Edvest Withdrawal Form

What is the Edvest Withdrawal Form

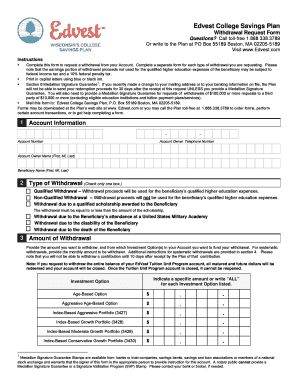

The Edvest withdrawal form is a specific document used by account holders to request the withdrawal of funds from their Edvest 529 college savings plan. This form is essential for individuals looking to access their savings for qualified education expenses or other approved uses. By completing this form, account holders can ensure that their requests are processed efficiently and in compliance with the plan's guidelines.

How to use the Edvest Withdrawal Form

Using the Edvest withdrawal form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from the official Edvest website or through customer service. Next, fill out the required sections, including personal information, account details, and the amount you wish to withdraw. Finally, review the completed form for accuracy before submitting it according to the specified submission methods.

Steps to complete the Edvest Withdrawal Form

Completing the Edvest withdrawal form requires careful attention to detail. Follow these steps:

- Download the form from the Edvest website or request it through customer service.

- Fill in your personal information, including your name, address, and account number.

- Specify the amount you wish to withdraw and the purpose of the withdrawal.

- Sign and date the form to validate your request.

- Submit the form via your chosen method: online, by mail, or in person.

Legal use of the Edvest Withdrawal Form

The Edvest withdrawal form is legally binding when completed correctly and submitted according to the guidelines established by the Edvest program. To ensure its legal standing, it is important to provide accurate information and obtain any necessary signatures. Compliance with relevant laws and regulations, such as those governing 529 plans, further solidifies the form's validity.

Required Documents

When submitting the Edvest withdrawal form, certain documents may be required to support your request. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Documentation of qualified education expenses, if applicable.

- Any additional forms or paperwork requested by the Edvest program.

Form Submission Methods

The Edvest withdrawal form can be submitted through various methods to accommodate user preferences. These methods include:

- Online submission via the Edvest portal, which allows for quick processing.

- Mailing the completed form to the designated Edvest address.

- In-person submission at an authorized Edvest location, if available.

Eligibility Criteria

To use the Edvest withdrawal form, account holders must meet certain eligibility criteria. Generally, these criteria include:

- Being the account owner or having authorized access to the account.

- Ensuring that the funds are being withdrawn for qualified education expenses or other approved purposes.

- Adhering to any age or account balance requirements set by the Edvest program.

Quick guide on how to complete edvest withdrawal form

Prepare Edvest Withdrawal Form effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documentation, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Edvest Withdrawal Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and electronically sign Edvest Withdrawal Form with ease

- Obtain Edvest Withdrawal Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the features that airSlate SignNow provides specifically for that task.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to distribute your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from the device of your choice. Edit and electronically sign Edvest Withdrawal Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the edvest withdrawal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the edvest withdrawal form and how does it work?

The edvest withdrawal form is a document designed to facilitate the withdrawal process from an Edvest account. It allows users to easily request and authorize the withdrawal of funds, ensuring a smooth transaction. By using airSlate SignNow, you can electronically sign this form, making it a quick and convenient option for users.

-

How can I access the edvest withdrawal form using airSlate SignNow?

To access the edvest withdrawal form on airSlate SignNow, simply log into your account and navigate to the templates section. You can either create a new withdrawal form from scratch or use a premade version. Our platform's user-friendly interface makes it easy to customize and send the form for eSigning.

-

Is there a cost associated with using the edvest withdrawal form on airSlate SignNow?

airSlate SignNow offers various pricing plans, including a free trial that allows you to try out the features related to the edvest withdrawal form. Depending on your needs, you can choose a plan that provides flexible options for sending and signing documents digitally. Be sure to check our pricing page for the latest offers.

-

What are the benefits of using airSlate SignNow for the edvest withdrawal form?

Using airSlate SignNow for the edvest withdrawal form brings several benefits, including enhanced security, speed, and ease of use. Electronic signatures streamline the approval process and save valuable time. Additionally, our platform ensures that all your documents are stored securely and accessible at any time.

-

Can I integrate the edvest withdrawal form with other applications?

Yes, airSlate SignNow supports integrations with various applications to enhance your workflow with the edvest withdrawal form. You can connect with popular tools such as Google Drive, Salesforce, and more. This allows for seamless document management and expedites the signing process across platforms.

-

Is the edvest withdrawal form legally binding when signed electronically?

Yes, the edvest withdrawal form signed electronically via airSlate SignNow is legally binding. Our platform complies with eSignature laws and regulations, ensuring that your electronically signed documents hold the same legal weight as traditional handwritten signatures. This offers peace of mind for users completing transactions.

-

Can multiple users sign the edvest withdrawal form at the same time?

Absolutely! airSlate SignNow allows multiple users to sign the edvest withdrawal form simultaneously, making it convenient for collaborative approvals. You can easily send the form to all required parties, and they can sign from anywhere, improving efficiency in your withdrawal process.

Get more for Edvest Withdrawal Form

Find out other Edvest Withdrawal Form

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF