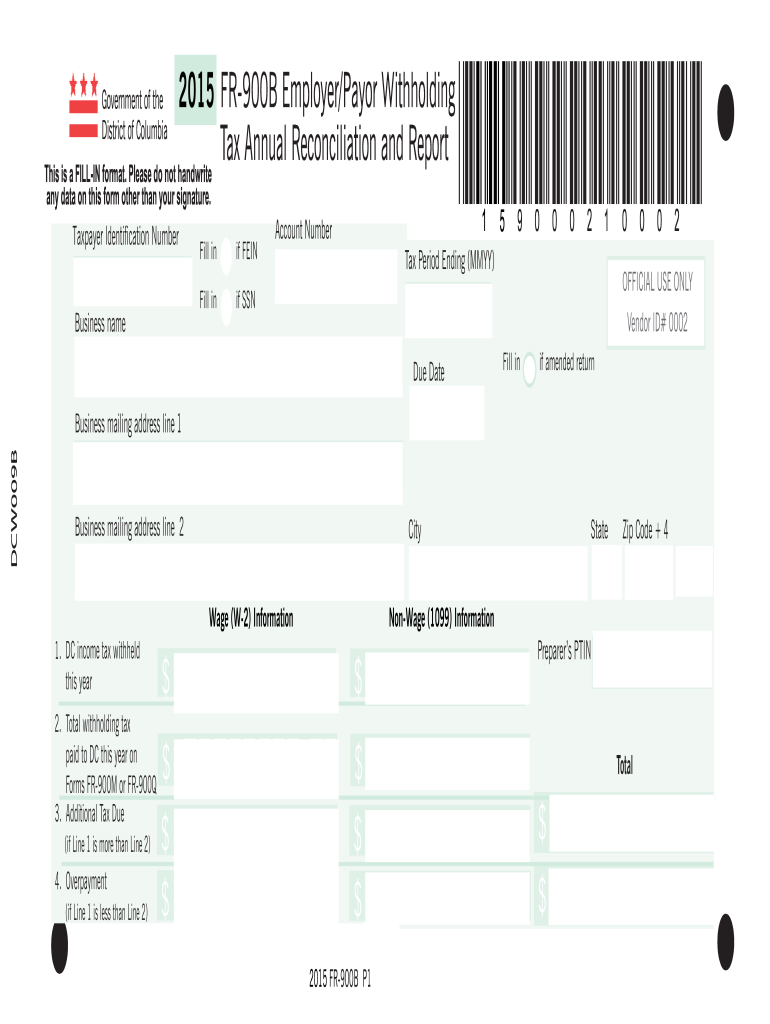

FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc Form

What is the FR 900Q Employer/Payer Withholding Tax Annual OTR CFO DC

The FR 900Q is a crucial form used for reporting employer and payer withholding tax in Washington, D.C. This form is specifically designed for businesses and employers to report the total amount of withholding tax they have collected from employees throughout the tax year. It is essential for ensuring compliance with local tax regulations and helps the D.C. Office of Tax and Revenue (OTR) monitor tax collection effectively. Accurate completion of the FR 900Q is vital for maintaining good standing with tax authorities and avoiding potential penalties.

Steps to Complete the FR 900Q Employer/Payer Withholding Tax Annual OTR CFO DC

Completing the FR 900Q involves several important steps to ensure accuracy and compliance. First, gather all necessary financial records, including payroll reports and withholding amounts for each employee. Next, accurately fill out the form, ensuring that all required fields are completed, such as the total amount withheld and the employer's identification details. After completing the form, review it carefully for any errors or omissions. Finally, submit the FR 900Q to the D.C. Office of Tax and Revenue by the specified deadline, either electronically or via mail, based on your preference.

Legal Use of the FR 900Q Employer/Payer Withholding Tax Annual OTR CFO DC

The FR 900Q is legally binding when completed and submitted according to the guidelines set forth by the D.C. Office of Tax and Revenue. Compliance with local tax laws is essential, as failure to submit the form or providing inaccurate information can lead to penalties and interest charges. Additionally, the form must be signed by an authorized representative of the business, ensuring that the information provided is accurate and true to the best of their knowledge. Understanding the legal implications of the FR 900Q is crucial for businesses operating in D.C.

