Irs Letter 474c 2014

What is the IRS Letter 474C?

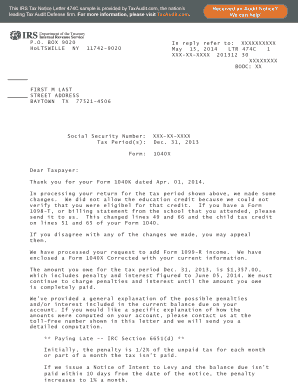

The IRS Letter 474C is a correspondence issued by the Internal Revenue Service (IRS) that notifies taxpayers of discrepancies or issues related to their tax returns. This letter typically indicates that the IRS has identified potential errors or missing information in a taxpayer's submitted documents. Understanding the contents of this letter is crucial for taxpayers to address any concerns and ensure compliance with tax regulations.

How to Use the IRS Letter 474C

When you receive the IRS Letter 474C, it is important to carefully review the information provided. The letter will outline specific issues that need to be addressed, such as unreported income or discrepancies in deductions. To effectively use this letter:

- Read the letter thoroughly to understand the IRS's concerns.

- Gather any supporting documents that may clarify or correct the issues mentioned.

- Respond to the IRS in a timely manner, providing the necessary documentation or explanations as requested.

Steps to Complete the IRS Letter 474C

Completing the IRS Letter 474C involves several key steps to ensure that you respond appropriately:

- Identify the specific issues raised in the letter.

- Collect relevant tax documents, such as W-2s, 1099s, or receipts.

- Draft a response that addresses each concern, including any corrections or explanations.

- Submit your response to the IRS by the deadline specified in the letter.

Legal Use of the IRS Letter 474C

The IRS Letter 474C is a legally binding document that requires careful handling. When responding to the letter, it is essential to ensure that all information provided is accurate and complete. Misrepresentation or failure to respond adequately can lead to penalties or further action by the IRS. It is advisable to keep a copy of the letter and any correspondence sent to the IRS for your records.

Key Elements of the IRS Letter 474C

The IRS Letter 474C typically includes several key elements:

- Taxpayer Information: Your name, address, and taxpayer identification number.

- Issue Description: A clear explanation of the discrepancy or issue identified by the IRS.

- Required Actions: Instructions on how to respond, including any deadlines.

- Contact Information: Details on how to reach the IRS for further clarification or assistance.

How to Obtain the IRS Letter 474C

If you believe you should have received an IRS Letter 474C but have not, there are steps you can take to obtain it. First, check your mail and any electronic correspondence from the IRS. If you still cannot locate the letter, you may contact the IRS directly through their customer service line. Be prepared to provide your personal information for verification purposes. Additionally, you can request a transcript of your tax account, which may provide insights into any issues that have been flagged by the IRS.

Quick guide on how to complete irs letter 474c

Complete Irs Letter 474c effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools you require to construct, modify, and eSign your documents rapidly without hold-ups. Manage Irs Letter 474c on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Irs Letter 474c with ease

- Find Irs Letter 474c and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Irs Letter 474c and ensure exceptional communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs letter 474c

Create this form in 5 minutes!

How to create an eSignature for the irs letter 474c

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS letter 474c and why might I need it?

An IRS letter 474c is a notification from the IRS indicating a taxpayer's account has been adjusted or corrected. You might need this letter to confirm your tax status and resolve any discrepancies with the IRS. Understanding the details of this letter is crucial for managing your tax obligations effectively.

-

How can airSlate SignNow help with IRS letter 474c processing?

airSlate SignNow streamlines the process of signing and submitting documents related to your IRS letter 474c. With our easy-to-use electronic signature solution, you can quickly prepare and send your responses to the IRS, ensuring a timely and organized approach to your tax communications.

-

What features should I look for when using airSlate SignNow for IRS letter 474c?

When utilizing airSlate SignNow for managing IRS letter 474c, look for features like customizable templates, automated reminders, and real-time document tracking. These tools simplify your workflow and help ensure that you never miss a critical deadline regarding your IRS correspondence.

-

Is airSlate SignNow a cost-effective solution for handling IRS letter 474c?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing IRS letter 474c. Our competitive pricing plans offer flexibility and value, ensuring that you have access to essential features without breaking the bank while staying compliant with IRS requirements.

-

Can airSlate SignNow integrate with other tools to help with IRS letter 474c?

Absolutely! airSlate SignNow offers integrations with various business applications, making it easier to handle IRS letter 474c along with your existing workflows. You can connect with tools like CRM systems, accounting software, and cloud storage services to streamline document management and ensure seamless collaboration.

-

How secure is the information processed with airSlate SignNow regarding IRS letter 474c?

Security is a top priority at airSlate SignNow. We implement industry-leading encryption and compliance protocols to protect your sensitive data, including any information related to IRS letter 474c. You can trust that your documents are secure during signing and storage.

-

What are the benefits of using airSlate SignNow for IRS letter 474c?

Using airSlate SignNow for IRS letter 474c provides numerous benefits, including ease of use, efficiency in document processing, and enhanced compliance. With our platform, you can track the status of your letters, reduce paperwork, and ensure timely submissions, ultimately simplifying your tax management.

Get more for Irs Letter 474c

Find out other Irs Letter 474c

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document