Primary Caregiver Tax Credit Level of Care Equivalency Guideline 2017

What is the Primary Caregiver Tax Credit Level of Care Equivalency Guideline

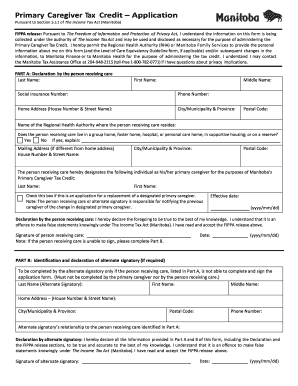

The Primary Caregiver Tax Credit Level of Care Equivalency Guideline is a framework established to assist caregivers in determining their eligibility for tax credits. This guideline outlines the specific levels of care required for caregivers to qualify for financial benefits. It is essential for caregivers to understand these criteria to effectively navigate the tax credit application process. The guideline serves as a reference point for evaluating the type and intensity of care provided, ensuring that caregivers can accurately assess their qualifications for the tax credit.

How to Use the Primary Caregiver Tax Credit Level of Care Equivalency Guideline

Steps to Complete the Primary Caregiver Tax Credit Level of Care Equivalency Guideline

Completing the Primary Caregiver Tax Credit Level of Care Equivalency Guideline involves several key steps. First, gather all relevant information about the care recipient, including medical documentation and care needs. Second, review the guideline thoroughly to understand the levels of care required. Next, assess the care you provide, ensuring it aligns with the outlined levels. Document your findings, including dates, types of care, and any supporting evidence. Finally, prepare to submit this documentation as part of your tax credit application, ensuring all information is accurate and complete.

Eligibility Criteria for the Primary Caregiver Tax Credit Level of Care Equivalency Guideline

Eligibility for the Primary Caregiver Tax Credit Level of Care Equivalency Guideline is determined by specific criteria. Caregivers must provide a defined level of care to a qualifying individual, typically a family member or dependent with significant health issues. The care provided must meet the standards set forth in the guideline, which may include daily assistance with activities of daily living or medical care. Additionally, caregivers must ensure they meet any income limitations and residency requirements established by the IRS to qualify for the tax credit.

Required Documents for the Primary Caregiver Tax Credit Level of Care Equivalency Guideline

IRS Guidelines for the Primary Caregiver Tax Credit Level of Care Equivalency Guideline

Quick guide on how to complete primary caregiver tax credit level of care equivalency guideline

Effortlessly Prepare Primary Caregiver Tax Credit Level Of Care Equivalency Guideline on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as it allows you to access the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Primary Caregiver Tax Credit Level Of Care Equivalency Guideline on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

The Easiest Way to Edit and eSign Primary Caregiver Tax Credit Level Of Care Equivalency Guideline Effortlessly

- Obtain Primary Caregiver Tax Credit Level Of Care Equivalency Guideline and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools offered by airSlate SignNow specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you prefer to send your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Primary Caregiver Tax Credit Level Of Care Equivalency Guideline while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct primary caregiver tax credit level of care equivalency guideline

Create this form in 5 minutes!

How to create an eSignature for the primary caregiver tax credit level of care equivalency guideline

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary caregiver tax credit level of care equivalency guideline?

The primary caregiver tax credit level of care equivalency guideline outlines the specific criteria used to determine the eligibility for tax credits available to caregivers. This guideline helps caregivers understand the levels of care required to qualify for financial assistance. Understanding these guidelines is essential for maximizing potential tax benefits.

-

How can airSlate SignNow assist with managing caregiver tax documentation?

airSlate SignNow provides a streamlined platform for securely signing and managing documents related to the primary caregiver tax credit level of care equivalency guideline. By using our solution, caregivers can easily upload, sign, and share necessary documents, ensuring compliance and organization for tax purposes. This efficiency can save valuable time during tax preparation.

-

What features does airSlate SignNow offer for users applying for caregiver tax credits?

Our platform includes features such as customizable document templates tailored to the primary caregiver tax credit level of care equivalency guideline. Users can also benefit from the ability to track document status, obtain e-signatures, and automate workflows, all of which simplify the process of applying for and managing caregiver tax credits. These features are designed to enhance productivity and accuracy.

-

Is there a cost associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, including those related to the primary caregiver tax credit level of care equivalency guideline. Each plan is designed to provide essential features at a competitive price, ensuring that users can efficiently manage their caregiver tax documentation without excessive costs. Free trials are also available for new users.

-

Can I integrate airSlate SignNow with other applications for tax management?

Absolutely! airSlate SignNow offers seamless integrations with popular applications used for tax management and accounting, helping users better handle the primary caregiver tax credit level of care equivalency guideline. This capability allows for a unified approach to document management, ensuring that all necessary files are accessible in one place for ease of use.

-

How secure are the documents signed through airSlate SignNow?

Security is a top priority at airSlate SignNow. All documents signed through our platform are protected using advanced encryption methods that adhere to industry standards. This ensures that sensitive information related to the primary caregiver tax credit level of care equivalency guideline remains confidential and secure throughout the signing process.

-

Who qualifies as a primary caregiver under the tax credit guidelines?

A primary caregiver is typically defined as an individual who provides assistance to a relative or loved one, meeting the specific criteria outlined in the primary caregiver tax credit level of care equivalency guideline. This may include individuals who help with daily living activities and personal care needs. Understanding these criteria is crucial for determining eligibility for tax credits.

Get more for Primary Caregiver Tax Credit Level Of Care Equivalency Guideline

- Certificate of currency form

- Confirmation of identity verification for aboriginal andconfirmation of aboriginality application formconfirmation of

- Dangerous goods security card form

- Wwwmidwesternnswgovaufilesassetsmudgee showground management committee conditions of hiring form

- Building notice application form

- Go gateshead card and go gateshead accesscard form

- Safeguarding alerter form

- Community care grant north ayrshire form

Find out other Primary Caregiver Tax Credit Level Of Care Equivalency Guideline

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors