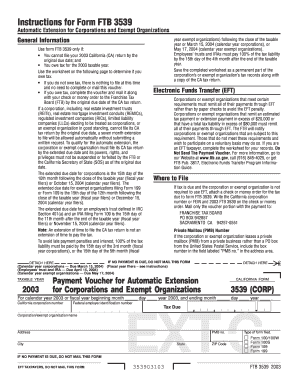

Form 3539

What is the Form 3539

The California Form 3539 is a tax form used by individuals and businesses to request a payment plan for their tax liabilities. This form is particularly relevant for taxpayers who may be unable to pay their taxes in full by the due date. By submitting Form 3539, taxpayers can establish an installment agreement with the California Franchise Tax Board (FTB), allowing them to pay their taxes over time.

How to use the Form 3539

To use the California Form 3539, taxpayers must first complete the form accurately, providing all required information, including personal details and tax information. Once completed, the form should be submitted to the FTB along with any necessary documentation that supports the payment plan request. It is essential to ensure that all information is correct to avoid delays in processing.

Steps to complete the Form 3539

Completing the California Form 3539 involves several steps:

- Gather personal and financial information, including your Social Security number or Employer Identification Number.

- Fill out the form, ensuring all sections are completed accurately.

- Calculate the total tax amount owed and determine a reasonable monthly payment amount.

- Review the form for any errors or omissions.

- Submit the completed form to the FTB, either online or via mail.

Legal use of the Form 3539

The California Form 3539 is legally binding once it is submitted and accepted by the FTB. This means that taxpayers who enter into an installment agreement are obligated to adhere to the terms outlined in the form. Failure to comply with the agreement can result in penalties, including additional interest and collection actions by the FTB.

Filing Deadlines / Important Dates

Timely submission of Form 3539 is crucial. Taxpayers should be aware of the deadlines for filing the form and making the initial payment. Typically, the form must be submitted by the tax return due date. Additionally, any payments outlined in the installment agreement must be made according to the schedule established in the form to avoid penalties.

Who Issues the Form

The California Form 3539 is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's personal income tax and corporate income tax laws. Taxpayers can access the form directly through the FTB's official website or request it through their customer service channels.

Quick guide on how to complete form 3539 10922562

Effortlessly Prepare Form 3539 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents quickly and without any holdups. Manage Form 3539 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to Modify and Electronically Sign Form 3539 with Ease

- Locate Form 3539 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure confidential details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Form 3539 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3539 10922562

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California 3539 and how does it relate to eSigning?

California 3539 refers to the legal framework governing electronic signatures in California. It ensures that eSignatures hold the same legal validity as traditional signatures, providing businesses with a secure way to sign documents online using airSlate SignNow.

-

How does airSlate SignNow support compliance with California 3539?

airSlate SignNow is designed to comply with California 3539 regulations, ensuring that all electronic signatures are legally binding. Our platform incorporates robust security measures and a thorough audit trail to guarantee compliance for your business transactions.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored for different business sizes and needs. Our pricing options include monthly and annual subscriptions, allowing you to choose the best fit for your company while leveraging the benefits of California 3539 compliance.

-

What features does airSlate SignNow offer that align with California 3539?

AirSlate SignNow offers a variety of features that align with California 3539, such as customizable templates, mobile signing, and advanced authentication methods. These features enhance the signing experience while ensuring that your documents remain compliant and secure.

-

Can airSlate SignNow be integrated with other software tools?

Yes, airSlate SignNow can be seamlessly integrated with various software applications, including CRM and project management tools. These integrations facilitate smoother workflows and streamline document management while adhering to the standards set by California 3539.

-

How does eSigning with airSlate SignNow benefit my business in California?

Utilizing airSlate SignNow for eSigning simplifies document workflows, reduces turnaround times, and enhances customer experience. These benefits are particularly valuable for businesses in California that must comply with regulations like California 3539, making the signing process more efficient.

-

Is airSlate SignNow suitable for all business types in California?

Absolutely! AirSlate SignNow caters to various industries and business types across California. Whether you're a small business or a large enterprise, our platform's compliance with California 3539 ensures that all your electronic documentation needs are met effectively.

Get more for Form 3539

- Landlord failure form

- Ny codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497321302 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497321303 form

- Letter tenant in 497321304 form

- New york landlord 497321305 form

- New york tenant 497321306 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497321307 form

Find out other Form 3539

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament