Form 564 Oklahoma

What is the Form 564 Oklahoma

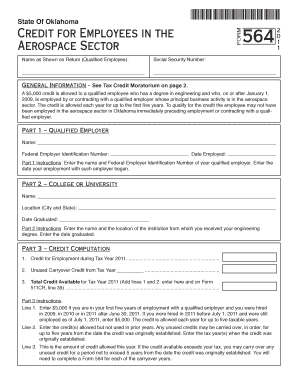

The Form 564 Oklahoma is a tax document used by businesses and individuals to report specific financial information to the Oklahoma Tax Commission. This form is essential for ensuring compliance with state tax regulations and is primarily utilized for reporting income, deductions, and credits. Understanding the purpose of this form is crucial for accurate tax filing and avoiding potential penalties.

Steps to complete the Form 564 Oklahoma

Completing the Form 564 Oklahoma involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay special attention to the calculations, as errors can lead to delays or penalties. After completing the form, review it thoroughly before submission to confirm that all entries are correct.

How to obtain the Form 564 Oklahoma

The Form 564 Oklahoma can be obtained directly from the Oklahoma Tax Commission's website or through their local offices. It is available in a downloadable format, allowing users to print it for completion. Additionally, many tax preparation software programs include the form, making it easier to fill out and submit electronically.

Legal use of the Form 564 Oklahoma

To ensure the legal validity of the Form 564 Oklahoma, it is essential to follow state guidelines for completion and submission. This includes providing accurate information and ensuring that all required signatures are included. Utilizing a reliable electronic signature platform can enhance the legal standing of the submitted form, as it complies with the ESIGN Act and other relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 564 Oklahoma are critical to avoid penalties. Typically, the form must be submitted by the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It is advisable to check for any changes or specific deadlines that may apply to your situation, especially for extensions or special circumstances.

Form Submission Methods (Online / Mail / In-Person)

The Form 564 Oklahoma can be submitted through various methods, providing flexibility for taxpayers. It can be filed online via the Oklahoma Tax Commission's e-file system, which is often the fastest option. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs.

Quick guide on how to complete form 564 oklahoma

Prepare Form 564 Oklahoma effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any delays. Manage Form 564 Oklahoma on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The simplest way to modify and electronically sign Form 564 Oklahoma with ease

- Obtain Form 564 Oklahoma and click on Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to deliver your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow caters to your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 564 Oklahoma and ensure excellent communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 564 oklahoma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Oklahoma Form 564 instructions?

The Oklahoma Form 564 instructions provide detailed guidance on how to complete and file the form accurately. It is essential for businesses looking to ensure compliance with Oklahoma tax regulations. Understanding these instructions will help streamline the filing process and prevent errors.

-

How can airSlate SignNow help with filing Oklahoma Form 564?

airSlate SignNow allows users to easily complete and eSign documents, including the Oklahoma Form 564. Our platform simplifies the process by providing templates and a user-friendly interface that guides you through the necessary steps. This makes filing much more efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for Oklahoma Form 564?

Yes, while airSlate SignNow offers a cost-effective solution for document management, there are subscription plans that you can choose based on your business needs. These plans provide access to various features that can enhance your experience when dealing with Oklahoma Form 564 instructions and other documents.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a variety of features including eSignature, document templates for Oklahoma Form 564, and the ability to store and share documents securely. Additionally, the platform supports real-time collaboration, making it easier for teams to work together on important files.

-

Can I integrate airSlate SignNow with other applications for Oklahoma Form 564?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and more. This facilitates easier access to your documents and helps streamline the entire process of managing the Oklahoma Form 564 instructions within your existing workflows.

-

Are there any benefits to using airSlate SignNow for Oklahoma Form 564 instructions?

Using airSlate SignNow to manage your Oklahoma Form 564 instructions can save you time and reduce the risk of errors. The platform is designed to provide a straightforward way to prepare and eSign documents, allowing you to focus on your business operations rather than getting bogged down with paperwork.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption methods and comply with data protection regulations to ensure that your documents, including those related to Oklahoma Form 564 instructions, remain safe and confidential throughout the entire process.

Get more for Form 564 Oklahoma

- Employment or job termination package georgia form

- Newly widowed individuals package georgia form

- Employment interview package georgia form

- Employment employee form

- Assignment of mortgage package georgia form

- Assignment of lease package georgia form

- Georgia purchase form

- Satisfaction cancellation or release of mortgage package georgia form

Find out other Form 564 Oklahoma

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form