Sales and Use Tax Return Annual Reconciliation Rhode Island Tax Ri Form

What is the Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri

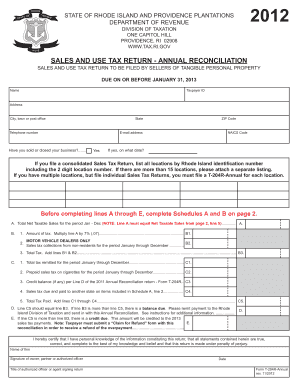

The Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri is a form that businesses in Rhode Island must complete to reconcile their sales and use tax obligations for the year. This form ensures that the total amount of sales tax collected aligns with the amount reported to the state. It is essential for maintaining compliance with state tax regulations and avoiding penalties. The form typically requires detailed information about sales, purchases, and tax collected throughout the year.

Steps to complete the Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri

Completing the Sales And Use Tax Return Annual Reconciliation involves several key steps:

- Gather all relevant financial records, including sales receipts and purchase invoices.

- Calculate the total sales tax collected during the year.

- Determine any exemptions or deductions applicable to your business.

- Fill out the form accurately, ensuring all figures are correct and supported by your records.

- Review the completed form for accuracy before submission.

Legal use of the Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri

The legal use of the Sales And Use Tax Return Annual Reconciliation is crucial for businesses operating in Rhode Island. This form must be filed accurately and on time to comply with state tax laws. Failure to submit this form or inaccuracies in reporting can lead to penalties, interest charges, and potential audits. It is important to understand the legal implications of the information provided on the form and to ensure that all data is truthful and complete.

Filing Deadlines / Important Dates

Businesses must be aware of specific deadlines related to the Sales And Use Tax Return Annual Reconciliation. Typically, the form is due on the last day of the month following the end of the tax year. For example, if your tax year ends on December thirty-first, the form would be due by January thirty-first of the following year. Keeping track of these deadlines is essential to avoid late fees and compliance issues.

Required Documents

When preparing to complete the Sales And Use Tax Return Annual Reconciliation, businesses should gather several key documents:

- Sales records, including invoices and receipts.

- Purchase records to identify exempt items.

- Previous tax returns for reference.

- Any correspondence from the Rhode Island Division of Taxation.

Form Submission Methods

The Sales And Use Tax Return Annual Reconciliation can be submitted through various methods. Businesses can file the form online through the Rhode Island Division of Taxation's website, which is often the most efficient option. Alternatively, forms can be mailed directly to the tax division or submitted in person at designated offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits your business needs.

Penalties for Non-Compliance

Non-compliance with the Sales And Use Tax Return Annual Reconciliation can result in significant penalties. Businesses may face fines for late submissions, inaccuracies, or failure to file altogether. Additionally, interest may accrue on any unpaid taxes, further increasing the financial burden. Understanding these penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete sales and use tax return annual reconciliation rhode island tax ri

Effortlessly prepare Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri seamlessly

- Locate Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and electronically sign Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax return annual reconciliation rhode island tax ri

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri?

The Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri is a process that helps businesses ensure compliance with state tax regulations. It allows companies to accurately calculate their sales and use tax owed for the year, making it crucial for maintaining proper financial records. Understanding this reconciliation will help you avoid penalties and ensure your taxes are correctly reported.

-

How can airSlate SignNow assist with my Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri?

airSlate SignNow streamlines the process of managing and filing your Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri by allowing you to send and eSign necessary documents quickly. Our platform helps reduce errors by providing templates and automation features, enabling you to focus on your business. With our solution, you can enhance efficiency and stay organized throughout tax season.

-

What features does airSlate SignNow offer that can help with tax reconciliation?

airSlate SignNow offers features such as customizable document templates, eSignatures, and collaboration tools to assist with tax reconciliation. These features simplify the preparation and submission of your Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri documentation, allowing for smoother workflows. With our user-friendly interface, you can manage your tax-related documents effectively.

-

Is there a pricing plan for using airSlate SignNow for tax returns?

Yes, airSlate SignNow offers flexible pricing plans designed to fit different business needs, including those focusing on tax returns like the Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri. Our plans are cost-effective and reflect the value of our features, ensuring you can choose the one that best suits your activities. With competitive pricing, you can maximize your savings while ensuring compliance.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation offers numerous benefits, including increased accuracy, time savings, and improved workflow efficiency. You can easily manage your Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri documents, minimizing the risk of errors and overwriting. Additionally, our electronic signature capabilities expedite the approval process, getting you to compliance faster.

-

Can airSlate SignNow integrate with accounting software for tax filings?

Absolutely! airSlate SignNow can integrate seamlessly with a variety of accounting software to facilitate your Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri filings. This integration allows for automatic data transfer, reducing manual entry errors and ensuring your tax records are accurately maintained. Streamlined bookkeeping leads to easier tax compliance and reporting for your business.

-

How secure is airSlate SignNow for managing tax documents?

airSlate SignNow prioritizes security when handling tax documents, including your Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri paperwork. We utilize advanced encryption technology to protect your sensitive data, ensuring that your documents are safe from unauthorized access. Our platform also complies with industry standards to maintain your peace of mind.

Get more for Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri

Find out other Sales And Use Tax Return Annual Reconciliation Rhode Island Tax Ri

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple