Irs Form 8812

What is the IRS Form 8812

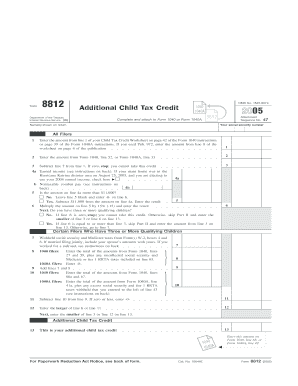

The IRS Form 8812, also known as the Additional Child Tax Credit, is a tax form used by eligible taxpayers to claim a refundable credit for qualifying children. This form allows taxpayers to receive a credit even if they do not owe any taxes, providing financial relief for families. The credit is designed to help lower-income families benefit from the Child Tax Credit, ensuring that they receive support based on their financial circumstances.

How to use the IRS Form 8812

To effectively use the IRS Form 8812, taxpayers must first determine their eligibility based on income and the number of qualifying children. The form requires specific information, including the taxpayer's filing status, adjusted gross income (AGI), and details about each qualifying child. After gathering the necessary information, taxpayers fill out the form and attach it to their tax return, ensuring that they claim the credit accurately and completely.

Steps to complete the IRS Form 8812

Completing the IRS Form 8812 involves several key steps:

- Gather necessary documentation, including Social Security numbers for qualifying children and income statements.

- Determine eligibility by reviewing the income thresholds and requirements for the Child Tax Credit.

- Fill out the form, entering personal information, AGI, and details about qualifying children.

- Calculate the credit amount based on the instructions provided with the form.

- Attach the completed Form 8812 to your tax return before submission.

Legal use of the IRS Form 8812

The IRS Form 8812 is legally valid when completed accurately and submitted in accordance with IRS guidelines. To ensure legal compliance, taxpayers must provide truthful information and retain supporting documents for their claims. The form must be filed by the tax deadline to avoid penalties and ensure eligibility for the credit. Utilizing electronic signature solutions can enhance the legal validity of the submitted form by providing a secure and compliant method of signing.

Key elements of the IRS Form 8812

The IRS Form 8812 includes several key elements that taxpayers must understand:

- Qualifying Children: Taxpayers must identify children who meet the age and relationship criteria.

- Income Limits: The form outlines the income thresholds that determine eligibility for the credit.

- Credit Calculation: Instructions for calculating the credit based on the number of qualifying children and income level.

- Signature Requirements: The form must be signed and dated by the taxpayer to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8812 align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these dates to ensure timely submission and avoid penalties. Additionally, if filing for an extension, the form must still be submitted by the extended deadline to claim the credit.

Quick guide on how to complete irs form 8812

Effortlessly Prepare Irs Form 8812 on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without holdups. Manage Irs Form 8812 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Edit and Electronically Sign Irs Form 8812 with Ease

- Locate Irs Form 8812 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irs Form 8812 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8812

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Irs Form 8812, and who needs it?

Irs Form 8812 is used to claim the Additional Child Tax Credit. Taxpayers who qualify for the Child Tax Credit may need to fill out this form to receive additional financial benefits. It's important for families with dependents to understand how to properly complete Irs Form 8812 to maximize their tax refund.

-

How can airSlate SignNow help with Irs Form 8812?

airSlate SignNow streamlines the process of sending and signing Irs Form 8812 electronically. By using our platform, you can easily prepare, send, and eSign the document, ensuring that it is submitted accurately and on time. This simplifies the often complicated tax documentation process.

-

Is airSlate SignNow cost-effective for filing Irs Form 8812?

Yes, airSlate SignNow offers a cost-effective solution for individuals and businesses needing to manage Irs Form 8812. Our pricing plans are designed to fit various budgets while providing essential features for document management and eSigning. You can save both time and money by using airSlate SignNow.

-

What features does airSlate SignNow offer for Irs Form 8812?

airSlate SignNow provides several powerful features specifically designed for documents like Irs Form 8812. You can create templates, track document status, and ensure secure eSigning. These features help you manage your tax documents more efficiently.

-

How does airSlate SignNow ensure the security of Irs Form 8812?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents such as Irs Form 8812. Our platform uses industry-standard encryption and complies with regulations to protect your data. You can confidently eSign and send your tax forms knowing that they are secure.

-

Can airSlate SignNow integrate with other software for managing Irs Form 8812?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to enhance your experience with Irs Form 8812. Whether it's accounting software or CRM platforms, these integrations help streamline your workflow and eliminate unnecessary data entry.

-

What are the benefits of using airSlate SignNow for Irs Form 8812?

Using airSlate SignNow for Irs Form 8812 offers numerous benefits, including time savings, improved accuracy, and enhanced collaboration. You can quickly send forms for eSignature and track their progress. This efficient process allows you to focus on what matters most—taking care of your finances.

Get more for Irs Form 8812

Find out other Irs Form 8812

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer