Ebirforms

What is the Ebirforms?

The Ebirforms are electronic forms used primarily for tax-related purposes in the United States. They facilitate the submission of various tax documents, allowing individuals and businesses to complete their filings more efficiently. These forms are designed to streamline the process of reporting income, deductions, and other financial information to the Internal Revenue Service (IRS). The offline ebirforms profile page serves as a repository for users to manage their forms, ensuring they have access to the necessary documents when needed.

How to use the Ebirforms

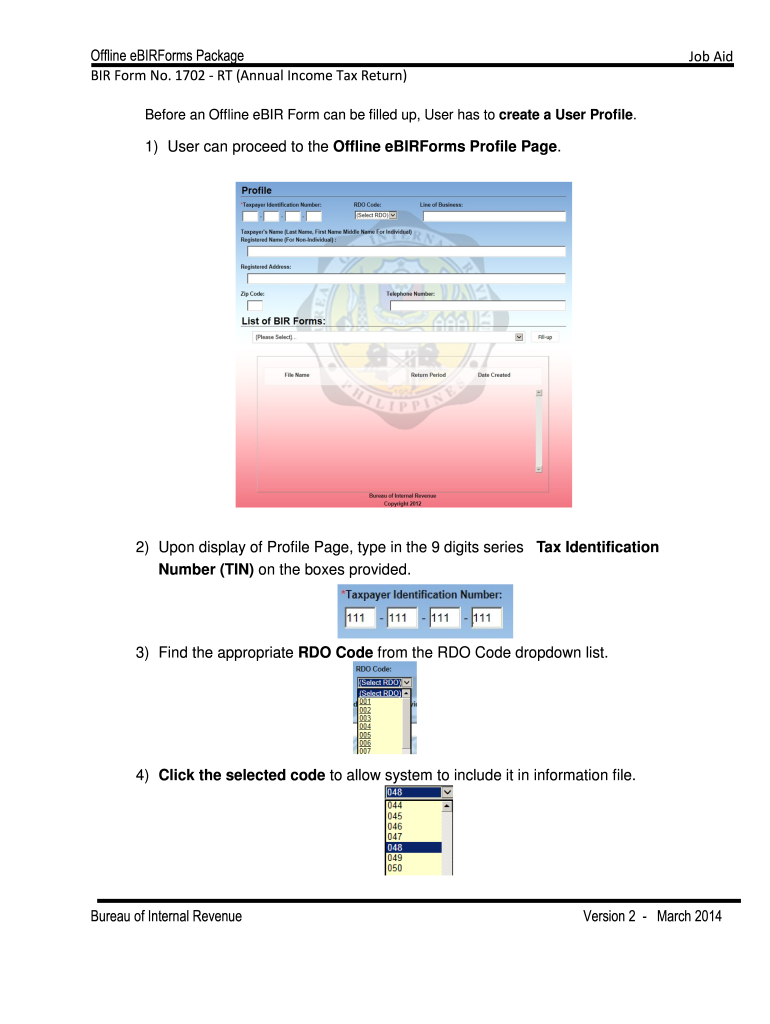

Using the Ebirforms is straightforward. First, users need to access the offline ebirforms profile page, where they can view and manage their forms. Once on the page, individuals can select the specific form they need, such as the bir form 1701 offline. After selecting the form, users can fill it out digitally, ensuring all required fields are completed accurately. Once the form is filled, it can be saved for future reference or printed for submission. It is essential to review the completed form for accuracy before finalizing it.

Steps to complete the Ebirforms

Completing the Ebirforms involves several key steps:

- Access the offline ebirforms profile page and log in to your account.

- Select the appropriate form you need to complete.

- Fill in all required fields, ensuring accuracy and completeness.

- Review the form for any errors or missing information.

- Save the completed form or print it for submission.

Following these steps will help ensure that your form is filled out correctly and submitted on time.

Legal use of the Ebirforms

The legal use of Ebirforms is governed by various regulations that ensure their validity. To be considered legally binding, electronic signatures must comply with the ESIGN Act and UETA, which outline the requirements for electronic documents and signatures. The offline ebirforms profile page provides a secure environment for completing these forms, ensuring compliance with legal standards. Users should ensure that they are using a trusted platform that provides digital certificates and maintains data security.

Required Documents

When completing the Ebirforms, certain documents may be required to support your submission. Commonly needed documents include:

- Proof of identity, such as a driver's license or Social Security card.

- Income statements, including W-2s or 1099 forms.

- Documentation for deductions or credits claimed.

Having these documents ready will facilitate a smoother completion process and help ensure that all necessary information is included.

Form Submission Methods

Ebirforms can be submitted through various methods, depending on the specific requirements of the form. Common submission methods include:

- Online submission through the IRS website or designated platforms.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at local IRS offices.

Choosing the right submission method is crucial to ensure timely processing of your forms.

Quick guide on how to complete ebirforms

Complete Ebirforms effortlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle Ebirforms on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and eSign Ebirforms seamlessly

- Find Ebirforms and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your preferred device. Modify and eSign Ebirforms and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ebirforms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the offline ebirforms profile page and how does it work?

The offline ebirforms profile page allows users to manage their forms and documents without the need for a constant internet connection. This feature is particularly beneficial for those who work in remote areas or require uninterrupted access to their documents. With the offline functionality, you can still fill out and sign your forms, and they will sync once you're back online.

-

Is there a cost associated with using the offline ebirforms profile page?

Yes, there is a cost for accessing the offline ebirforms profile page as part of airSlate SignNow's premium offerings. Pricing is designed to be affordable, allowing businesses of all sizes to utilize the feature. You can explore our pricing plans on the website to find the best fit for your needs.

-

What benefits can I expect from using the offline ebirforms profile page?

The offline ebirforms profile page enhances productivity by enabling users to complete essential forms without relying on an internet connection. This reliability ensures that your workflow remains uninterrupted, even in areas with poor connectivity. Additionally, it provides a seamless transition back to online operations once you're connected.

-

How secure is the offline ebirforms profile page?

Security is a top priority for airSlate SignNow, and the offline ebirforms profile page is no exception. Documents and signatures processed offline are encrypted and securely stored until they can sync with our servers. Our platform complies with industry standards to ensure that your data remains safe, even when working offline.

-

Can I integrate the offline ebirforms profile page with other tools?

Yes, the offline ebirforms profile page can be integrated with various third-party applications through our API. This flexibility allows you to enhance your document workflows and connect with other tools you use to streamline your processes. Check our integration documentation for more details on supported applications.

-

How do I set up my offline ebirforms profile page?

Setting up your offline ebirforms profile page is simple and user-friendly. After logging into your airSlate SignNow account, navigate to the settings menu to enable offline access. Once activated, you can download the necessary files and start managing your documents offline immediately.

-

Are there any limitations when using the offline ebirforms profile page?

While the offline ebirforms profile page is highly functional, some features may be limited compared to online access. For example, real-time collaboration and immediate cloud syncing are only available when connected to the internet. However, all essential signing and form-filling actions can be performed offline.

Get more for Ebirforms

Find out other Ebirforms

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online