Expenses Spreadsheet Form

What is the expenses spreadsheet?

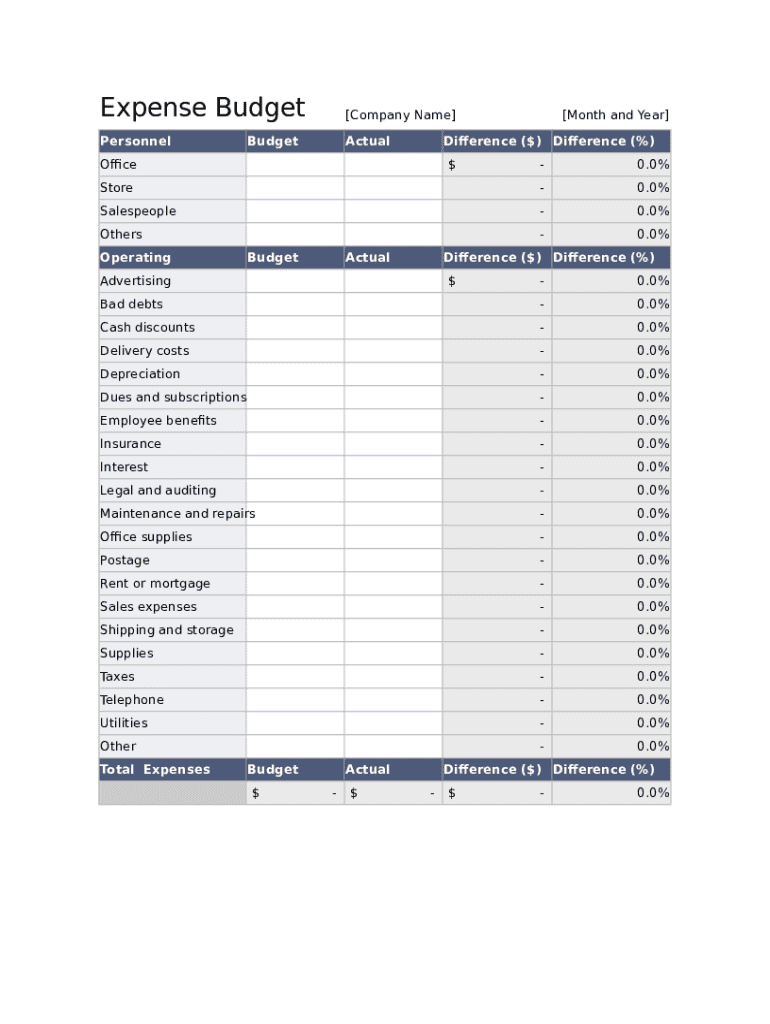

An expenses spreadsheet is a structured tool designed to help individuals and businesses track their financial expenditures. This document typically includes various categories for expenses, such as office supplies, utilities, and travel costs. By organizing expenses in a spreadsheet format, users can easily monitor their spending habits and prepare for budgeting or tax purposes. It serves as a vital resource for managing finances effectively, ensuring that all expenses are accounted for and categorized appropriately.

How to use the expenses spreadsheet

Using an expenses spreadsheet involves several straightforward steps. First, identify the categories relevant to your expenditures, such as operational costs, personal expenses, or rental property expenses for taxes. Next, enter the date, description, and amount of each expense in the corresponding columns. Regularly updating the spreadsheet allows for accurate tracking of spending patterns. Additionally, utilizing formulas can help calculate totals and averages, providing insights into overall financial health.

Steps to complete the expenses spreadsheet

Completing an expenses spreadsheet requires careful attention to detail. Follow these steps for effective completion:

- Gather all receipts and invoices related to your expenses.

- Open the expenses spreadsheet and create or select the appropriate categories.

- Input the date of each transaction, along with a brief description and the amount spent.

- Review entries for accuracy and ensure all expenses are accounted for.

- Utilize built-in functions to calculate totals and identify trends over time.

Legal use of the expenses spreadsheet

When using an expenses spreadsheet, it is essential to understand the legal implications associated with financial documentation. Properly maintained records can serve as evidence of expenses for tax purposes, ensuring compliance with IRS guidelines. Additionally, electronic records must adhere to eSignature laws if they are signed digitally. This means using a reliable platform to ensure that your expenses spreadsheet is secure and legally binding, protecting your interests in case of audits or disputes.

Key elements of the expenses spreadsheet

Several key elements are crucial for an effective expenses spreadsheet. These include:

- Date: The date of each expense entry.

- Description: A brief explanation of what the expense entails.

- Category: The classification of the expense, such as travel, supplies, or services.

- Amount: The total cost associated with each expense.

- Payment method: How the expense was paid, such as credit card or cash.

Examples of using the expenses spreadsheet

There are various scenarios where an expenses spreadsheet proves beneficial. For instance, a self-employed individual can use it to track business-related expenses, ensuring they claim all eligible deductions during tax season. Similarly, landlords may utilize a spreadsheet for landlord record keeping, documenting repairs and maintenance costs associated with their rental properties. These examples highlight the versatility of the expenses spreadsheet in managing financial records effectively.

Quick guide on how to complete expenses spreadsheet

Effortlessly Prepare Expenses Spreadsheet on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, allowing you to obtain the accurate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without interruptions. Handle Expenses Spreadsheet on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Expenses Spreadsheet effortlessly

- Obtain Expenses Spreadsheet and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you would like to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislocated files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from your selected device. Modify and eSign Expenses Spreadsheet and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the expenses spreadsheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for managing an expenses spreadsheet?

airSlate SignNow allows users to create, edit, and eSign documents seamlessly, including expenses spreadsheets. The platform provides templates and integrations that simplify tracking and managing expenses, making it an ideal solution for businesses looking to streamline their financial processes.

-

How can I integrate my expenses spreadsheet with other software?

With airSlate SignNow, you can easily integrate your expenses spreadsheet with popular accounting and productivity software. This integration allows for real-time updates and data synchronization, ensuring your expenses are accurately reflected across platforms.

-

Is airSlate SignNow cost-effective for small businesses managing an expenses spreadsheet?

Yes, airSlate SignNow offers flexible pricing plans that cater to small businesses looking to manage their expenses spreadsheet efficiently. The cost-effective solutions help businesses save time and money by simplifying document workflows and eSigning.

-

Can I customize my expenses spreadsheet in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates that you can use to tailor your expenses spreadsheet to meet your specific needs. This flexibility allows you to create a document that suits your business's unique requirements for expense management.

-

How secure is my expenses spreadsheet when using airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and secure access controls to protect your expenses spreadsheet and other sensitive information, ensuring that your data remains safe throughout the document signing process.

-

Can I track who has signed my expenses spreadsheet using airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the signing status of your expenses spreadsheet. You will receive notifications when signatures are obtained, providing you with a complete view of your document workflows.

-

What are the benefits of using an expenses spreadsheet with airSlate SignNow?

Using an expenses spreadsheet with airSlate SignNow enhances your document management by providing an efficient way to collect signatures and share information. The platform simplifies the process, increases productivity, and reduces paperwork, making it an essential tool for any business.

Get more for Expenses Spreadsheet

- Donation receipt true value company 2017 spring reunion form

- Wwwtripadvisorcomshowuserreviews g1509268 dgood review of athletic club ampamp spa anjali at the westin form

- Post construction cleaning checklist pdf form

- Wwwbodypiercingbybinkcom uploads 253state of florida body piercing by bink form

- Form sls2

- Wwwnjsbaorgwp contentuploadssample jointbracket nominating petition for annual school form

- Permission form for float riders

- Fundraiser permission slip form

Find out other Expenses Spreadsheet

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template