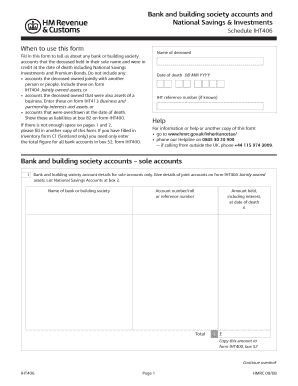

Iht406 Form

What is the IHT406?

The IHT406 form is a crucial document used in the United States for reporting the value of an estate for inheritance tax purposes. It is typically required when an individual passes away and their estate exceeds a certain threshold. This form helps the Internal Revenue Service (IRS) and state authorities assess the estate's value to determine any taxes owed. The IHT406 is essential for ensuring compliance with tax regulations and for the proper distribution of the deceased's assets.

How to Use the IHT406

Using the IHT406 form involves several steps to ensure accurate completion. First, gather all necessary information regarding the deceased's assets, liabilities, and any applicable deductions. Next, fill out the form with precise details, including the total value of the estate and any exemptions that may apply. Once completed, review the form for accuracy before submitting it to the appropriate tax authority. It is advisable to consult with a tax professional if you have questions about specific entries or requirements.

Steps to Complete the IHT406

Completing the IHT406 form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including bank statements, property deeds, and investment records.

- Calculate the total value of the estate, including both assets and liabilities.

- Fill out the IHT406 form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS or the relevant state authority by the specified deadline.

Legal Use of the IHT406

The IHT406 form is legally binding and must be filled out in accordance with federal and state regulations. It serves as an official declaration of the estate's value and is used by tax authorities to determine any inheritance tax owed. Failure to accurately complete and submit the form can result in penalties or legal complications, making it essential to adhere to all guidelines and requirements.

Required Documents

To complete the IHT406 form, you will need several key documents, including:

- Death certificate of the deceased.

- List of all assets and their valuations.

- Documentation of any outstanding debts or liabilities.

- Records of any prior gifts made by the deceased that may affect the estate's value.

- Legal documents such as wills or trusts that outline the distribution of assets.

Filing Deadlines / Important Dates

Filing the IHT406 form within the designated timeframe is critical to avoid penalties. Generally, the form must be submitted within nine months of the date of death. Extensions may be available under certain circumstances, but it is essential to check with the IRS or state tax authority for specific guidelines. Missing the deadline can lead to interest charges and additional penalties, making timely submission vital.

Quick guide on how to complete iht406

Complete Iht406 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Iht406 on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

How to alter and eSign Iht406 effortlessly

- Obtain Iht406 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent parts of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal standing as a conventional wet ink signature.

- Review all the information and then click the Done button to save your edits.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device you choose. Edit and eSign Iht406 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht406

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht406 in relation to airSlate SignNow?

The iht406 refers to a specific workflow or feature within airSlate SignNow tailored for efficient document signing and management. This functionality allows businesses to streamline their processes and ensure that eSigning is compliant with various regulations.

-

How much does airSlate SignNow with iht406 cost?

Pricing for airSlate SignNow with the iht406 feature varies based on the subscription plan you choose. Each plan is designed to provide maximum value while being cost-effective, ensuring that all businesses can afford to utilize its powerful eSigning capabilities.

-

What are the key features of airSlate SignNow's iht406?

airSlate SignNow's iht406 includes features such as customizable templates, real-time collaboration, and comprehensive audit trails. These features not only enhance user experience but also facilitate seamless integration into existing workflows, making document management more efficient.

-

What benefits does iht406 offer to businesses?

The benefits of using iht406 with airSlate SignNow include increased efficiency in document processing, reduced turnaround time for approvals, and enhanced security for sensitive information. This empowers teams to focus on their core activities rather than get bogged down in paperwork.

-

Can iht406 be integrated with other software tools?

Yes, the iht406 feature of airSlate SignNow can easily be integrated with various software tools and platforms, enhancing its utility. This interoperability allows businesses to maintain their workflow and increase productivity by leveraging existing systems.

-

Is there a free trial available for airSlate SignNow's iht406?

Yes, airSlate SignNow often provides a free trial period for users to explore the iht406 feature at no cost. This allows prospective customers to assess the platform's capabilities and determine if it meets their needs before committing to a subscription.

-

How does airSlate SignNow ensure the security of documents signed with iht406?

airSlate SignNow takes security seriously by implementing robust encryption and compliance measures for documents signed with the iht406 feature. This commitment to security safeguards sensitive information and builds trust among users.

Get more for Iht406

Find out other Iht406

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template