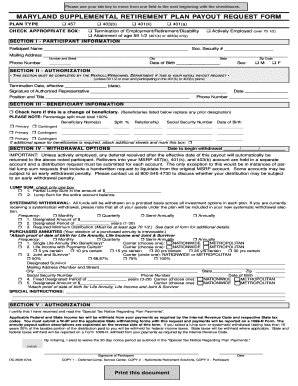

Maryland Supplemental Retirement Plan Payout Request Form

What is the Maryland Supplemental Retirement Plan Payout Request Form

The Maryland Supplemental Retirement Plan Payout Request Form is a crucial document for individuals seeking to withdraw funds from their Maryland Supplemental Retirement Plan. This form is designed to facilitate the request for a distribution of retirement benefits, ensuring that all necessary information is collected to process the request efficiently. It is essential for participants to understand the purpose of this form, as it directly impacts their financial planning and retirement strategy.

How to use the Maryland Supplemental Retirement Plan Payout Request Form

Using the Maryland Supplemental Retirement Plan Payout Request Form involves several key steps. First, individuals must accurately complete all required fields, providing personal information, account details, and the type of payout requested. Next, it is important to review the form for completeness and accuracy to avoid delays in processing. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the preferred method of submission. Understanding these steps helps ensure a smooth experience when accessing retirement funds.

Steps to complete the Maryland Supplemental Retirement Plan Payout Request Form

Completing the Maryland Supplemental Retirement Plan Payout Request Form requires careful attention to detail. Follow these steps:

- Gather necessary personal information, including your Social Security number and retirement account details.

- Fill out the form, ensuring all sections are completed accurately.

- Specify the type of payout you are requesting, such as a lump sum or periodic payments.

- Review the form for any errors or missing information.

- Sign and date the form to validate your request.

- Submit the completed form through your chosen method, either online or by mail.

Legal use of the Maryland Supplemental Retirement Plan Payout Request Form

The legal validity of the Maryland Supplemental Retirement Plan Payout Request Form hinges on compliance with federal and state regulations governing retirement distributions. To ensure the form is legally binding, it must be completed accurately and submitted according to the guidelines set forth by the Maryland State Retirement Agency. Additionally, using a secure electronic signature solution can enhance the legitimacy of the submission, providing a verifiable record of the request.

Key elements of the Maryland Supplemental Retirement Plan Payout Request Form

Several key elements are essential for the Maryland Supplemental Retirement Plan Payout Request Form to be processed effectively:

- Personal Information: Full name, address, and Social Security number.

- Account Information: Details of your retirement account, including account number.

- Payout Type: Indication of whether you are requesting a lump sum or annuity payments.

- Signature: Required to authenticate the request.

- Date: The date of submission must be included for processing timelines.

Form Submission Methods

The Maryland Supplemental Retirement Plan Payout Request Form can be submitted through various methods, providing flexibility for users. Options typically include:

- Online Submission: Many users opt to complete and submit the form electronically for quicker processing.

- Mail: The form can be printed, filled out, and sent via postal service to the appropriate agency.

- In-Person: Some individuals may choose to deliver the form directly to a designated office for immediate processing.

Quick guide on how to complete maryland supplemental retirement plan payout request form

Complete Maryland Supplemental Retirement Plan Payout Request Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly and efficiently. Manage Maryland Supplemental Retirement Plan Payout Request Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Maryland Supplemental Retirement Plan Payout Request Form with ease

- Locate Maryland Supplemental Retirement Plan Payout Request Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information closely and click on the Done button to save your updates.

- Choose how you wish to send your form, whether via email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Maryland Supplemental Retirement Plan Payout Request Form to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland supplemental retirement plan payout request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland supplemental retirement plan payout request form?

The Maryland supplemental retirement plan payout request form is a document used to initiate the withdrawal of funds from a supplemental retirement account. This form is essential for individuals looking to access their retirement savings efficiently and can streamline the process of fund distribution.

-

How do I access the Maryland supplemental retirement plan payout request form?

You can easily access the Maryland supplemental retirement plan payout request form through the airSlate SignNow platform. Simply log in to your account, navigate to the document section, and search for the payout request form to begin your request.

-

What features does the airSlate SignNow offer for the Maryland supplemental retirement plan payout request form?

airSlate SignNow offers various features for the Maryland supplemental retirement plan payout request form, including electronic signatures, document tracking, and secure storage. These features ensure that your request is processed smoothly and that your personal information remains protected.

-

Are there any fees associated with submitting the Maryland supplemental retirement plan payout request form using airSlate SignNow?

While airSlate SignNow provides a cost-effective solution for managing your documents, there may be nominal fees associated with certain features. However, using the Maryland supplemental retirement plan payout request form through our platform is generally affordable and designed to save you money in the long run.

-

How long does it take to process the Maryland supplemental retirement plan payout request form?

The processing time for the Maryland supplemental retirement plan payout request form varies, but with airSlate SignNow, you can expedite the process. Once submitted, you can track the status of your request in real-time, ensuring you stay informed of any updates.

-

Can I integrate the Maryland supplemental retirement plan payout request form with other tools?

Yes, airSlate SignNow allows for seamless integration with various applications, making it easy to connect the Maryland supplemental retirement plan payout request form with tools you already use. This integration helps streamline your workflow and enhances overall productivity.

-

What are the benefits of using airSlate SignNow for the Maryland supplemental retirement plan payout request form?

Using airSlate SignNow for the Maryland supplemental retirement plan payout request form offers numerous benefits, including time savings, increased efficiency, and enhanced security. Our platform simplifies the paperwork process, allowing you to focus on what matters most - your financial future.

Get more for Maryland Supplemental Retirement Plan Payout Request Form

- Letter from landlord to tenant as notice of default on commercial lease new mexico form

- Residential or rental lease extension agreement new mexico form

- Commercial rental lease application questionnaire new mexico form

- Apartment lease rental application questionnaire new mexico form

- Residential rental lease application new mexico form

- Salary verification form for potential lease new mexico

- Nm landlord tenant form

- Notice of default on residential lease new mexico form

Find out other Maryland Supplemental Retirement Plan Payout Request Form

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure