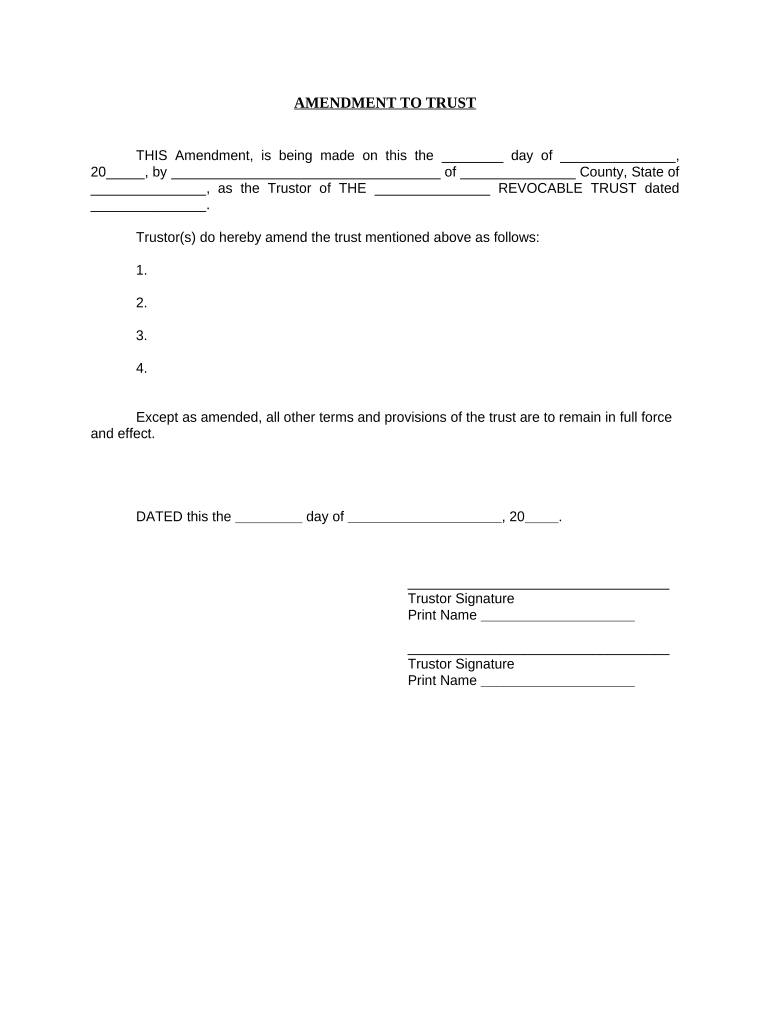

Completing the Nc Trust involves a systematic approach:

- Define your goals: Determine the purpose of the trust and the assets involved.

- Select a trustee: Choose a responsible individual or institution to manage the trust.

- Draft the trust document: Work with a legal professional to create a document that reflects your wishes.

- Fund the trust: Transfer ownership of the selected assets into the trust.

- Review and update: Periodically assess the trust to ensure it meets your needs and complies with legal requirements.

Legal use of the Nc Trust

The Nc Trust must comply with state laws to be legally valid. This includes adhering to regulations regarding the creation, funding, and management of the trust. Proper legal documentation is essential to ensure that the trust is recognized by courts and can effectively carry out its intended purpose. Additionally, the trust should be structured to meet tax obligations and protect the interests of the beneficiaries.

Key elements of the Nc Trust

Several key elements define the Nc Trust:

- Trustor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or organizations designated to receive benefits from the trust.

- Trust document: A legal document that outlines the terms, conditions, and rules governing the trust.

- Funding: The process of transferring assets into the trust to enable its operation.

Eligibility Criteria

To establish an Nc Trust, individuals must meet certain eligibility criteria. Generally, anyone with legal capacity can create a trust, which includes being of legal age and mentally competent. It is also important to have identifiable assets that can be placed in the trust. Additionally, the trust must comply with state-specific laws and regulations, which may vary across jurisdictions.

Quick guide on how to complete nc trust 497317135

Effortlessly Prepare Nc Trust on Any Device

Digital document management has become increasingly popular among both organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Nc Trust on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and electronically sign Nc Trust with minimal effort

- Obtain Nc Trust and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive details with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Nc Trust and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is NC Trust and how does it relate to airSlate SignNow?

NC Trust is a legal concept that ensures the validity and enforceability of electronic signatures. With airSlate SignNow, businesses can confidently execute documents under NC Trust provisions, knowing that their eSigned agreements are legally binding according to North Carolina law.

-

How secure is airSlate SignNow for managing NC Trust documents?

airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your NC Trust documents. We prioritize data protection and compliance, ensuring that your sensitive information remains safe throughout the entire signing process.

-

What are the main features of airSlate SignNow that support NC Trust?

airSlate SignNow offers a range of features that enhance compliance with NC Trust, such as customizable templates, in-person signing options, and audit trails. These tools not only streamline the signing process but also ensure that all agreements adhere to legal standards in North Carolina.

-

Is there a free trial available for airSlate SignNow to test NC Trust capabilities?

Yes, airSlate SignNow provides a free trial that lets users explore its NC Trust capabilities without commitment. This allows potential customers to evaluate the platform’s features and determine if it meets their document signing needs related to NC Trust.

-

How much does airSlate SignNow cost for NC Trust eSigning services?

airSlate SignNow offers several pricing plans designed to accommodate different business sizes and needs, all of which include features that support NC Trust. You can choose a plan based on your document volume and team size, ensuring that you find a solution that fits your budget.

-

Can I integrate airSlate SignNow with other tools to manage NC Trust processes?

Absolutely! airSlate SignNow can seamlessly integrate with various applications such as CRM systems and document management tools to streamline your NC Trust processes. These integrations enhance workflow efficiency, allowing users to manage their documents in one unified platform.

-

What benefits does airSlate SignNow provide for businesses needing NC Trust compliance?

Using airSlate SignNow helps businesses achieve NC Trust compliance by simplifying the signing process and ensuring that eSignatures meet all legal requirements. This efficiency can lead to faster contract turnaround times and improved customer satisfaction, ultimately boosting the bottom line.

Get more for Nc Trust

Find out other Nc Trust

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation