Montana Mw3 Form

What is the Montana Mw3

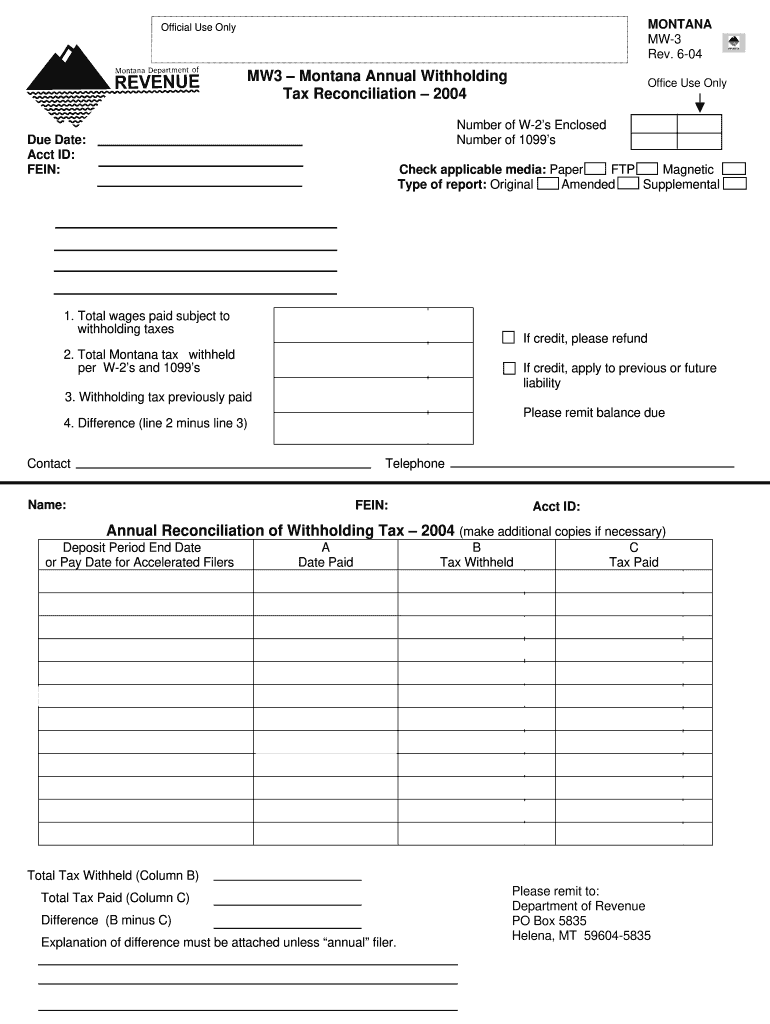

The Montana Mw3 form is a specific document used within the state of Montana, primarily for tax-related purposes. It is essential for individuals and businesses to accurately report their income and deductions to the state tax authority. Understanding the Mw3 form is crucial for ensuring compliance with state tax laws and regulations.

How to use the Montana Mw3

Using the Montana Mw3 form involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and deduction records. Next, fill out the form carefully, ensuring that all information is accurate and complete. Once filled, the form can be submitted electronically or via mail, depending on your preference and the requirements set by the Montana Department of Revenue.

Steps to complete the Montana Mw3

Completing the Montana Mw3 form requires a systematic approach:

- Collect all relevant financial information, including W-2s and 1099s.

- Access the Mw3 form through the official Montana Department of Revenue website.

- Fill in personal identification details, including your name, address, and Social Security number.

- Report your total income accurately, including wages, interest, and dividends.

- Detail any deductions you are eligible for, such as business expenses or educational credits.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, either electronically or by mailing it to the appropriate address.

Legal use of the Montana Mw3

The Montana Mw3 form is legally binding when completed and submitted according to state regulations. It is crucial to adhere to all guidelines set forth by the Montana Department of Revenue to ensure that the form is accepted and processed without issues. Failure to comply with these regulations can lead to penalties or delays in processing.

Key elements of the Montana Mw3

Several key elements must be included in the Montana Mw3 form for it to be valid:

- Personal Information: Accurate identification details of the taxpayer.

- Income Reporting: Comprehensive reporting of all income sources.

- Deductions: Clear documentation of any deductions claimed.

- Signature: A signature is required to validate the submission.

Form Submission Methods

The Montana Mw3 form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online Submission: Many taxpayers choose to submit the form electronically through the Montana Department of Revenue's online portal.

- Mail: The form can also be printed and mailed to the appropriate tax office.

- In-Person: Some may prefer to deliver the form directly to their local tax office for immediate processing.

Quick guide on how to complete montana mw3

Complete Montana Mw3 with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents promptly without delays. Handle Montana Mw3 on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Montana Mw3 seamlessly

- Locate Montana Mw3 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device of your choice. Modify and eSign Montana Mw3 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the montana mw3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is montana mw3, and how does it relate to airSlate SignNow?

Montana mw3 refers to a specific configuration of airSlate SignNow tailored for enhanced document management. By deploying montana mw3, businesses can efficiently send and eSign documents, ensuring a seamless workflow. Take advantage of this solution to boost productivity and simplify your documentation process.

-

What are the pricing options for montana mw3?

The pricing for montana mw3 varies based on your business needs and the number of users. airSlate SignNow offers flexible subscription plans that cater to small businesses and large enterprises alike. Visit our pricing page to explore all your options and find the best fit for your organization.

-

What features can I expect with montana mw3?

Montana mw3 includes robust features such as document templates, advanced eSigning capabilities, and real-time collaboration tools. These features ensure that your team can work efficiently and effectively in managing documents. Experience the convenience of automation and streamlined workflows with montana mw3.

-

How does montana mw3 benefit businesses?

Montana mw3 streamlines the document signing process, enabling businesses to save time and reduce errors. With this solution, you can enhance your customer experience by providing faster turnaround times for essential documents. Additionally, montana mw3 contributes to cost savings by minimizing paper usage and improving operational efficiency.

-

Can montana mw3 integrate with other software?

Yes, montana mw3 integrates seamlessly with various software applications, enhancing its functionality. Whether you're using CRM systems, project management tools, or accounting software, airSlate SignNow can connect with them easily. This ensures that your workflow remains uninterrupted and integrated.

-

Is montana mw3 secure for document management?

Absolutely! Montana mw3 prioritizes security with advanced encryption methods and strict compliance with industry standards. The platform provides a secure environment for your sensitive documents, ensuring that your data remains protected at all times. Trust that montana mw3 safeguards your information effectively.

-

How can I get started with montana mw3?

Getting started with montana mw3 is simple! Visit the airSlate SignNow website, sign up for a free trial, and explore its features. Our user-friendly onboarding process will guide you through, ensuring that you can leverage montana mw3's capabilities to meet your business needs.

Get more for Montana Mw3

Find out other Montana Mw3

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document