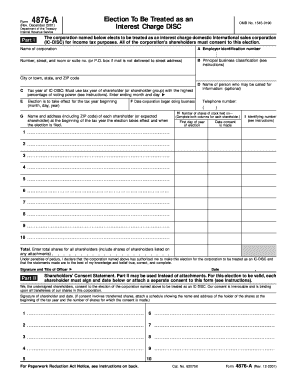

Form 4876 a

What is the Form 4876 A

The Form 4876 A is a tax-related document used in the United States, specifically for the election of certain tax treatments for businesses. This form allows entities to choose how they want to be taxed, which can significantly affect their tax obligations and overall financial strategy. It is crucial for businesses to understand the implications of their selection on this form, as it can determine whether they are taxed as a corporation, partnership, or another entity type.

How to use the Form 4876 A

Using the Form 4876 A involves several steps to ensure proper completion and submission. First, gather all necessary information about your business, including its legal structure, ownership details, and financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. It is essential to review the instructions provided with the form to avoid common mistakes. Once completed, the form must be submitted to the appropriate tax authority, which may vary depending on the entity type and state of operation.

Steps to complete the Form 4876 A

Completing the Form 4876 A requires attention to detail and a clear understanding of your business structure. Follow these steps:

- Identify the correct version of the form for your business type.

- Provide accurate information about your business, including its name, address, and tax identification number.

- Choose the tax treatment option that best fits your business needs.

- Sign and date the form, ensuring that the signature is from an authorized individual.

- Review the completed form for accuracy before submission.

Legal use of the Form 4876 A

The legal use of the Form 4876 A is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the specified deadlines. The use of electronic signatures is permitted under U.S. law, provided that the electronic signature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Ensuring compliance with these regulations helps maintain the legal standing of the form in any potential disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4876 A can vary depending on the specific tax year and the type of entity. Typically, the form must be filed by the due date of the tax return for the entity's first tax year. It is important to stay informed about any changes to deadlines, as late submissions may result in penalties or the inability to elect the desired tax treatment. Keeping a calendar of important dates related to tax filings can help ensure timely submission.

Who Issues the Form

The Form 4876 A is issued by the Internal Revenue Service (IRS). This federal agency is responsible for overseeing tax collection and enforcement of tax laws in the United States. The IRS provides guidelines and instructions for completing the form, which are essential for ensuring compliance with federal tax regulations. It is advisable to refer to the IRS website or contact them directly for any specific inquiries related to the form.

Quick guide on how to complete form 4876 a

Complete Form 4876 A effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Form 4876 A on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 4876 A effortlessly

- Locate Form 4876 A and click Get Form to begin.

- Use the tools at your disposal to fill out your document.

- Highlight key sections of your documents or redact sensitive details with the tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your delivery method for your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or the hassle of needing to print new document copies due to errors. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 4876 A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4876 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4876 A?

Form 4876 A is a crucial document for businesses that facilitates the submission of tax-related information. It helps streamline the process of managing compliance, especially for organizations needing to file specific tax forms. Understanding how to properly complete Form 4876 A is vital for maintaining accurate records and ensuring timely submissions.

-

How does airSlate SignNow simplify the signing process for Form 4876 A?

airSlate SignNow offers an intuitive platform that allows users to easily upload, send, and eSign Form 4876 A. The process is streamlined, which reduces the time spent on document handling and enhances workflow efficiency. With just a few clicks, you can ensure your Form 4876 A is signed and sent securely.

-

What are the key features of airSlate SignNow for managing Form 4876 A?

AirSlate SignNow provides features specifically designed for managing documents like Form 4876 A, including customizable templates, real-time tracking of signatures, and secure cloud storage. These features help businesses maintain a smooth process while handling important tax documentation. With advanced security protocols, you can trust airSlate SignNow to protect your sensitive data.

-

Is there a cost associated with using airSlate SignNow for Form 4876 A?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is justified by the time savings and efficiency gained when dealing with documents like Form 4876 A. Users can select a plan that fits their budget while still getting access to robust features for document management.

-

What benefits can businesses expect when using airSlate SignNow for Form 4876 A?

By using airSlate SignNow for managing Form 4876 A, businesses can expect increased efficiency, reduced paperwork, and a more streamlined signing process. It empowers teams to collaborate remotely and securely manage their documents without delays. This approach saves time and enhances overall productivity.

-

Can airSlate SignNow integrate with other software for Form 4876 A processing?

Absolutely! airSlate SignNow supports integrations with various business applications, allowing for seamless processing of Form 4876 A. Whether it’s CRM systems, project management tools, or accounting software, these integrations simplify the workflow and enhance data management capabilities.

-

Is airSlate SignNow compliant with regulations for handling Form 4876 A?

Yes, airSlate SignNow is fully compliant with industry regulations, ensuring that the handling of Form 4876 A meets legal standards. This compliance guarantees that your documents are processed securely and that sensitive information remains protected. Businesses can rest assured knowing they are using a solution that prioritizes legal adherence.

Get more for Form 4876 A

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497428269 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497428270 form

- Va marital property 497428271 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497428272 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497428273 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497428274 form

- Virginia dissolve form

- Virginia dissolve llc form

Find out other Form 4876 A

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form