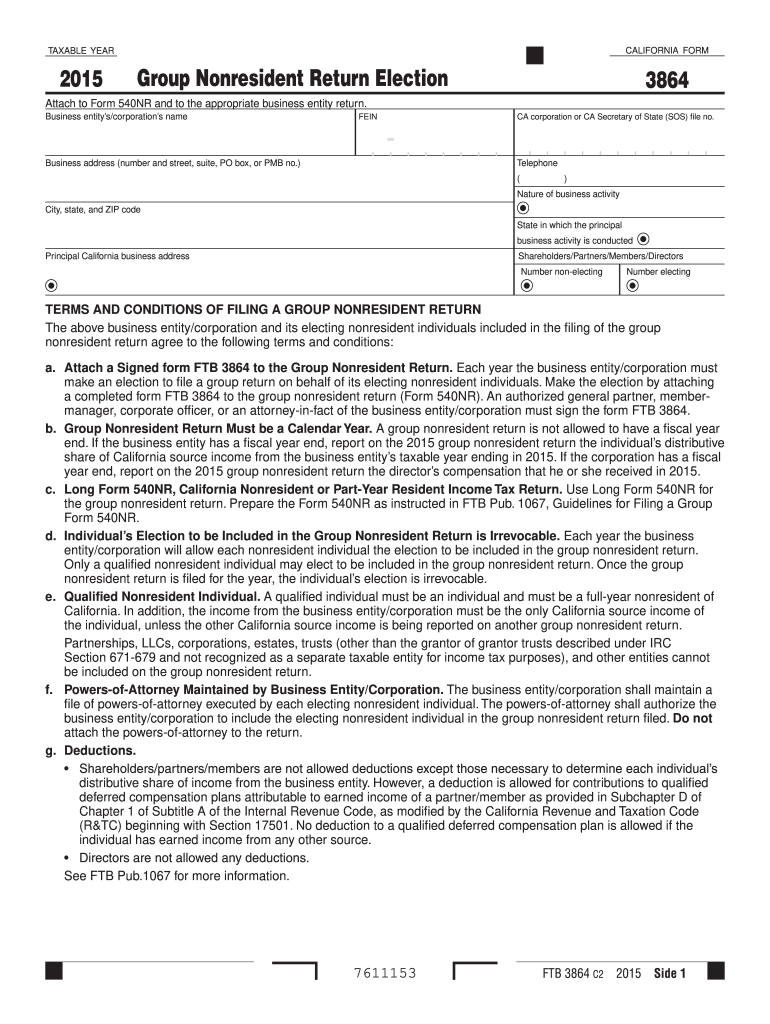

Form 3864 Group Nonresident Return Election Ftb Ca

What is the Form 540NR 2015?

The Form 540NR 2015, known as the California Nonresident or Part-Year Resident Income Tax Return, is specifically designed for individuals who do not reside in California for the entire year but have income sourced from California. This form allows nonresidents to report their California income, calculate their tax liability, and determine any potential refunds. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with California tax laws.

Steps to Complete the Form 540NR 2015

Completing the Form 540NR 2015 involves several key steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Determine Residency Status: Confirm your residency status for the tax year to ensure you are using the correct form.

- Report Income: Accurately report all California-sourced income on the form, including wages, rental income, and other earnings.

- Calculate Deductions: Identify eligible deductions that apply to your situation, which can help reduce your taxable income.

- Complete the Form: Fill out the form carefully, ensuring all calculations are accurate and all required fields are completed.

- Review and Sign: Double-check your entries for accuracy before signing the form and preparing it for submission.

Legal Use of the Form 540NR 2015

The Form 540NR 2015 is legally binding when completed and submitted according to California tax regulations. It is essential to provide truthful and accurate information, as any discrepancies can lead to penalties or audits by the California Franchise Tax Board (FTB). The form must be filed by the applicable deadline to avoid late fees and interest on unpaid taxes. Understanding the legal implications of this form ensures compliance and helps maintain a good standing with tax authorities.

Filing Deadlines / Important Dates

For the 2015 tax year, the filing deadline for the Form 540NR is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to keep track of these deadlines to ensure timely filing and avoid penalties. Additionally, if you are unable to file by the deadline, you may request an extension, but any taxes owed must still be paid by the original due date to prevent interest and penalties.

Required Documents

To complete the Form 540NR 2015, you will need several key documents:

- W-2 Forms: For reporting wages and salaries earned.

- 1099 Forms: For reporting other income sources, such as freelance work or interest income.

- Documentation of Deductions: Receipts or statements for any deductions you plan to claim, such as mortgage interest or property taxes.

- Identification Numbers: Your Social Security number or Individual Taxpayer Identification Number (ITIN).

Eligibility Criteria

To file the Form 540NR 2015, you must meet specific eligibility criteria. You should be a nonresident or part-year resident of California and have income sourced from California. Additionally, you must have a valid Social Security number or ITIN. Understanding these criteria helps ensure that you are using the correct form and complying with state tax laws.

Quick guide on how to complete 2015 form 3864 group nonresident return election ftb ca

Effortlessly prepare Form 3864 Group Nonresident Return Election Ftb Ca on any device

Managing documents online has gained increased traction among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents efficiently without delays. Handle Form 3864 Group Nonresident Return Election Ftb Ca on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to effortlessly modify and eSign Form 3864 Group Nonresident Return Election Ftb Ca

- Locate Form 3864 Group Nonresident Return Election Ftb Ca and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the specialized tools that airSlate SignNow offers for this purpose.

- Create your eSignature with the Sign tool, which is quick and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Revise and eSign Form 3864 Group Nonresident Return Election Ftb Ca to ensure excellent communication throughout the formation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 3864 group nonresident return election ftb ca

How to generate an electronic signature for your 2015 Form 3864 Group Nonresident Return Election Ftb Ca in the online mode

How to make an eSignature for your 2015 Form 3864 Group Nonresident Return Election Ftb Ca in Chrome

How to make an electronic signature for signing the 2015 Form 3864 Group Nonresident Return Election Ftb Ca in Gmail

How to create an electronic signature for the 2015 Form 3864 Group Nonresident Return Election Ftb Ca right from your smartphone

How to create an electronic signature for the 2015 Form 3864 Group Nonresident Return Election Ftb Ca on iOS

How to generate an eSignature for the 2015 Form 3864 Group Nonresident Return Election Ftb Ca on Android OS

People also ask

-

What is the 540nr 2015 form and how does airSlate SignNow help with it?

The 540nr 2015 form is used by non-residents to report income earned in California. With airSlate SignNow, you can easily fill out, sign, and send your 540nr 2015 document electronically, ensuring a streamlined process that saves time and enhances accuracy.

-

Is airSlate SignNow a cost-effective solution for managing the 540nr 2015 form?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, making it a cost-effective solution for managing the 540nr 2015 form. By using our platform, you reduce the costs associated with paper forms and manual signatures.

-

Can I integrate airSlate SignNow with other tools for managing the 540nr 2015 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when handling the 540nr 2015 form. This integration feature simplifies document management and helps you stay organized.

-

What features does airSlate SignNow offer for the 540nr 2015 document?

airSlate SignNow provides a range of features for the 540nr 2015 document, including electronic signatures, template creation, and document tracking. These features streamline the signing process, making it efficient and legally binding.

-

How does airSlate SignNow ensure the security of my 540nr 2015 form?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure data storage to protect your 540nr 2015 form and sensitive information from unauthorized access.

-

Can I send my completed 540nr 2015 form directly from airSlate SignNow?

Yes, once you have filled and signed your 540nr 2015 form on airSlate SignNow, you can send it directly to the necessary recipients with just a few clicks. This functionality simplifies the submission process and ensures timely delivery.

-

What are the benefits of using airSlate SignNow for my 540nr 2015 filings?

Using airSlate SignNow for your 540nr 2015 filings enhances efficiency, accuracy, and compliance. The platform’s user-friendly interface and signature options allow you to complete your forms quickly, ensuring that you meet deadlines without stress.

Get more for Form 3864 Group Nonresident Return Election Ftb Ca

- Form diet

- Bellflower city hall form

- Sample property co ownership agreement for two parties investing together form

- Chronology report sample form

- Developer guide form 499r 2cw 2cpr

- Class c private investigator license florida department of form

- 503 3786699 form

- Lausd tk report card commoncore tcoe form

Find out other Form 3864 Group Nonresident Return Election Ftb Ca

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate