California Resident Income Tax Return Form 540 2EZ

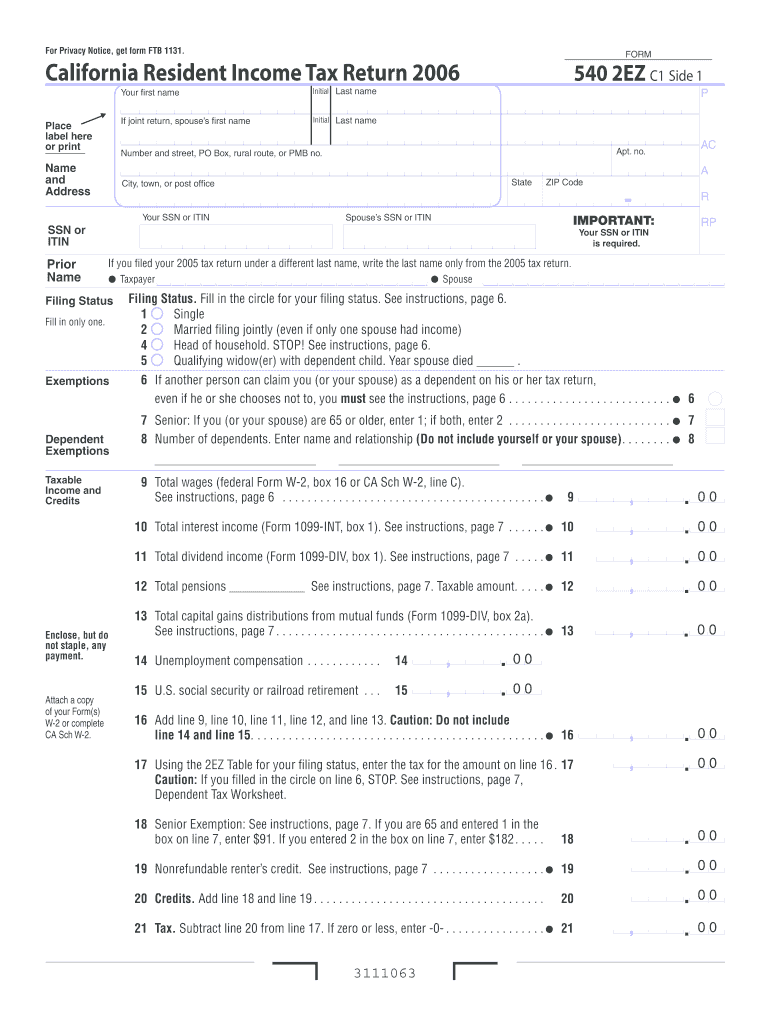

What is the California Resident Income Tax Return Form 540 2EZ

The California Resident Income Tax Return Form 540 2EZ is a simplified tax form designed for California residents with straightforward tax situations. This form is specifically intended for individuals who meet certain criteria, such as having a taxable income below a specific threshold and not claiming certain deductions or credits. By using Form 540 2EZ, taxpayers can efficiently report their income, calculate their tax liability, and determine their refund or amount owed to the state. This form is ideal for those who prefer a streamlined process without the complexities of additional schedules or forms.

Steps to complete the California Resident Income Tax Return Form 540 2EZ

Completing the California Resident Income Tax Return Form 540 2EZ involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and other income statements.

- Ensure you meet the eligibility criteria for using Form 540 2EZ, such as income limits and filing status.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your income by entering amounts from your W-2s and other income sources.

- Calculate your total tax liability using the provided tax tables.

- Determine any credits or adjustments you may qualify for, ensuring you do not exceed the limits for Form 540 2EZ.

- Sign and date the form before submitting it to the California Franchise Tax Board.

Legal use of the California Resident Income Tax Return Form 540 2EZ

The California Resident Income Tax Return Form 540 2EZ is legally recognized as a valid document for filing state income taxes. To ensure its legal standing, taxpayers must adhere to specific guidelines, including accurate reporting of income and proper completion of all required sections. Additionally, when submitting the form electronically, it is crucial to utilize a compliant eSignature solution that meets the standards set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the submission is legally binding and accepted by the California Franchise Tax Board.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines when filing the California Resident Income Tax Return Form 540 2EZ. The standard filing deadline is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to stay informed about any changes in deadlines, especially for specific situations such as natural disasters or state emergencies.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the California Resident Income Tax Return Form 540 2EZ. The form can be filed electronically through the California Franchise Tax Board's e-file system, which is often the fastest method for processing refunds. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address provided by the Franchise Tax Board. For those who prefer in-person submissions, some local offices may accept forms directly, but it is advisable to check in advance for availability and hours of operation.

Eligibility Criteria

To qualify for using the California Resident Income Tax Return Form 540 2EZ, taxpayers must meet specific eligibility criteria. This includes having a total income below a designated limit, typically set for single filers and married couples filing jointly. Additionally, individuals must not claim certain deductions, such as itemized deductions or credits that require additional forms. It is essential to review the latest guidelines from the California Franchise Tax Board to ensure compliance with all eligibility requirements before filing.

Quick guide on how to complete california resident income tax return form 540 2ez 397388258

Effortlessly set up California Resident Income Tax Return Form 540 2EZ on any gadget

Digital document administration has increasingly become favored by both businesses and individuals. It offers a superb environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the needed form and securely keep it online. airSlate SignNow equips you with all the resources necessary to produce, alter, and eSign your documents promptly without delays. Handle California Resident Income Tax Return Form 540 2EZ on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign California Resident Income Tax Return Form 540 2EZ effortlessly

- Obtain California Resident Income Tax Return Form 540 2EZ and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to confirm your changes.

- Choose how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate generating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign California Resident Income Tax Return Form 540 2EZ while ensuring exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california resident income tax return form 540 2ez 397388258

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2006 ca.?

airSlate SignNow is a powerful eSignature solution designed to streamline document workflows. Since 2006 ca., it has provided businesses with an easy-to-use platform for sending and signing documents securely online. This helps organizations save time and reduce paperwork.

-

How much does airSlate SignNow cost for businesses wanting to use it in 2006 ca.?

Pricing for airSlate SignNow is competitive, making it a cost-effective option for businesses in 2006 ca. Various subscription plans cater to different needs, allowing users to select a package that fits their budget and requirements. This flexibility ensures that any organization can implement the solution without overspending.

-

What features does airSlate SignNow offer that are particularly useful in 2006 ca.?

airSlate SignNow boasts several key features, including document templates, bulk sending, and advanced security options. These capabilities are particularly beneficial for organizations in 2006 ca. looking to enhance productivity and ensure compliance with legal standards. Users can customize their workflows to fit their specific document signing needs.

-

What are the benefits of choosing airSlate SignNow for eSignatures in 2006 ca.?

Choosing airSlate SignNow provides numerous benefits, including faster turnaround times, reduced operational costs, and improved document tracking. For businesses in 2006 ca., this translates to enhanced efficiency and the ability to focus on core operations rather than paperwork. Its user-friendly interface also ensures easy adoption by all team members.

-

Can airSlate SignNow integrate with other software solutions in 2006 ca.?

Yes, airSlate SignNow offers integration capabilities with various popular software solutions, making it easier for businesses in 2006 ca. to streamline their processes. Common integrations include CRM systems, project management tools, and cloud storage services. This flexibility allows users to enhance their workflows without disrupting existing systems.

-

How secure is the airSlate SignNow platform for users in 2006 ca.?

airSlate SignNow prioritizes security by employing advanced encryption and compliance with international security standards. For users in 2006 ca., this means that their sensitive information is protected throughout the signing process. The platform also offers options for authentication and audit trails to further enhance document security.

-

Is there a mobile app available for airSlate SignNow in 2006 ca.?

Yes, airSlate SignNow offers a mobile app that allows users in 2006 ca. to send and sign documents on the go. This mobile functionality is perfect for business professionals who need access to documents anytime, anywhere. The app provides a seamless experience similar to the desktop version, ensuring productivity while traveling.

Get more for California Resident Income Tax Return Form 540 2EZ

Find out other California Resident Income Tax Return Form 540 2EZ

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document