Primary Caregiver Tax CreditApplicationSouthern Health 2022-2026

Understanding the Primary Caregiver Tax Credit

The Primary Caregiver Tax Credit is designed to provide financial relief to individuals who take on the responsibility of caring for a family member with a disability or chronic illness. This tax credit can significantly reduce the caregiver's tax burden, making it essential for caregivers to understand the eligibility criteria and application process. The credit is available to primary caregivers who meet specific requirements set by the IRS, ensuring that those who provide essential support to their loved ones can receive appropriate financial assistance.

Eligibility Criteria for the Tax Credit

To qualify for the Primary Caregiver Tax Credit, caregivers must meet several criteria. The individual receiving care must have a qualifying condition, such as a physical or mental disability, that necessitates assistance. Additionally, the caregiver must be a relative of the care recipient, and the care must be provided in the home of the recipient or the caregiver. It is important to review IRS guidelines to ensure compliance with all eligibility requirements, as these can vary based on state regulations and specific circumstances.

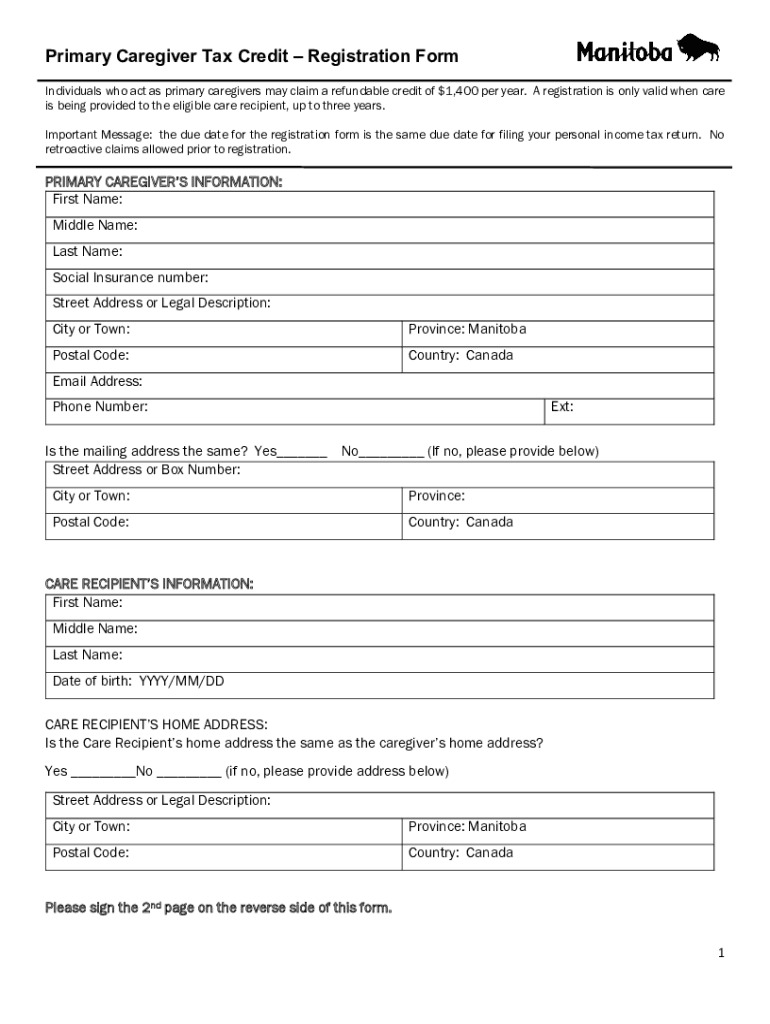

Steps to Complete the Tax Credit Application

Completing the application for the Primary Caregiver Tax Credit involves several key steps. First, gather all necessary documentation, including proof of relationship to the care recipient and evidence of the care provided. Next, fill out the appropriate tax forms, ensuring that all information is accurate and complete. It is advisable to consult the IRS guidelines or a tax professional for assistance in navigating the application process. Once the forms are completed, submit them according to the specified methods, which may include online submission, mailing, or in-person delivery.

Required Documents for Application

When applying for the Primary Caregiver Tax Credit, certain documents are required to support the application. These typically include:

- Proof of the caregiving relationship, such as birth certificates or marriage licenses.

- Medical documentation confirming the care recipient's condition.

- Records of expenses incurred while providing care, including receipts and invoices.

- Completed tax forms, including any additional schedules required by the IRS.

Ensuring that all required documents are included with the application can prevent delays in processing and approval.

Filing Deadlines and Important Dates

It is crucial for caregivers to be aware of the filing deadlines associated with the Primary Caregiver Tax Credit. Typically, tax returns must be filed by April 15 each year, although extensions may be available. Caregivers should also keep track of any state-specific deadlines that may apply. Being mindful of these dates helps ensure that applications are submitted on time, allowing caregivers to receive the financial support they need without unnecessary delays.

IRS Guidelines for Compliance

Adhering to IRS guidelines is essential for successfully claiming the Primary Caregiver Tax Credit. These guidelines outline the eligibility requirements, necessary documentation, and application procedures. Caregivers should familiarize themselves with these regulations to ensure compliance and avoid potential penalties. Regularly reviewing IRS updates can also help caregivers stay informed about any changes that may impact their eligibility or the application process.

Quick guide on how to complete primary caregiver tax creditapplicationsouthern health

Complete Primary Caregiver Tax CreditApplicationSouthern Health effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Primary Caregiver Tax CreditApplicationSouthern Health on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Primary Caregiver Tax CreditApplicationSouthern Health without difficulty

- Obtain Primary Caregiver Tax CreditApplicationSouthern Health and then click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Primary Caregiver Tax CreditApplicationSouthern Health to guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct primary caregiver tax creditapplicationsouthern health

Create this form in 5 minutes!

How to create an eSignature for the primary caregiver tax creditapplicationsouthern health

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canada primary caregiver tax credit?

The Canada primary caregiver tax credit is a non-refundable tax credit designed to provide financial relief to individuals who care for a dependent with a physical or mental impairment. This credit helps offset the costs associated with caregiving, making it easier for caregivers to manage their responsibilities while receiving some tax benefits.

-

Who is eligible for the Canada primary caregiver tax credit?

To be eligible for the Canada primary caregiver tax credit, you must be a caregiver for a dependent who has a physical or mental impairment. The dependent must also meet specific criteria set by the Canada Revenue Agency, including age and income limits, to qualify for the credit.

-

How can I apply for the Canada primary caregiver tax credit?

You can apply for the Canada primary caregiver tax credit by completing the appropriate sections of your income tax return. Ensure you have all necessary documentation, such as medical certificates and proof of your caregiving relationship, to support your claim for the credit.

-

What are the benefits of the Canada primary caregiver tax credit?

The benefits of the Canada primary caregiver tax credit include reducing your overall tax liability and providing financial support for caregivers. This credit acknowledges the important role caregivers play and helps alleviate some of the financial burdens associated with caregiving responsibilities.

-

Is the Canada primary caregiver tax credit a refundable credit?

No, the Canada primary caregiver tax credit is a non-refundable credit, meaning it can reduce your tax owed to zero but will not result in a refund if the credit exceeds your tax liability. It's essential to understand this aspect when planning your finances as a caregiver.

-

Can I claim the Canada primary caregiver tax credit for multiple dependents?

Yes, you can claim the Canada primary caregiver tax credit for multiple dependents, provided each dependent meets the eligibility criteria. Ensure you have the necessary documentation for each dependent to support your claims on your tax return.

-

How does the Canada primary caregiver tax credit affect my overall tax situation?

The Canada primary caregiver tax credit can signNowly impact your overall tax situation by lowering your taxable income and reducing the amount of tax you owe. This can provide much-needed financial relief, especially for those managing the costs associated with caregiving.

Get more for Primary Caregiver Tax CreditApplicationSouthern Health

- Exemption for ignition interlock device form

- Michigan legal last will and testament form for married person with adult children

- Dch 1625 form in michigan

- Cookie contest rules form

- Requesting driver safety course dsc city of houston form

- Cosigner loan agreement template form

- Health club contract template form

- Healthcare consult contract template form

Find out other Primary Caregiver Tax CreditApplicationSouthern Health

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy