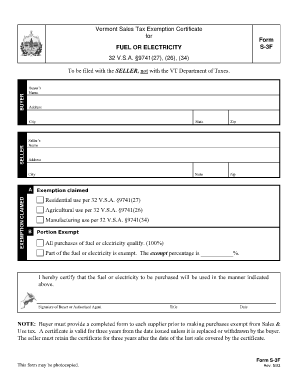

S 3F State of Vermont State Vt Form

What is the S 3F State Of Vermont State Vt

The S 3F State Of Vermont State Vt form is a specific document used primarily for state tax purposes in Vermont. It serves as a declaration for various tax-related matters, allowing individuals and businesses to report their financial information accurately. This form is essential for ensuring compliance with state regulations and may be required for various financial transactions or filings.

How to use the S 3F State Of Vermont State Vt

Using the S 3F State Of Vermont State Vt form involves several steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, accurately fill out the form, ensuring that all information is correct and complete. Once filled, review the form for any errors before submission. This process helps to avoid delays or complications with your tax filings.

Steps to complete the S 3F State Of Vermont State Vt

Completing the S 3F State Of Vermont State Vt form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Vermont Department of Taxes website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any deductions you are eligible for, using accurate figures.

- Double-check all entries for accuracy.

- Sign and date the form before submission.

Legal use of the S 3F State Of Vermont State Vt

The legal use of the S 3F State Of Vermont State Vt form is crucial for compliance with Vermont tax laws. This form must be completed accurately to ensure that all reported information is valid and can be verified by tax authorities. Failure to use the form correctly may result in penalties or legal consequences, highlighting the importance of understanding its requirements.

State-specific rules for the S 3F State Of Vermont State Vt

Vermont has specific rules governing the use of the S 3F State Of Vermont State Vt form. These include deadlines for submission, eligibility criteria for certain deductions, and guidelines for reporting income. Familiarity with these regulations is essential for anyone filing this form to ensure compliance and avoid potential issues with state tax authorities.

Examples of using the S 3F State Of Vermont State Vt

Examples of using the S 3F State Of Vermont State Vt form include reporting income from self-employment, claiming deductions for business expenses, or filing for tax credits. Each scenario requires accurate reporting to ensure that the form serves its purpose effectively. Understanding how to apply the form in various contexts can help taxpayers maximize their benefits while remaining compliant with state laws.

Quick guide on how to complete s 3f state of vermont state vt

Effortlessly Prepare S 3F State Of Vermont State Vt on Any Device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage S 3F State Of Vermont State Vt on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign S 3F State Of Vermont State Vt Smoothly

- Locate S 3F State Of Vermont State Vt and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive details using features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign option, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign S 3F State Of Vermont State Vt while ensuring effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s 3f state of vermont state vt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's solution for the S 3F State Of Vermont State Vt.?

airSlate SignNow provides businesses in the S 3F State Of Vermont State Vt. with a hassle-free way to send and electronically sign documents. This cost-effective solution enhances efficiency and streamlines workflows, allowing users to manage their documents easily.

-

How does airSlate SignNow improve document management for businesses in S 3F State Of Vermont State Vt.?

With airSlate SignNow, businesses in the S 3F State Of Vermont State Vt. can automate their document workflows, ensuring that all documents are managed efficiently. The platform offers tools for tracking and organizing documents, which saves time and minimizes errors.

-

What features does airSlate SignNow offer for users in S 3F State Of Vermont State Vt.?

airSlate SignNow includes features such as document templates, real-time collaboration, and advanced security measures tailored for the S 3F State Of Vermont State Vt. businesses. These features ensure a smooth signing process while maintaining the integrity and confidentiality of documents.

-

Is airSlate SignNow cost-effective for small businesses in S 3F State Of Vermont State Vt.?

Yes, airSlate SignNow offers various pricing plans designed for businesses of all sizes in the S 3F State Of Vermont State Vt. region. This allows small businesses to access essential eSigning features without straining their budgets.

-

What are the benefits of using airSlate SignNow in the S 3F State Of Vermont State Vt.?

Using airSlate SignNow in the S 3F State Of Vermont State Vt. offers numerous benefits, including increased signing speed, reduced paperwork, and enhanced document security. This results in lower operational costs and improved productivity for businesses.

-

Can airSlate SignNow integrate with other software commonly used in S 3F State Of Vermont State Vt.?

Absolutely! airSlate SignNow supports integrations with various popular software applications, making it adaptable for businesses in the S 3F State Of Vermont State Vt. Whether it’s CRM, accounting, or project management tools, airSlate SignNow can help sync workflows seamlessly.

-

How secure is airSlate SignNow for businesses in S 3F State Of Vermont State Vt.?

airSlate SignNow prioritizes the security of its users in the S 3F State Of Vermont State Vt. with advanced encryption and compliance with industry standards. This ensures that all electronic signatures and documents are protected, providing peace of mind for users.

Get more for S 3F State Of Vermont State Vt

Find out other S 3F State Of Vermont State Vt

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free