P L Liquor Store Form

What is the P L Liquor Store

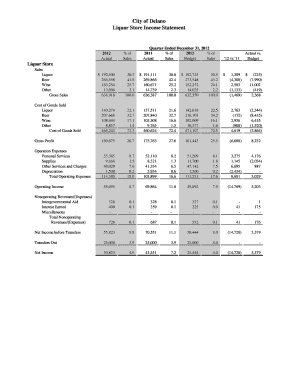

The P L liquor store refers to a specific type of financial document used by liquor store owners to track their profit and loss. This document is essential for understanding the financial health of a liquor store, detailing revenues, expenses, and net income over a specific period. By maintaining an accurate P L liquor store statement, owners can make informed decisions about their business operations and financial strategies.

Key elements of the P L Liquor Store

A comprehensive P L liquor store statement typically includes several key elements:

- Revenue: Total sales generated from liquor and other products.

- Cost of Goods Sold (COGS): Direct costs attributable to the production of the goods sold, including inventory costs.

- Operating Expenses: Indirect costs such as rent, utilities, salaries, and marketing.

- Net Profit: The final profit after subtracting COGS and operating expenses from total revenue.

How to use the P L Liquor Store

Using the P L liquor store effectively involves several steps:

- Gather financial data, including sales receipts and expense invoices.

- Calculate total revenue from liquor and ancillary sales.

- Determine COGS by accounting for inventory purchases and related costs.

- List all operating expenses incurred during the reporting period.

- Compile the information into the P L liquor store format to assess profitability.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for businesses, including liquor stores, regarding the reporting of income and expenses. It is crucial for liquor store owners to adhere to these guidelines to ensure compliance and avoid penalties. Keeping accurate records and filing the appropriate tax forms, such as the Schedule C for sole proprietorships, is essential for proper tax reporting.

Filing Deadlines / Important Dates

Liquor store owners must be aware of key filing deadlines to ensure compliance with tax regulations. Generally, the deadline for filing individual income tax returns is April 15 each year. However, if a business operates as a corporation or partnership, different deadlines may apply. Staying informed about these dates helps avoid late fees and penalties.

State-specific rules for the P L Liquor Store

Each state in the U.S. has its own regulations governing liquor sales and taxation. It is important for liquor store owners to familiarize themselves with these state-specific rules, which may include licensing requirements, tax rates, and reporting obligations. Compliance with local laws is crucial for the successful operation of a liquor store.

Quick guide on how to complete p l liquor store

Complete P L Liquor Store effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage P L Liquor Store on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign P L Liquor Store effortlessly

- Obtain P L Liquor Store and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing out new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign P L Liquor Store and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p l liquor store

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a liquor store profit and loss statement?

A liquor store profit and loss statement is a financial report that summarizes the revenues, costs, and expenses associated with operating a liquor store over a specific period. This document helps owners assess their store's financial health and make informed decisions based on profitability. By analyzing this statement, liquor store owners can identify trends and areas for improvement.

-

How can I create a liquor store profit and loss statement?

Creating a liquor store profit and loss statement involves gathering all financial data related to sales, costs of goods sold, and operating expenses. You can utilize accounting software or templates to organize this information efficiently. The final statement will help you review your income against your expenses, giving you a clear view of profitability.

-

What features does airSlate SignNow offer for managing profit and loss statements?

AirSlate SignNow offers features that allow you to easily send, eSign, and share your liquor store profit and loss statement securely. With our user-friendly interface, you can customize documents and ensure your financial reports are compliant with industry standards. This efficiency reduces paperwork, allowing you to focus more on managing your business effectively.

-

Why is it important to regularly update my liquor store profit and loss statement?

Regularly updating your liquor store profit and loss statement is crucial for tracking your business's financial performance over time. This practice helps identify profitability trends, seasonal variances, and potential financial issues early on. By keeping this statement up-to-date, you can make timely decisions to optimize your store's operations and improve profitability.

-

What are the benefits of using airSlate SignNow for my financial documents?

Using airSlate SignNow for your financial documents like liquor store profit and loss statements provides signNow benefits, including time savings and enhanced security. Our platform simplifies the eSigning process and ensures that your documents are stored safely in the cloud. This efficiency allows you to focus on the core aspects of your liquor store while maintaining organized financial records.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow can be integrated with various accounting software applications, enhancing the management of your liquor store profit and loss statement. This integration streamlines your workflow, allowing for automatic data syncing and reducing the risk of manual errors. Connect your existing systems to enjoy seamless document management and signing.

-

How does a liquor store profit and loss statement help in tax preparation?

A liquor store profit and loss statement is a vital tool for tax preparation, as it summarizes your income and expenses needed for reporting to tax authorities. By having an accurate and current statement, you can easily track allowable deductions, minimizing your tax liability. This organized approach aids in preparing your taxes efficiently, reducing the chances of audits or discrepancies.

Get more for P L Liquor Store

- Sign permit application city of foristell form

- Cake tasting amp consultation form nina s cookies

- Certified payroll reporting form

- New jersey park fire form

- New jersey direct deposit form

- Pemberton township recreation department 500 pemberton form

- Assistance for seniorsfood and nutrition service usda form

- South bound brook fire department chili cook off form

Find out other P L Liquor Store

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word