Form 593 V Payment Voucher for Real Estate Withholding Ftb Ca

What is the Form 593 V Payment Voucher for Real Estate Withholding FTB CA

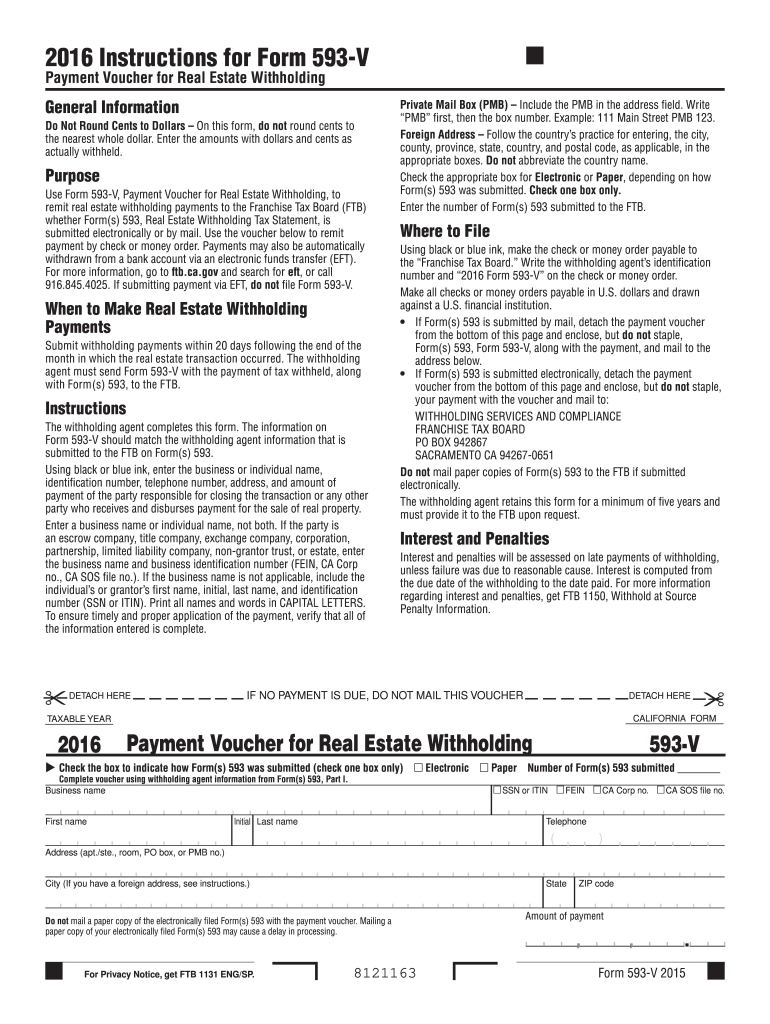

The Form 593 V is a payment voucher used in California for real estate withholding. This form is essential for buyers who are required to withhold a portion of the sales price when purchasing real property from a seller who is not a resident of California. The withheld amount is then submitted to the California Franchise Tax Board (FTB) as a prepayment of the seller's California income tax liability. Understanding the purpose of this form is crucial for compliance with state tax regulations.

Steps to Complete the Form 593 V Payment Voucher for Real Estate Withholding FTB CA

Completing the Form 593 V involves several key steps to ensure accuracy and compliance. First, gather necessary information, including the seller's details and the sales price of the property. Next, enter the withholding amount, which is typically calculated as a percentage of the sales price. Ensure that all fields are filled out correctly, including the buyer's information and the payment amount. After completing the form, review it for any errors before submission to avoid delays or penalties.

How to Obtain the Form 593 V Payment Voucher for Real Estate Withholding FTB CA

The Form 593 V can be obtained directly from the California Franchise Tax Board's website. It is available as a downloadable PDF, allowing users to print and fill it out manually. Additionally, tax professionals and real estate agents may provide copies of the form. Ensuring you have the most current version is important, as tax forms can be updated annually.

Legal Use of the Form 593 V Payment Voucher for Real Estate Withholding FTB CA

The legal use of Form 593 V is governed by California tax laws. It is mandatory for buyers to use this form when purchasing property from non-resident sellers to comply with withholding requirements. Failure to submit the form correctly can result in penalties and interest on unpaid taxes. Therefore, understanding the legal implications of this form is essential for both buyers and sellers involved in real estate transactions.

Key Elements of the Form 593 V Payment Voucher for Real Estate Withholding FTB CA

Key elements of the Form 593 V include the buyer's and seller's names, addresses, and taxpayer identification numbers. The form also requires details about the property being sold, including the sales price and the amount withheld. Additionally, there is a section for the buyer to indicate the payment method. Accurate completion of these elements is crucial for the form to be processed correctly by the FTB.

Filing Deadlines / Important Dates

Filing deadlines for Form 593 V are critical to ensure compliance with California tax regulations. The form must be submitted to the FTB at the time of the real estate transaction, typically when the sale is finalized. Buyers should be aware of any specific deadlines that may apply, particularly during peak real estate seasons or changes in tax laws. Staying informed about these dates helps avoid penalties and ensures timely processing of the payment voucher.

Quick guide on how to complete 2016 form 593 v payment voucher for real estate withholding ftb ca

Effortlessly Prepare Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to swiftly create, modify, and eSign your documents without any hold-ups. Handle Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca on any device with airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Most Efficient Way to Modify and eSign Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca with Ease

- Find Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential details with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which requires mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements with just a few clicks from your preferred device. Modify and eSign Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 593 v payment voucher for real estate withholding ftb ca

How to create an electronic signature for your 2016 Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca in the online mode

How to make an eSignature for your 2016 Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca in Chrome

How to generate an electronic signature for putting it on the 2016 Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca in Gmail

How to make an electronic signature for the 2016 Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca from your smartphone

How to generate an electronic signature for the 2016 Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca on iOS

How to generate an electronic signature for the 2016 Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca on Android

People also ask

-

What is the FTB form 593 and why is it important?

The FTB form 593 is a crucial document for non-resident sellers of California real estate, as it reports withholding on the sale. It's essential for ensuring compliance with California tax laws and helps avoid penalties. Using airSlate SignNow simplifies the process of filling and submitting the FTB form 593, making it more efficient for all parties involved.

-

How can airSlate SignNow help me complete my FTB form 593?

airSlate SignNow streamlines the completion of your FTB form 593 by providing customizable templates and intuitive editing tools. You can easily fill in required information, add signatures, and submit the document securely online. This saves time and reduces the risk of errors compared to traditional methods.

-

Is airSlate SignNow a cost-effective solution for filing the FTB form 593?

Yes, airSlate SignNow offers a cost-effective solution for managing your FTB form 593. With its competitive pricing plans, you can access features that help you efficiently handle your documents without breaking the bank. This makes it a great choice for individuals and businesses needing to file tax forms accurately and affordably.

-

What features does airSlate SignNow offer for FTB form 593?

airSlate SignNow provides several features to assist with the FTB form 593, including electronic signatures, document tracking, and secure storage. These features ensure your document is processed quickly and remains accessible for future reference. Additionally, the platform integrates seamlessly with other tools, enhancing your workflow.

-

Can I access my completed FTB form 593 from different devices?

Absolutely! airSlate SignNow allows you to access your completed FTB form 593 from any device with internet connectivity. This flexibility means you can review, sign, or send your documents from your computer, tablet, or smartphone, making it convenient for busy professionals.

-

Are there integration options for airSlate SignNow when handling the FTB form 593?

Yes, airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and CRM systems, which can effortlessly streamline the management of your FTB form 593. These integrations enhance your productivity by allowing you to pull in necessary data or store documents in your preferred storage solution, making document management a breeze.

-

What advantages does eSigning provide for my FTB form 593?

eSigning through airSlate SignNow for your FTB form 593 offers signNow advantages such as faster turnaround times and improved security. Electronic signatures are legally binding and can be applied from anywhere, eliminating the need for physical document exchanges. This enhances efficiency and lets you focus more on your business.

Get more for Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca

- Hbku recommendation form

- Bore profile template form

- Patient re evaluation questionnaire ashton chiropractic center form

- Private rental sample lease form

- Form 59a

- Au digital computershare com w8ben form

- Formato de solicitud y notificacin detranscripcin para

- Sv 120 response to petition for private postsecondary school violence restraining orders form

Find out other Form 593 V Payment Voucher For Real Estate Withholding Ftb Ca

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT