Gov Tax Exempt Form Hotel

What is the Gov Tax Exempt Form Hotel

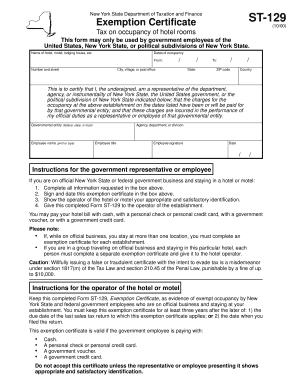

The Gov Tax Exempt Form Hotel is a specific document used in Massachusetts that allows qualifying organizations, such as government entities and certain non-profits, to claim exemption from hotel taxes. This form serves as a certificate of tax exemption, enabling eligible groups to avoid paying the standard hotel occupancy tax when booking accommodations. Understanding this form is crucial for organizations looking to manage their travel expenses effectively.

How to use the Gov Tax Exempt Form Hotel

To utilize the Gov Tax Exempt Form Hotel, eligible organizations must complete the form accurately and present it to the hotel at the time of check-in. The hotel will review the form to ensure that it meets the necessary criteria for tax exemption. It is important to provide all required information, including the name of the organization, the purpose of the stay, and any identification numbers that may be necessary for verification.

Steps to complete the Gov Tax Exempt Form Hotel

Completing the Gov Tax Exempt Form Hotel involves several key steps:

- Download the form in PDF format from an official source.

- Fill in the organization's name, address, and contact information.

- Provide details about the stay, including the hotel name, address, and dates of occupancy.

- Include the reason for the tax exemption, ensuring it aligns with the qualifying criteria.

- Sign and date the form to certify its accuracy.

Once completed, the form should be printed and presented to the hotel upon arrival.

Legal use of the Gov Tax Exempt Form Hotel

The Gov Tax Exempt Form Hotel is legally binding when completed correctly. It must be used in compliance with Massachusetts tax laws, which outline the specific criteria for tax exemption. Misuse of the form, such as falsifying information or using it for ineligible stays, can lead to penalties. Therefore, organizations should ensure they understand the legal implications of using this form and maintain accurate records of their tax-exempt transactions.

Key elements of the Gov Tax Exempt Form Hotel

Several key elements are essential for the Gov Tax Exempt Form Hotel to be valid:

- Organization Information: The name and address of the exempt organization.

- Purpose of Stay: A clear explanation of the reason for the exemption.

- Hotel Details: The name and address of the hotel where accommodations are being booked.

- Dates of Stay: Specific check-in and check-out dates.

- Signature: An authorized representative must sign the form to validate it.

Eligibility Criteria

To qualify for the Gov Tax Exempt Form Hotel, organizations must meet specific eligibility criteria set by Massachusetts tax regulations. Generally, this includes being a government agency, a non-profit organization, or an educational institution. It is essential for organizations to review these criteria carefully to ensure they qualify for tax exemption before submitting the form.

Quick guide on how to complete gov tax exempt form hotel

Easily Prepare Gov Tax Exempt Form Hotel on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Gov Tax Exempt Form Hotel on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Edit and eSign Gov Tax Exempt Form Hotel Effortlessly

- Locate Gov Tax Exempt Form Hotel and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign Gov Tax Exempt Form Hotel and maintain exceptional communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gov tax exempt form hotel

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Massachusetts hotel tax exemption form?

The Massachusetts hotel tax exemption form is a document that allows eligible individuals or organizations to avoid paying certain hotel taxes in Massachusetts. This form is essential for qualifying guests, such as government employees or non-profit organizations, who are exempt from hotel taxes under specific conditions. By using the Massachusetts hotel tax exemption form, you can save on travel expenses while ensuring compliance with state tax regulations.

-

How do I obtain a Massachusetts hotel tax exemption form?

You can obtain the Massachusetts hotel tax exemption form from the Massachusetts Department of Revenue website or directly from the hotel you are booking. Typically, hotels will have these forms available upon request. Make sure to fill them out accurately to ensure you qualify for the exemption.

-

Can airSlate SignNow help me complete the Massachusetts hotel tax exemption form?

Yes, airSlate SignNow provides an easy-to-use platform to complete the Massachusetts hotel tax exemption form digitally. You can sign, edit, and store your forms securely, streamlining the process. This ability to digitize and manage your documents contributes to a hassle-free experience when dealing with tax exemptions.

-

Are there any fees associated with using airSlate SignNow to manage my Massachusetts hotel tax exemption forms?

airSlate SignNow offers a variety of pricing plans, including options that cater to different business needs. While there may be costs involved, the service is generally cost-effective compared to traditional methods of document handling. This ensures that you can manage your Massachusetts hotel tax exemption forms affordably and efficiently.

-

What benefits do I gain from using airSlate SignNow for my Massachusetts hotel tax exemption form?

Using airSlate SignNow for your Massachusetts hotel tax exemption form allows you to save time with easy document management. You can eSign forms and share them instantly, enhancing collaboration. Additionally, the platform keeps your documents secure while ensuring a smooth tax exemption process.

-

How does airSlate SignNow integrate with other tools I use for managing travel?

airSlate SignNow offers seamless integrations with a variety of platforms, making it easy to incorporate your Massachusetts hotel tax exemption form into your existing workflow. Whether you use travel management software or project management tools, you can streamline your processes. These integrations enhance productivity by allowing you to manage documents and travel expenses efficiently.

-

Is my data safe when using airSlate SignNow for the Massachusetts hotel tax exemption form?

Absolutely! airSlate SignNow prioritizes data security by employing industry-standard encryption and secure storage solutions. When you use the platform for your Massachusetts hotel tax exemption form, you can trust that your sensitive information is well-protected throughout the entire process.

Get more for Gov Tax Exempt Form Hotel

- Excavation contractor package mississippi form

- Renovation contractor package mississippi form

- Concrete mason contractor package mississippi form

- Demolition contractor package mississippi form

- Security contractor package mississippi form

- Insulation contractor package mississippi form

- Paving contractor package mississippi form

- Site work contractor package mississippi form

Find out other Gov Tax Exempt Form Hotel

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form