Filing Deadlines / Important Dates for the FR 900Q

Filing deadlines for the FR 900Q are critical for compliance. Typically, the form must be submitted annually, with the deadline falling on the last day of February for the previous tax year. It is important for employers to mark this date on their calendars to avoid late filing penalties. Additionally, any changes in tax regulations or deadlines will be communicated by the D.C. Office of Tax and Revenue, so staying informed about updates is essential for timely submissions.

Form Submission Methods for the FR 900Q

The FR 900Q can be submitted through various methods, providing flexibility for employers. Businesses can choose to file the form electronically through the D.C. Office of Tax and Revenue’s online portal, which is often the fastest and most efficient method. Alternatively, employers may opt to mail the completed form to the designated address provided by the OTR. In-person submissions are also accepted, allowing for direct interaction with tax officials if needed. Each method has its own advantages, so employers should choose the one that best suits their needs.

Penalties for Non-Compliance with the FR 900Q

Non-compliance with the FR 900Q can result in significant penalties for businesses. Late submissions may incur fines, and inaccurate reporting can lead to additional interest charges on unpaid taxes. In severe cases, persistent non-compliance may result in legal action or further scrutiny from tax authorities. It is essential for employers to understand these risks and prioritize timely and accurate completion of the FR 900Q to avoid potential repercussions.

Quick guide on how to complete 2015 fr 900b employerpayer withholding tax annual otr cfo dc

Prepare FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow offers you all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to edit and eSign FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc with ease

- Find FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight signNow sections of your documents or obscure sensitive information with the tools airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal standing as a traditional ink signature.

- Review all the details and click on the Done button to save your edits.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 fr 900b employerpayer withholding tax annual otr cfo dc

How to create an eSignature for your 2015 Fr 900b Employerpayer Withholding Tax Annual Otr Cfo Dc in the online mode

How to generate an eSignature for your 2015 Fr 900b Employerpayer Withholding Tax Annual Otr Cfo Dc in Chrome

How to make an eSignature for putting it on the 2015 Fr 900b Employerpayer Withholding Tax Annual Otr Cfo Dc in Gmail

How to generate an electronic signature for the 2015 Fr 900b Employerpayer Withholding Tax Annual Otr Cfo Dc straight from your mobile device

How to make an eSignature for the 2015 Fr 900b Employerpayer Withholding Tax Annual Otr Cfo Dc on iOS devices

How to generate an eSignature for the 2015 Fr 900b Employerpayer Withholding Tax Annual Otr Cfo Dc on Android devices

People also ask

-

What is the fr 900q feature in airSlate SignNow?

The fr 900q feature in airSlate SignNow refers specifically to our advanced document signing capabilities. This feature allows users to create, send, and manage digital signatures securely. With fr 900q, businesses can streamline their document workflows and enhance productivity.

-

How does airSlate SignNow pricing compare for fr 900q users?

For businesses looking to utilize the fr 900q feature, airSlate SignNow offers competitive pricing plans. These plans cater to various needs, ensuring that every customer can find a suitable option. Overall, companies will find our pricing to be cost-effective for the value provided with the fr 900q capabilities.

-

What are the main benefits of using fr 900q in airSlate SignNow?

The fr 900q feature in airSlate SignNow signNowly enhances the efficiency of document management. Businesses can reduce turnaround times for signing documents, which translates to faster operations. Additionally, it provides a secure environment for document transactions, ensuring peace of mind.

-

Can I integrate fr 900q with other applications?

Yes, airSlate SignNow allows integration with various applications while using the fr 900q capabilities. This means you can connect your favorite tools and streamline your workflows even further. Our platform supports numerous integrations to enhance your document signing experience.

-

Is fr 900q suitable for businesses of all sizes?

Absolutely! The fr 900q feature in airSlate SignNow is designed to accommodate businesses of all sizes. From small startups to large enterprises, everyone can benefit from the effective document signing solutions we offer. It's a versatile tool that can scale as your business grows.

-

How does airSlate SignNow ensure the security of the fr 900q feature?

airSlate SignNow employs industry-leading security measures to protect documents signed through the fr 900q feature. Our platform uses encryption and secure storage methods to ensure your sensitive information remains safe. Trust is paramount, and we prioritize safeguarding your documents.

-

What types of documents can I sign using fr 900q?

You can sign a wide range of document types using the fr 900q feature in airSlate SignNow. This includes contracts, agreements, and forms, making it versatile for various industries. Whether you're in real estate, finance, or healthcare, fr 900q caters to your document signing needs.

Get more for FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc

Find out other FR 900B EmployerPayer Withholding Tax Annual Otr Cfo Dc

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP