St16 Form Colorado

What is the St16 Form Colorado

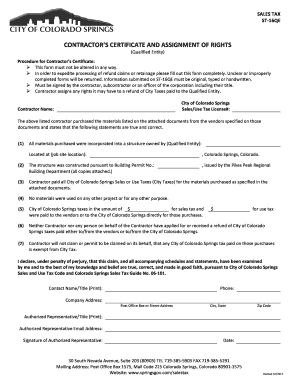

The St16 form Colorado is a specific document used within the state of Colorado for various administrative purposes. This form is primarily associated with tax reporting and compliance, particularly for businesses and individuals who need to provide specific information to the state. Understanding the purpose of the St16 form is essential for ensuring proper compliance with Colorado state regulations.

How to use the St16 Form Colorado

Using the St16 form Colorado involves several steps to ensure accurate completion and submission. First, gather all necessary information, including identification details and any relevant financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once completed, the form can be submitted according to the guidelines provided by the state, either online or through traditional mail. Proper usage of the form helps maintain compliance with state laws.

Steps to complete the St16 Form Colorado

Completing the St16 form Colorado requires attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the St16 form from the official Colorado state website.

- Read the instructions carefully to understand each section of the form.

- Fill in your personal and business information as required.

- Provide any necessary financial details or supporting documentation.

- Review the completed form for accuracy before submission.

- Submit the form through the designated method, ensuring you keep a copy for your records.

Legal use of the St16 Form Colorado

The legal use of the St16 form Colorado is governed by state regulations, ensuring that the information provided is accurate and truthful. This form may be required for various legal and financial purposes, including tax filings and compliance verification. Failure to use the form correctly can result in penalties or legal repercussions, making it crucial to adhere to all guidelines and requirements established by the state.

Key elements of the St16 Form Colorado

Key elements of the St16 form Colorado include specific fields that must be completed for the form to be valid. These typically encompass:

- Personal identification information, including name and address.

- Business details, if applicable, such as the business name and tax identification number.

- Financial information relevant to the purpose of the form.

- Signature and date fields to certify the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The St16 form Colorado can be submitted through various methods, providing flexibility for users. Options include:

- Online submission via the Colorado state website, which may offer a streamlined process.

- Mailing the completed form to the appropriate state department, ensuring it is sent to the correct address.

- In-person submission at designated state offices, which may allow for immediate assistance and confirmation of receipt.

Quick guide on how to complete st16 form colorado

Complete St16 Form Colorado seamlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the appropriate form and safely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your files swiftly without holdups. Handle St16 Form Colorado on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign St16 Form Colorado effortlessly

- Obtain St16 Form Colorado and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and eSign St16 Form Colorado to ensure excellent communication at any point in the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st16 form colorado

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st16 form colorado?

The st16 form colorado is a tax-exempt certificate used in Colorado for various exempt transactions. It allows organizations to make purchases without paying sales tax when applicable. Understanding how to properly use the st16 form colorado can help businesses save money during their procurement processes.

-

How can airSlate SignNow help with the st16 form colorado?

airSlate SignNow streamlines the process of completing and signing the st16 form colorado electronically. Our platform allows users to fill out, sign, and send the form quickly, ensuring compliance and saving time. With airSlate SignNow, you can manage all your documents efficiently, including tax forms.

-

Is there a cost associated with using the st16 form colorado through airSlate SignNow?

airSlate SignNow offers various pricing plans, allowing businesses to choose an option that fits their budget for using the st16 form colorado and other documents. Our cost-effective solutions ensure you only pay for the features you need while simplifying eSigning processes. Visit our pricing page for detailed information on plans.

-

Can I integrate the st16 form colorado with other apps using airSlate SignNow?

Yes, airSlate SignNow offers integrations with a wide range of applications, allowing you to link the st16 form colorado to your existing workflows. This flexibility enhances productivity and ensures that all your documents, including tax forms, are easily accessible. Explore our integration options to learn more.

-

What benefits does airSlate SignNow provide for managing the st16 form colorado?

Using airSlate SignNow for the st16 form colorado offers numerous benefits, including increased efficiency and secure storage. Our platform ensures your tax-exempt forms are protected while allowing easy access and signature collection. Experience the convenience of digitizing your document management securely.

-

How secure is the st16 form colorado when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the st16 form colorado. We use advanced encryption and secure cloud storage to protect your sensitive information. Trust that your tax-exempt forms are safeguarded and easily retrievable when needed.

-

Is training available for using the st16 form colorado in airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources to help users efficiently navigate the st16 form colorado process. From video tutorials to live support, we ensure that you are well-equipped to utilize our platform effectively. signNow out to our support team for assistance.

Get more for St16 Form Colorado

- Easypaysm form

- Tuition and fees financial aid discipline housing assignments and other information

- 20 individual member worksheet form

- Records request form form 101 f pdf free download

- Annuity beneficiary claim form nationwide life insurance

- Mission ampampamp outreachswedish medical center seattle and form

- Fillable online fillable online reset form print form

- Abstracthospital acquired infectionintensive care unit form

Find out other St16 Form Colorado

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe