Email W9 Form

What is the Email W-9 Form

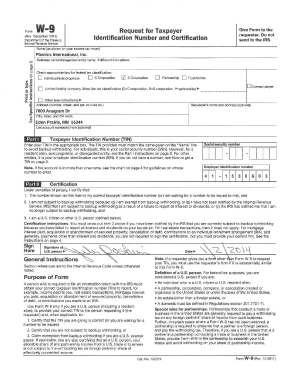

The Email W-9 Form is a digital version of the IRS Form W-9, which is used by individuals and businesses to provide their taxpayer identification information. This form is essential for reporting income paid to contractors or freelancers, allowing the payer to accurately report payments to the IRS. The Email W-9 Form streamlines the process of collecting necessary information, such as the name, business name (if applicable), address, and taxpayer identification number (TIN), making it easier for businesses to manage tax reporting obligations.

How to Use the Email W-9 Form

Using the Email W-9 Form involves a few straightforward steps. First, the requester sends the form to the individual or business that needs to provide their information. Once received, the recipient fills out the form with accurate details. After completing the form, the recipient can send it back via email. It is important to ensure that the document is securely transmitted to protect sensitive information. Utilizing a reliable eSignature platform can enhance security and compliance, ensuring that the form is legally binding.

Steps to Complete the Email W-9 Form

Completing the Email W-9 Form requires careful attention to detail. Here are the steps to follow:

- Open the Email W-9 Form and review the instructions provided.

- Fill in your name and, if applicable, your business name.

- Provide your address, ensuring it matches your tax records.

- Enter your taxpayer identification number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Sign and date the form electronically if using an eSignature solution.

- Save the completed form and attach it to an email for submission.

Legal Use of the Email W-9 Form

The Email W-9 Form is legally recognized when it is filled out correctly and signed. Under U.S. law, electronic signatures are valid and enforceable, provided they meet certain criteria outlined in the ESIGN Act and UETA. This means that as long as the form is completed with the required information and securely transmitted, it can be used for tax reporting purposes without any legal issues. It is advisable to retain a copy of the submitted form for your records.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 Form. It is essential to ensure that the information provided is accurate and up to date, as incorrect details can lead to penalties or delays in processing. The IRS requires that the W-9 Form be submitted whenever a business pays an independent contractor or freelancer $600 or more in a calendar year. Additionally, the IRS may request a completed W-9 Form for various tax-related purposes, making it crucial to keep this document readily available.

Penalties for Non-Compliance

Failing to submit a completed W-9 Form can result in significant penalties. If a business does not collect a W-9 from a contractor, it may be required to withhold taxes at a higher rate, typically 24%, from payments made. Additionally, the IRS may impose fines for failing to file correct information returns. It is essential for both payers and recipients to understand their responsibilities regarding the Email W-9 Form to avoid unnecessary financial repercussions.

Quick guide on how to complete email w9 form

Complete Email W9 Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed materials, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents promptly without any delays. Manage Email W9 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The simplest way to modify and eSign Email W9 Form effortlessly

- Find Email W9 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Email W9 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the email w9 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Is it safe to send W9 over email using airSlate SignNow?

Yes, sending W9 over email using airSlate SignNow is safe and secure. Our platform employs advanced encryption and security protocols to protect sensitive information, ensuring that your W9 forms are transmitted safely over email.

-

What are the benefits of sending W9 over email with airSlate SignNow?

Sending W9 over email with airSlate SignNow offers numerous benefits, including speed, convenience, and reduced paper usage. You can easily eSign and send documents from any device, streamlining your workflow and enhancing productivity.

-

Are there any costs associated with sending W9 over email using airSlate SignNow?

airSlate SignNow provides a cost-effective solution for sending W9 over email. We offer various pricing plans that cater to different business sizes, ensuring that you can find an option that fits your budget without compromising on features.

-

How can I track my W9 once I send it over email?

After sending your W9 over email with airSlate SignNow, you can easily track the status of your document. Our platform provides real-time updates, allowing you to see when the recipient views, signs, or completes the document.

-

What features does airSlate SignNow offer for sending W9 over email?

airSlate SignNow includes a variety of features for sending W9 over email, such as customizable templates, electronic signatures, and integration with other applications. These features enhance your experience and streamline the document management process.

-

Can I integrate airSlate SignNow with other software to ease sending W9 over email?

Yes, airSlate SignNow offers seamless integrations with various software and applications, simplifying the process of sending W9 over email. This allows you to incorporate electronic signature capabilities into your existing systems for better efficiency.

-

How quickly can I get a W9 signed after sending it over email?

With airSlate SignNow, sending a W9 over email can lead to quick turnaround times for signatures. The user-friendly interface encourages recipients to sign immediately, often within minutes, accelerating your document flow.

Get more for Email W9 Form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497431838 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497431839 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497431840 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497431841 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497431842 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497431843 form

- West virginia marital property form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497431845 form

Find out other Email W9 Form

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors