Ct1 Form Download

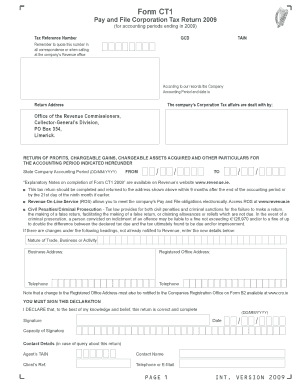

What is the CT1 Form?

The CT1 form, also known as the Ireland corporation tax return, is a crucial document for businesses operating in Ireland. It is used to report a company's income, assess its tax liability, and ensure compliance with the Ireland revenue corporation tax regulations. This form is essential for both domestic and foreign entities conducting business in Ireland, as it outlines the financial performance and tax obligations of the company.

Steps to Complete the CT1 Form

Completing the CT1 form requires careful attention to detail. Here are the key steps involved:

- Gather Financial Information: Collect all necessary financial records, including profit and loss statements, balance sheets, and any relevant tax documents.

- Fill Out the Form: Accurately enter your company's financial data into the CT1 form. Ensure that all figures are correct to avoid penalties.

- Review for Accuracy: Double-check all entries for accuracy and completeness. Mistakes can lead to delays or issues with the Ireland revenue corporation tax authorities.

- Submit the Form: File the completed CT1 form with the appropriate revenue office, either online or by mail, depending on your preference.

Legal Use of the CT1 Form

The CT1 form is legally binding once submitted to the Ireland revenue authorities. It must be filled out in accordance with the tax laws governing corporation tax in Ireland. Failure to comply with these regulations can result in penalties, including fines or additional tax assessments. Therefore, it is important to ensure that the form is completed accurately and submitted on time.

Filing Deadlines / Important Dates

Timely submission of the CT1 form is crucial for compliance. The deadlines for filing the form vary based on the company's accounting period. Generally, the form must be filed within nine months of the end of the accounting period. Companies should stay informed about specific deadlines to avoid late filing penalties.

Required Documents

To complete the CT1 form, several documents are necessary:

- Financial Statements: Profit and loss accounts and balance sheets for the relevant accounting period.

- Tax Records: Any previous tax returns or correspondence with the revenue authorities.

- Supporting Documentation: Additional documents that support claims made in the CT1 form, such as invoices or receipts.

Form Submission Methods

The CT1 form can be submitted through various methods. Companies can file the form online via the Ireland revenue's official portal, which offers a streamlined process. Alternatively, businesses may choose to submit the form by mail or in person at designated revenue offices. Each method has its own requirements and processing times, so it is important to choose the most suitable option for your needs.

Quick guide on how to complete ct1 form download 14341730

Prepare Ct1 Form Download seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow furnishes you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Ct1 Form Download on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Ct1 Form Download effortlessly

- Obtain Ct1 Form Download and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your revisions.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Ct1 Form Download and guarantee excellent communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct1 form download 14341730

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ireland Revenue Corporation Tax?

Ireland Revenue Corporation Tax is a tax imposed on the profits of corporations, making it essential for businesses operating in Ireland. Understanding how this tax works can help companies optimize their tax liabilities and enhance their financial strategies. With airSlate SignNow, you can easily manage documents related to corporation tax submissions.

-

How does airSlate SignNow help with Ireland Revenue Corporation Tax documentation?

airSlate SignNow simplifies the process of signing and managing documents required for the Ireland Revenue Corporation Tax. By streamlining the e-signature process, businesses can save time and ensure compliance with tax regulations. This ensures that your documents are securely signed and stored.

-

Can airSlate SignNow assist with calculating Corporation Tax in Ireland?

While airSlate SignNow does not directly calculate Corporation Tax, it provides tools to facilitate document flow related to tax calculations. By digitizing and automating document management, businesses can focus on accurate tax calculation without the stress of paperwork. This ensures efficient handling of all tax-related documents.

-

What pricing plans does airSlate SignNow offer for businesses managing Ireland Revenue Corporation Tax?

airSlate SignNow offers various pricing plans tailored to different business sizes, making it an ideal solution for managing documentation related to Ireland Revenue Corporation Tax. Each plan includes unique features to assist you in handling your corporation tax documents effectively. You can choose a plan based on your transaction volume and document needs.

-

Are there any features in airSlate SignNow specifically designed for tax-related documents?

Yes, airSlate SignNow has features specifically designed to optimize the management of tax-related documents. These features include customizable templates, secure storage, and advanced sharing options, which are beneficial for handling Ireland Revenue Corporation Tax documentation. This ensures all documents are accessible and securely signed whenever needed.

-

Does airSlate SignNow integrate with accounting software for corporation tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software tools, enabling businesses to streamline their workflow for Ireland Revenue Corporation Tax. This integration allows easy transfer of signed documents and data, ensuring all tax-related documentation is current and organized. It enhances the efficiency of tax preparation processes.

-

What are the benefits of using airSlate SignNow for Ireland Revenue Corporation Tax management?

Using airSlate SignNow for Ireland Revenue Corporation Tax management offers numerous benefits, including enhanced efficiency, cost savings, and improved compliance. Its user-friendly platform allows businesses to quickly create, send, and eSign tax documents, minimizing delays in submissions. Additionally, it removes the hassle of paper-based processes.

Get more for Ct1 Form Download

- Identity theft recovery package texas form

- Statutory general power of attorney for health care texas form

- Revocation of statutory power of attorney for health care texas form

- Aging parent package texas form

- Sale of a business package texas form

- Guardianship of a minor in texas form

- New state resident package texas form

- Texas directive physicians form

Find out other Ct1 Form Download

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online