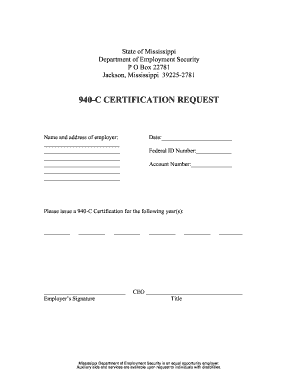

940c Form

What is the 940c Form

The 940c form, officially known as the "Employer's Annual Federal Unemployment (FUTA) Tax Return," is a crucial document for employers in the United States. It is used to report and pay federal unemployment taxes on employee wages. This form is essential for businesses to maintain compliance with federal regulations regarding unemployment insurance. Employers must file the 940c form annually, detailing the total wages paid to employees and the corresponding unemployment tax owed.

Steps to Complete the 940c Form

Completing the 940c form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your Employer Identification Number (EIN) and total wages paid to employees. Follow these steps:

- Enter your business information, including name, address, and EIN.

- Report total payments made to employees during the year.

- Calculate the FUTA tax based on the wages reported.

- Complete any applicable schedules or additional sections as required.

- Review the form for accuracy before submission.

How to Obtain the 940c Form

The 940c form can be easily obtained from the Internal Revenue Service (IRS) website or by contacting the IRS directly. Employers can download the form in PDF format, ensuring they have the most current version. Additionally, many tax preparation software programs include the 940c form, allowing for electronic completion and filing.

Legal Use of the 940c Form

The legal use of the 940c form is governed by federal regulations that require employers to report unemployment taxes accurately. Filing this form is necessary to comply with the Federal Unemployment Tax Act (FUTA). Failure to file the form correctly or on time can result in penalties, including interest on unpaid taxes and potential legal action. Employers must ensure that all information reported is truthful and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the 940c form. The form is due annually on January 31 for the previous calendar year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important for employers to mark their calendars and prepare the necessary information in advance to avoid late filing penalties.

Form Submission Methods

The 940c form can be submitted through various methods, providing flexibility for employers. Options include:

- Filing electronically through IRS-approved e-filing systems.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Employers should choose the method that best suits their needs while ensuring compliance with submission guidelines.

Quick guide on how to complete form 940c

Complete form 940c effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly and without delays. Handle form 940c on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and electronically sign 940c form with minimal effort

- Locate what is a 940 form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and then click the Done button to save your modifications.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign 940 c and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 940c

Create this form in 5 minutes!

How to create an eSignature for the 940c form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask 940 c

-

What is the 940c form and why is it important?

The 940c form is a crucial document used for reporting annual federal unemployment tax. It helps businesses summarize their tax liability for the year. Understanding the 940c form is important for compliance with federal regulations and avoiding penalties.

-

How can airSlate SignNow help with the 940c form?

airSlate SignNow provides an efficient solution for electronically signing and sending the 940c form. With its user-friendly interface, you can easily manage, share, and store your IRS forms securely. This streamlines the process, ensuring you meet filing deadlines with ease.

-

Is airSlate SignNow affordable for small businesses needing to file the 940c form?

Absolutely! airSlate SignNow offers cost-effective plans tailored for small businesses that need to manage and eSign the 940c form. Our pricing model ensures you get the features you need without breaking your budget.

-

What features does airSlate SignNow offer for handling the 940c form?

airSlate SignNow includes various features perfect for managing the 940c form, such as secure e-signature, document templates, and audit trails. These tools not only enhance efficiency but also ensure compliance and security during the filing process.

-

Can I integrate airSlate SignNow with other accounting software for the 940c form?

Yes, airSlate SignNow integrates seamlessly with numerous accounting software solutions. This integration allows you to sync your data and manage the 940c form effortlessly alongside your financial reports, enhancing your workflow and reducing manual errors.

-

What benefits does eSigning the 940c form provide?

E-signing the 940c form with airSlate SignNow provides multiple benefits, including faster completion times, reduced paperwork, and enhanced security. By electronically signing this form, you can ensure that it is stored safely and is easily accessible for future reference.

-

Is it easy to get started with airSlate SignNow for the 940c form?

Yes, getting started with airSlate SignNow for your 940c form is a straightforward process. Simply sign up for an account, and you can begin uploading and sending your documents within minutes. Our user guides and customer support are available to assist you along the way.

Get more for form 940c

Find out other 940c form

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online