Irs Form 8606 for

What is the IRS Form 8606 For

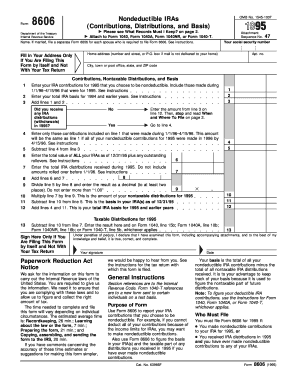

The IRS Form 8606 is essential for taxpayers who have made non-deductible contributions to traditional Individual Retirement Accounts (IRAs) or have received distributions from such accounts. It is used to report these contributions and to calculate the taxable portion of distributions from IRAs. This form is particularly important for individuals who wish to avoid double taxation on their retirement savings. Additionally, it helps track the basis in IRAs, ensuring that taxpayers do not pay taxes on the same money more than once.

How to Use the IRS Form 8606 For

To effectively use the IRS Form 8606, you must first determine if you need to file it based on your IRA contributions or distributions. If you have made non-deductible contributions or if you have received distributions from your IRA, complete the form to report these transactions accurately. Ensure that all required information, such as your total contributions and distributions, is accurately documented. After filling out the form, attach it to your tax return to ensure compliance with IRS regulations.

Steps to Complete the IRS Form 8606 For

Completing the IRS Form 8606 involves several key steps:

- Gather necessary information, including your total non-deductible contributions and any distributions from your IRA.

- Fill out Part I of the form to report your non-deductible contributions.

- Complete Part II to calculate the taxable amount of any distributions you received.

- Double-check your entries for accuracy to avoid potential errors that could lead to penalties.

- Attach the completed form to your tax return before submitting it to the IRS.

Legal Use of the IRS Form 8606 For

The IRS Form 8606 is legally binding when completed accurately and submitted in accordance with IRS guidelines. It serves as a record of your non-deductible contributions and distributions, ensuring that you are compliant with tax laws. Failing to file this form when required can result in penalties and interest on any unpaid taxes. It is crucial to maintain accurate records and submit the form timely to avoid legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8606 align with the standard tax return deadlines. Typically, individual taxpayers must submit their tax returns, including Form 8606, by April 15 of each year. If you require additional time, you may file for an extension, but be aware that any taxes owed must still be paid by the original deadline to avoid penalties. Always check for any changes in deadlines that may occur due to specific circumstances or IRS announcements.

Required Documents

To complete the IRS Form 8606, you will need several documents, including:

- Your previous year's tax return, which may provide relevant information on contributions and distributions.

- Records of any non-deductible contributions made to your IRA during the tax year.

- Statements from your IRA custodian detailing any distributions received.

- Any additional documentation that supports your calculations on the form.

Quick guide on how to complete irs form 8606 for

Accomplish Irs Form 8606 For effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed papers, allowing you to obtain the right template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without interruptions. Oversee Irs Form 8606 For on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to alter and eSign Irs Form 8606 For with ease

- Obtain Irs Form 8606 For and click Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your PC.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 8606 For and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8606 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 8606 for?

IRS Form 8606 is used to report non-deductible contributions to Traditional IRAs and to calculate the taxable portion of IRAs when distributions are taken. It is essential for anyone who has made Roth IRA conversions or has non-deductible contributions. Completing IRS Form 8606 for your tax filings ensures compliance and helps you avoid unnecessary taxes.

-

How can airSlate SignNow help with IRS Form 8606 for tax purposes?

AirSlate SignNow streamlines the process of sending and eSigning IRS Form 8606 for your tax submissions. With its easy-to-use interface, you can quickly prepare your forms, send them for signatures, and store them securely. This way, you can focus on other important tasks while ensuring your IRS Form 8606 is filed correctly.

-

Is there a cost associated with using airSlate SignNow for IRS Form 8606 for individuals?

AirSlate SignNow offers flexible pricing plans, with options that cater to both businesses and individuals. The cost is highly competitive and provides great value for the features offered, including document storage and eSigning for IRS Form 8606. You can choose a plan that fits your needs without breaking the bank.

-

What features does airSlate SignNow offer for managing IRS Form 8606 for businesses?

AirSlate SignNow offers robust features such as customizable templates, bulk sending, and real-time tracking of your IRS Form 8606 documents. You can also automate reminders to ensure timely submissions, enhancing your productivity and compliance. These features make it easier for businesses to handle tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for IRS Form 8606 for enhanced workflow?

Yes, airSlate SignNow integrates seamlessly with various cloud storage solutions and accounting software, enabling you to manage IRS Form 8606 for tax requirements effectively. These integrations help you pull in necessary information directly from your systems, reducing the risk of errors and improving efficiency. You can easily connect your existing software to streamline your processes.

-

What are the benefits of using airSlate SignNow for IRS Form 8606 for freelancers?

Freelancers can benefit signNowly from using airSlate SignNow for IRS Form 8606 as it simplifies the eSigning and document management process. The platform saves time, allows for easy tracking of document status, and helps maintain accurate records for tax purposes. This means freelancers can focus more on their work and less on paperwork.

-

How secure is my information when using airSlate SignNow for IRS Form 8606?

AirSlate SignNow takes security seriously, employing industry-standard encryption and secure cloud storage to protect your IRS Form 8606 and other documents. Your information is safeguarded against unauthorized access, ensuring that your sensitive tax data remains confidential. You can use the platform with peace of mind knowing your data is secure.

Get more for Irs Form 8606 For

Find out other Irs Form 8606 For

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy