Form Hawaii

What is the Form Hawaii

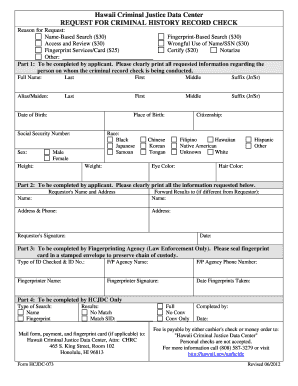

The Form Hawaii is a specific document used for various administrative and legal purposes within the state of Hawaii. It may pertain to tax filings, business registrations, or other official processes. Understanding the purpose and requirements of this form is crucial for individuals and businesses operating in Hawaii.

How to use the Form Hawaii

Using the Form Hawaii involves several steps to ensure compliance with state regulations. First, identify the specific purpose of the form, whether for tax, legal, or administrative use. Next, gather all necessary information and documents required to complete the form accurately. Finally, follow the instructions provided with the form to ensure it is filled out correctly, which may include signatures and dates.

Steps to complete the Form Hawaii

Completing the Form Hawaii requires careful attention to detail. Here are the essential steps:

- Read the instructions thoroughly to understand the requirements.

- Gather all relevant information, such as identification numbers and financial data.

- Fill out the form completely, ensuring all fields are addressed.

- Review the completed form for accuracy and completeness.

- Sign and date the form as required.

- Submit the form according to the specified submission methods.

Legal use of the Form Hawaii

The legal use of the Form Hawaii is governed by state laws and regulations. To be considered valid, the form must be completed in accordance with these laws. This includes ensuring that all necessary signatures are obtained and that the form is submitted within any applicable deadlines. Compliance with legal standards is essential for the form to be recognized by governmental agencies and courts.

Key elements of the Form Hawaii

Key elements of the Form Hawaii typically include:

- Identification of the individual or business submitting the form.

- Clear description of the purpose of the form.

- Required signatures and dates.

- Any supporting documentation that must accompany the form.

Ensuring these elements are correctly included is vital for the form's acceptance.

Form Submission Methods

Submitting the Form Hawaii can be done through various methods, including:

- Online submission through designated state portals.

- Mailing the completed form to the appropriate state office.

- In-person delivery at designated government offices.

Choosing the right submission method can impact the processing time and confirmation of receipt.

Quick guide on how to complete form hawaii

Effortlessly Complete Form Hawaii on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any holdups. Manage Form Hawaii on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process right now.

How to Edit and eSign Form Hawaii with Ease

- Find Form Hawaii and click on Get Form to initiate.

- Utilize the tools provided to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all data and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiresome form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Form Hawaii and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form hawaii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form Hawaii and how does it work?

Form Hawaii is an electronic document solution that allows users to create, send, and eSign forms seamlessly. With airSlate SignNow, businesses can streamline their document workflows by digitizing the entire process, ensuring compliance and efficiency. Users can easily manage their Form Hawaii documents from any device, making it convenient for on-the-go signing.

-

How much does it cost to use Form Hawaii with airSlate SignNow?

Pricing for Form Hawaii with airSlate SignNow varies based on the plan chosen. There are different subscription tiers available to meet diverse business needs, ensuring that everyone can find a suitable option. Additionally, users can take advantage of a free trial to explore the features before committing to a plan.

-

What features does airSlate SignNow offer for Form Hawaii?

airSlate SignNow provides a range of features for Form Hawaii, including secure eSigning, templates, and customizable workflows. Users can also track document status in real-time, set reminders, and automate notifications to ensure timely responses. These features empower businesses to enhance their efficiency and speed of operations.

-

Is Form Hawaii secure for handling sensitive information?

Yes, Form Hawaii through airSlate SignNow is designed with security in mind. The platform employs bank-grade encryption and complies with industry standards to protect sensitive information. Users can trust that their documents are safe while using airSlate SignNow for their eSigning needs.

-

Can I integrate Form Hawaii with other software applications?

Absolutely! airSlate SignNow supports integrations with a variety of software applications, enhancing the functionality of Form Hawaii. Popular integrations include CRM systems, document management tools, and payment processors, allowing for a streamlined workflow across platforms. This flexibility enables businesses to tailor their eSigning process to meet specific needs.

-

What are the benefits of using Form Hawaii for my business?

Using Form Hawaii with airSlate SignNow can signNowly improve your business’s operational efficiency. It reduces the time spent on document management and enhances collaboration among team members. Moreover, by digitizing your processes, you can reduce paper usage and contribute to sustainability efforts.

-

How can I get started with Form Hawaii on airSlate SignNow?

Getting started with Form Hawaii on airSlate SignNow is simple. You can sign up for a free trial on their website to explore the platform's features. Once you create your account, you can start creating and sending your forms for eSigning immediately.

Get more for Form Hawaii

- About form 8992 us shareholder calculation of irs

- Fhubspotusercontent00nethubfs14534253confirmation of provider new form

- New hampshire dp 10 form

- Ohio income tax return form

- Individual resident tax return form

- Wwwmichiganbusinessnetworkcomblogtreasurytreasury state individual income tax deadline in a week form

- Cdntoledoohgov uploads documentscity of toledo 2021 individual tax return form

- Bt 191 form

Find out other Form Hawaii

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed