Tulsa County Form 901 2014-2026

What is the Tulsa County Form 901

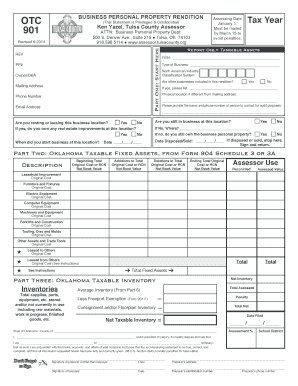

The Tulsa County Form 901, often referred to as the OTC 901, is a specific document used for various administrative and legal purposes within Tulsa County, Oklahoma. This form is essential for individuals and businesses who need to report certain information to local authorities, particularly in relation to tax obligations or property transactions. Understanding the purpose and requirements of this form is crucial for compliance and accurate reporting.

How to obtain the Tulsa County Form 901

Obtaining the Tulsa County Form 901 is a straightforward process. The form can typically be accessed through the official Tulsa County government website or the Oklahoma Tax Commission’s online portal. Additionally, physical copies may be available at designated county offices. It is advisable to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to complete the Tulsa County Form 901

Completing the Tulsa County Form 901 requires careful attention to detail to ensure accuracy. Follow these steps for successful completion:

- Gather all necessary information, including personal identification details and any relevant financial data.

- Read the instructions provided with the form to understand the requirements and sections.

- Fill out the form clearly, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Sign and date the form as required, ensuring compliance with any signature guidelines.

Legal use of the Tulsa County Form 901

The Tulsa County Form 901 serves a legal purpose and must be filled out in accordance with applicable laws and regulations. When submitted correctly, it can be used as a binding document in various legal and administrative processes. Compliance with local and state laws is essential to ensure that the form holds up in legal contexts, particularly regarding tax assessments or property ownership disputes.

Key elements of the Tulsa County Form 901

Several key elements must be included in the Tulsa County Form 901 for it to be considered valid. These elements typically include:

- Identification of the individual or entity submitting the form.

- Details regarding the specific purpose of the form, such as tax reporting or property transactions.

- Accurate financial information, if applicable, to support the claims made in the form.

- Signature and date to validate the submission.

Form Submission Methods (Online / Mail / In-Person)

The Tulsa County Form 901 can be submitted through various methods, offering flexibility to users. The available submission methods include:

- Online submission via the official Tulsa County or Oklahoma Tax Commission website, where applicable.

- Mailing the completed form to the appropriate county office address.

- In-person submission at designated county offices, allowing for immediate processing and assistance if needed.

Quick guide on how to complete tulsa county form 901

Easily prepare Tulsa County Form 901 on any device

Digital document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to acquire the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Tulsa County Form 901 on any device using the airSlate SignNow Android or iOS applications and simplify any document-driven process today.

The easiest way to edit and eSign Tulsa County Form 901 effortlessly

- Obtain Tulsa County Form 901 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and eSign Tulsa County Form 901 to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tulsa county form 901

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is OTC 901 in Tulsa County?

OTC 901 Tulsa County refers to the specific category of documents that must be filed with the Tulsa County Court for various transactions. Understanding OTC 901 is crucial for businesses operating in this area, as it ensures compliance with local regulations. airSlate SignNow can help streamline this process, making document signing and management straightforward.

-

How does airSlate SignNow support OTC 901 in Tulsa County?

airSlate SignNow provides a user-friendly platform that allows businesses to easily send and eSign OTC 901 documents in Tulsa County. By utilizing advanced features like templates and bulk sending, users can save time and reduce the risk of errors. This seamless integration can enhance productivity for organizations dealing with legal documents.

-

What are the pricing options for airSlate SignNow for handling OTC 901 Tulsa County documents?

airSlate SignNow offers various pricing plans to accommodate the needs of businesses needing to manage OTC 901 Tulsa County documents. These plans range from basic to premium levels, ensuring users can select a solution that fits their budget and requirements. You can expect cost-effective solutions that deliver signNow value in document management.

-

Are there any specific features for managing OTC 901 documents in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing OTC 901 Tulsa County documents. Users can leverage electronic signatures, document templates, and real-time tracking to ensure that all necessary steps are completed efficiently. These features simplify the process of managing legal documents while promoting compliance with local laws.

-

What benefits does airSlate SignNow offer for OTC 901 Tulsa County processing?

Using airSlate SignNow for OTC 901 Tulsa County processing provides numerous benefits, including improved efficiency, reduced processing time, and enhanced document security. The platform allows for quick access and easy collaboration among team members, ensuring that documents are handled correctly. By adopting this solution, businesses can focus more on their core operations and less on paperwork.

-

Can airSlate SignNow integrate with other software for OTC 901 documents?

Absolutely! airSlate SignNow offers several integration options with popular software tools for managing OTC 901 Tulsa County documents. By connecting with CRM systems, cloud storage, and project management applications, users can create a more cohesive workflow. This integration capability enhances overall efficiency and helps businesses streamline their document management processes.

-

What types of businesses can benefit from airSlate SignNow for OTC 901 Tulsa County?

A variety of businesses, including legal firms, real estate agencies, and financial institutions, can benefit from airSlate SignNow when managing OTC 901 Tulsa County documents. The platform is adaptable for any organization that requires efficient document signing and management solutions. Its ease of use makes it suitable for both small and large enterprises.

Get more for Tulsa County Form 901

Find out other Tulsa County Form 901

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy