Wh 216 1 Form

What is the Wh 216 1 Form

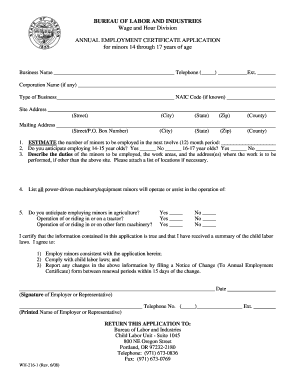

The Wh 216 1 Form is a specific document used primarily for tax purposes in the United States. It is often required by various entities to collect essential information from individuals or businesses for compliance with federal and state regulations. This form typically includes details such as taxpayer identification numbers, income information, and other relevant data necessary for accurate tax reporting.

How to use the Wh 216 1 Form

Using the Wh 216 1 Form involves filling it out with accurate information and submitting it to the appropriate authority. It is essential to ensure that all sections of the form are completed correctly to avoid delays or issues with processing. Users may need to refer to specific guidelines provided by the issuing agency to understand the requirements for completion and submission.

Steps to complete the Wh 216 1 Form

Completing the Wh 216 1 Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, such as identification and financial records.

- Fill in personal information, including your name, address, and taxpayer identification number.

- Provide any required financial details, ensuring accuracy in reporting income and deductions.

- Review the form for completeness and correctness before submission.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the Wh 216 1 Form

The Wh 216 1 Form is legally binding when filled out and submitted according to the applicable laws and regulations. To ensure its validity, it is crucial to comply with federal and state guidelines regarding the information provided. Additionally, using a reliable platform for electronic submission can enhance the form's legal standing by ensuring compliance with eSignature laws and data protection regulations.

Key elements of the Wh 216 1 Form

Key elements of the Wh 216 1 Form include:

- Taxpayer Identification: Essential for identifying the individual or business.

- Income Information: Details about earnings that must be reported.

- Deductions: Any applicable deductions that may reduce taxable income.

- Signature: Required to validate the information provided.

Form Submission Methods

The Wh 216 1 Form can be submitted through various methods, including:

- Online: Many agencies allow electronic submission, which can expedite processing.

- Mail: Physical copies can be sent to the appropriate department.

- In-Person: Some users may choose to deliver the form directly to an office for immediate processing.

Quick guide on how to complete wh 216 1 form

Effortlessly prepare Wh 216 1 Form on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, alter, and electronically sign your documents swiftly without delays. Manage Wh 216 1 Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Wh 216 1 Form with ease

- Obtain Wh 216 1 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent areas of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Decide how you would like to share your form—via email, text message (SMS), or an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Modify and eSign Wh 216 1 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh 216 1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wh 216 1 Form and how is it used?

The Wh 216 1 Form is a specific document used for tax purposes, allowing employers to report specific withholding information. Businesses can streamline the process of completing and submitting this form using airSlate SignNow's eSignature capabilities. By leveraging our platform, you can ensure that the Wh 216 1 Form is signed and filed correctly and efficiently.

-

How can airSlate SignNow help with filling out the Wh 216 1 Form?

airSlate SignNow simplifies the process of filling out the Wh 216 1 Form by providing an easy-to-use interface for document creation and management. Our platform allows users to input necessary information directly into the form, ensuring accuracy and compliance. With our tools, you can pre-fill and automate repetitive fields to save time and reduce errors.

-

What are the pricing options for using airSlate SignNow with the Wh 216 1 Form?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes, allowing you to eSign documents like the Wh 216 1 Form at an affordable rate. Pricing varies based on the features and number of users, but all plans include essential eSignature functionalities. You can choose a plan that fits your needs to manage documents effectively without breaking the bank.

-

Is airSlate SignNow secure for submitting the Wh 216 1 Form?

Yes, airSlate SignNow provides a highly secure environment for submitting the Wh 216 1 Form, ensuring that your data is protected. We utilize industry-standard encryption and security protocols to safeguard your documents. With our platform, you can confidently eSign and send sensitive information without worrying about unauthorized access.

-

Can I integrate airSlate SignNow with other applications for the Wh 216 1 Form?

Absolutely! airSlate SignNow offers integrations with a variety of applications, making it easy to work with the Wh 216 1 Form in your existing workflow. You can seamlessly connect with popular tools like CRM systems, cloud storage, and productivity applications to enhance document management and eSignature processes.

-

What are the benefits of using airSlate SignNow for the Wh 216 1 Form?

Using airSlate SignNow for the Wh 216 1 Form brings numerous benefits, including increased efficiency, reduced paperwork, and improved turnaround times for document signing. The platform allows for quick access to templates, automated reminders, and real-time tracking of document status. You'll save time and reduce the hassle of handling paper forms.

-

How do I get started with airSlate SignNow for the Wh 216 1 Form?

Getting started with airSlate SignNow for the Wh 216 1 Form is straightforward. Simply sign up for an account on our website, choose the plan that suits you, and begin uploading or creating your documents. Our user-friendly interface will guide you through the process of preparing and eSigning the Wh 216 1 Form with ease.

Get more for Wh 216 1 Form

- Staff fire training template form

- Udl lesson plan template form

- Purpose of transfer required for utmaugma ira qrp accounts and wire funds form

- Name of person filing document mohave county superior court form

- Public health awareness theres more than just reporting form

- Request medical recordstgh northbrooksville spring form

- Public school verification form

- Waiver updated 8 16 form

Find out other Wh 216 1 Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT