Va Ireg Form

What is the Va Ireg

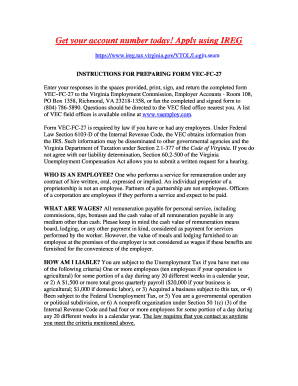

The Va Ireg is a specific form utilized in Virginia for various administrative and legal purposes. It serves as a critical document for individuals and businesses to ensure compliance with state regulations. This form is particularly relevant for those dealing with employment verification and tax-related matters. Understanding its purpose and the information it collects is essential for proper use.

How to use the Va Ireg

Using the Va Ireg involves several straightforward steps. First, individuals must gather the necessary information required to complete the form accurately. This includes personal identification details and any relevant employment history. Once the information is compiled, the form can be filled out either digitally or on paper. After completing the form, it should be submitted according to the specified guidelines to ensure it is processed correctly.

Steps to complete the Va Ireg

Completing the Va Ireg requires careful attention to detail. Here are the essential steps:

- Gather all required personal and employment information.

- Access the Va Ireg form through the appropriate channels, either online or in print.

- Fill out the form, ensuring all fields are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form as directed, either electronically or via mail.

Legal use of the Va Ireg

The legal use of the Va Ireg is governed by state laws and regulations. This form must be completed accurately to be considered valid. It is crucial for users to understand the legal implications of the information provided, as inaccuracies can lead to penalties or complications in legal matters. Compliance with all relevant laws ensures that the form serves its intended purpose effectively.

Required Documents

When completing the Va Ireg, certain documents may be required to support the information provided. These documents typically include:

- Proof of identity, such as a driver's license or state ID.

- Employment records or pay stubs to verify employment history.

- Tax documents, if applicable, to confirm income details.

Having these documents ready can streamline the completion process and enhance the accuracy of the information submitted.

Form Submission Methods

The Va Ireg can be submitted through various methods, depending on the preferences of the individual or business. Common submission methods include:

- Online submission through designated state portals.

- Mailing the completed form to the appropriate state office.

- In-person delivery at local government offices.

Choosing the right submission method can help ensure timely processing and compliance with state requirements.

Quick guide on how to complete va ireg

Complete Va Ireg easily on any device

Digital document management has become increasingly favored by companies and individuals. It presents an ideal environmentally friendly option to traditional printed and signed materials, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Va Ireg on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Va Ireg without hassle

- Locate Va Ireg and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your delivery method, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Va Ireg and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the va ireg

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vaireg and how does it benefit my business?

Vaireg is an innovative feature offered by airSlate SignNow that streamlines the document signing process. By utilizing vaireg, businesses can enhance workflow efficiency, reduce turnaround times, and improve overall productivity. This feature allows users to manage documents seamlessly, making it easier to handle multiple signers.

-

How much does it cost to use vaireg with airSlate SignNow?

The pricing for using vaireg with airSlate SignNow is competitive and designed to provide value for businesses of all sizes. Plans start with a basic option that includes essential features, while more advanced plans offer additional capabilities to maximize efficiency. It's best to visit our website to view detailed pricing options tailored to your needs.

-

What features does vaireg provide to enhance document signing?

Vaireg includes features such as template creation, automatic reminders, and real-time tracking of document status. These tools help ensure that all documents are signed on time and that you can monitor their progress easily. This makes vaireg a vital tool for any organization looking to manage their document workflows effectively.

-

Can vaireg integrate with other software platforms?

Yes, vaireg works seamlessly with various software platforms and applications to enhance your existing workflows. It integrates with popular tools like Google Drive, Salesforce, and more, allowing users to streamline their processes and improve connectivity. This integration capability makes vaireg a versatile option for many businesses.

-

Is it easy to use vaireg for document signing?

Absolutely! Vaireg is designed with user-friendliness in mind, ensuring that even those with minimal technical experience can navigate the platform effortlessly. The intuitive interface allows users to upload, edit, and send documents for signing quickly, making the process efficient and accessible for everyone.

-

What advantages does vaireg offer over traditional signing methods?

Vaireg signNowly reduces the time and effort typically required for traditional signing methods. It eliminates the need for printing, scanning, and mailing documents, which can delay processes and increase costs. By using vaireg, businesses can achieve faster turnarounds and minimize human errors in document handling.

-

How secure is the vaireg feature for document signing?

Security is a top priority with vaireg, as airSlate SignNow employs advanced encryption and authentication measures to protect your documents. This ensures that all signatures and sensitive information remain secure during the signing process. Customers can have peace of mind knowing their data is well-protected with vaireg.

Get more for Va Ireg

- Waiver and release from liability for minor child for bowling alley form

- Waiver and release from liability for adult for parasailing form

- Waiver and release from liability for minor child for parasailing form

- Liability adult 497427134 form

- Liability minor 497427135 form

- Waiver and release from liability for adult for curling facility form

- Waiver and release from liability for minor child for curling facility form

- Waiver and release from liability for adult for soccer complex form

Find out other Va Ireg

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast