Blank Vat 100 Form Download

What is the Blank Vat 100 Form Download

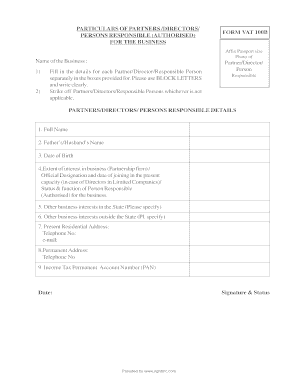

The Blank Vat 100 Form is a crucial document used by businesses to report value-added tax (VAT) in the United States. This form allows companies to declare their VAT liabilities and claim any applicable credits. The VAT 100 form download provides a convenient way for businesses to access and complete this essential document electronically, ensuring compliance with tax regulations.

Steps to Complete the Blank Vat 100 Form Download

Completing the Blank Vat 100 Form requires careful attention to detail. Here are the key steps:

- Download the Form: Access the Blank Vat 100 Form PDF from a reliable source.

- Gather Required Information: Collect all necessary financial data, including sales figures and VAT collected.

- Fill Out the Form: Input the gathered information accurately in the designated fields.

- Review for Accuracy: Double-check all entries to ensure there are no mistakes.

- Sign and Date: Include your signature and the date to validate the form.

- Submit the Form: Follow the appropriate submission method for your jurisdiction.

Legal Use of the Blank Vat 100 Form Download

The Blank Vat 100 Form is legally binding when filled out correctly and submitted in accordance with tax laws. It is essential for businesses to understand the legal implications of this form, as inaccuracies or omissions can lead to penalties. Compliance with the relevant tax regulations ensures that the form is accepted by tax authorities.

Who Issues the Form

The Blank Vat 100 Form is typically issued by the state tax authority or the Internal Revenue Service (IRS), depending on the jurisdiction. Businesses should verify the issuing authority to ensure they are using the correct version of the form and adhering to the specific requirements set forth by the relevant tax body.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Blank Vat 100 Form is crucial for compliance. Generally, businesses must submit this form on a quarterly or annual basis, depending on their sales volume and the regulations of their state. Missing these deadlines can result in fines or additional interest charges, so it is important to stay informed about the specific dates applicable to your business.

Examples of Using the Blank Vat 100 Form Download

The Blank Vat 100 Form is utilized in various scenarios, including:

- A small business reporting its VAT liabilities for the first quarter.

- A corporation claiming VAT refunds for eligible expenses.

- A freelancer documenting VAT collected from clients.

Each of these examples highlights the importance of accurately completing the form to ensure proper reporting and compliance.

Quick guide on how to complete blank vat 100 form download

Easily Prepare Blank Vat 100 Form Download on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Blank Vat 100 Form Download on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Effortlessly Modify and eSign Blank Vat 100 Form Download

- Find Blank Vat 100 Form Download and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your alterations.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign Blank Vat 100 Form Download while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank vat 100 form download

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT100 form PDF and why is it necessary?

The VAT100 form PDF is a document used by businesses to report their VAT (Value Added Tax) obligations to HM Revenue & Customs in the UK. Completing this form is essential for compliance, allowing businesses to accurately declare VAT collected and paid. Submitting the VAT100 form helps ensure businesses avoid penalties due to incorrect submissions.

-

How can airSlate SignNow help with VAT100 form PDF submission?

airSlate SignNow simplifies the process of eSigning and sending your VAT100 form PDF. With our intuitive platform, you can quickly prepare your form, collect necessary signatures, and securely submit your VAT100 electronically. This streamlines compliance and saves your business time.

-

Is there a cost associated with using airSlate SignNow for VAT100 form PDF?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our affordable solutions allow businesses to manage document workflows, including sending and signing VAT100 form PDFs, at a competitive price. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for VAT100 form PDF processing?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and various CRM systems, enhancing your workflow for VAT100 form PDF processing. This integration facilitates easier file management and access to important documents, ensuring a smoother experience.

-

What features does airSlate SignNow offer for managing VAT100 form PDFs?

airSlate SignNow provides features like document collaboration, customizable templates, and secure eSigning specifically for VAT100 form PDFs. These tools ensure that your documents are processed efficiently and in compliance with VAT regulations. Plus, our real-time tracking feature keeps you updated on the status of your submissions.

-

Is airSlate SignNow secure for handling VAT100 form PDFs?

Yes, airSlate SignNow prioritizes the security of your documents. We employ advanced encryption protocols to protect your VAT100 form PDFs and any sensitive information within them. Additionally, our platform adheres to industry standards to ensure that your data remains confidential and secure.

-

Can users access their VAT100 form PDFs from mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing users to manage their VAT100 form PDFs on-the-go. Whether you’re working remotely or in the office, you can easily fill out, sign, and send your VAT100 form PDF from your smartphone or tablet. This flexibility enhances productivity and convenience.

Get more for Blank Vat 100 Form Download

- Rhode island organization form

- Renunciation and disclaimer of property received by intestate succession rhode island form

- Rhode island notice form

- Quitclaim deed from individual to husband and wife rhode island form

- Warranty deed from individual to husband and wife rhode island form

- Quitclaim deed from corporation to husband and wife rhode island form

- Warranty deed from corporation to husband and wife rhode island form

- Quitclaim deed from corporation to individual rhode island form

Find out other Blank Vat 100 Form Download

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now