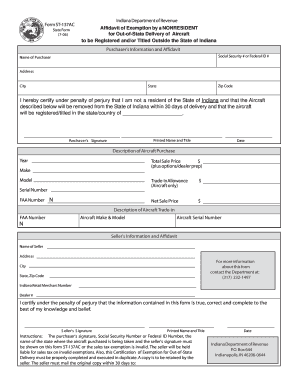

Indiana Department of Revenue Form ST 137AC State Form

What is the Indiana Department Of Revenue Form ST 137AC State Form

The Indiana Department Of Revenue Form ST 137AC State Form is a specific document used for claiming an exemption from sales tax for certain transactions in Indiana. This form is primarily utilized by businesses and individuals who qualify for tax exemptions under specific criteria set by the state. It allows eligible entities to avoid paying sales tax on qualifying purchases, thereby facilitating compliance with state tax regulations.

How to use the Indiana Department Of Revenue Form ST 137AC State Form

To effectively use the Indiana Department Of Revenue Form ST 137AC State Form, individuals and businesses must first determine their eligibility for sales tax exemption. Once eligibility is established, the form should be filled out accurately, providing all required information such as the purchaser's details, the nature of the transaction, and the reason for the exemption. After completing the form, it should be presented to the seller at the time of purchase to validate the tax-exempt status.

Steps to complete the Indiana Department Of Revenue Form ST 137AC State Form

Completing the Indiana Department Of Revenue Form ST 137AC State Form involves several key steps:

- Begin by downloading the form from the Indiana Department of Revenue website or obtaining a hard copy.

- Fill in the required fields, including the name and address of the purchaser, as well as the seller's information.

- Clearly state the reason for the tax exemption, ensuring it aligns with the criteria specified by the state.

- Sign and date the form to certify its accuracy and authenticity.

- Provide the completed form to the seller at the time of the transaction.

Legal use of the Indiana Department Of Revenue Form ST 137AC State Form

The Indiana Department Of Revenue Form ST 137AC State Form is legally binding when filled out and used correctly. It must be used in accordance with Indiana tax laws, which stipulate the conditions under which sales tax exemptions can be claimed. Proper use of this form helps ensure compliance with state regulations and protects both the purchaser and seller from potential tax liabilities.

Key elements of the Indiana Department Of Revenue Form ST 137AC State Form

Key elements of the Indiana Department Of Revenue Form ST 137AC State Form include:

- Purchaser Information: Name and address of the individual or business claiming the exemption.

- Seller Information: Name and address of the seller involved in the transaction.

- Exemption Reason: A clear statement of the reason for claiming the exemption, which must align with state guidelines.

- Signature: The signature of the purchaser or authorized representative, certifying the accuracy of the information provided.

Form Submission Methods (Online / Mail / In-Person)

The Indiana Department Of Revenue Form ST 137AC State Form can be submitted in various ways depending on the seller's preferences. Typically, the form is presented in person at the time of purchase. However, businesses may also choose to keep the form on file for future transactions. It is important to confirm with the seller regarding their preferred method of submission to ensure compliance with their record-keeping practices.

Quick guide on how to complete indiana department of revenue form st 137ac state form

Prepare Indiana Department Of Revenue Form ST 137AC State Form easily on any device

Online document organization has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Indiana Department Of Revenue Form ST 137AC State Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Indiana Department Of Revenue Form ST 137AC State Form effortlessly

- Locate Indiana Department Of Revenue Form ST 137AC State Form and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional ink signature.

- Review the details and click the Done button to save your edits.

- Choose how you wish to deliver your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Indiana Department Of Revenue Form ST 137AC State Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the indiana department of revenue form st 137ac state form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana Department Of Revenue Form ST 137AC State Form?

The Indiana Department Of Revenue Form ST 137AC State Form is a tax exemption certificate used by organizations to claim exemption from sales tax on eligible purchases. It is essential for qualifying businesses to properly fill out this form to avoid additional tax liabilities. Understanding its requirements can help ensure compliance with Indiana tax regulations.

-

How can I complete the Indiana Department Of Revenue Form ST 137AC State Form using airSlate SignNow?

With airSlate SignNow, you can easily complete the Indiana Department Of Revenue Form ST 137AC State Form digitally. The platform allows you to fill out the form, sign it electronically, and share it with relevant stakeholders quickly. This streamlines the process and reduces the chance of errors compared to paper forms.

-

Is there a cost associated with using airSlate SignNow for the Indiana Department Of Revenue Form ST 137AC State Form?

airSlate SignNow offers a cost-effective solution for managing documents, including the Indiana Department Of Revenue Form ST 137AC State Form. Pricing depends on the subscription plan you choose, which can accommodate small to large businesses. The value comes from saving time and reducing paper usage, making it an economical choice.

-

What features does airSlate SignNow offer for the Indiana Department Of Revenue Form ST 137AC State Form?

AirSlate SignNow provides a suite of features for handling the Indiana Department Of Revenue Form ST 137AC State Form, including customizable templates, electronic signatures, and audit trails. The platform is intuitive, ensuring an easy user experience for both document senders and signers. Additionally, you can track the document's status for peace of mind.

-

How does airSlate SignNow enhance the security of the Indiana Department Of Revenue Form ST 137AC State Form?

Security is a top priority at airSlate SignNow. When using the platform for the Indiana Department Of Revenue Form ST 137AC State Form, your data is protected through encryption and secure cloud storage. You also have control over who can access the document, ensuring that sensitive information remains confidential.

-

Can the Indiana Department Of Revenue Form ST 137AC State Form be integrated with other software?

Yes, airSlate SignNow allows seamless integrations with a variety of software applications, enhancing workflow efficiency. You can link it with CRM systems, project management tools, and cloud storage solutions, enabling you to manage the Indiana Department Of Revenue Form ST 137AC State Form alongside your other business processes. This ultimately improves productivity.

-

What benefits does airSlate SignNow provide for businesses using the Indiana Department Of Revenue Form ST 137AC State Form?

Using airSlate SignNow for the Indiana Department Of Revenue Form ST 137AC State Form offers multiple benefits, including time savings, reduced paperwork, and improved accuracy in document handling. These advantages contribute to a more efficient operational flow, allowing businesses to focus on their core activities instead. Enhanced compliance is another vital benefit as the platform helps ensure forms are completed correctly.

Get more for Indiana Department Of Revenue Form ST 137AC State Form

Find out other Indiana Department Of Revenue Form ST 137AC State Form

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself