Internal Revenue Service Taxaudit Com 2022-2026

Understanding the 474c Letter

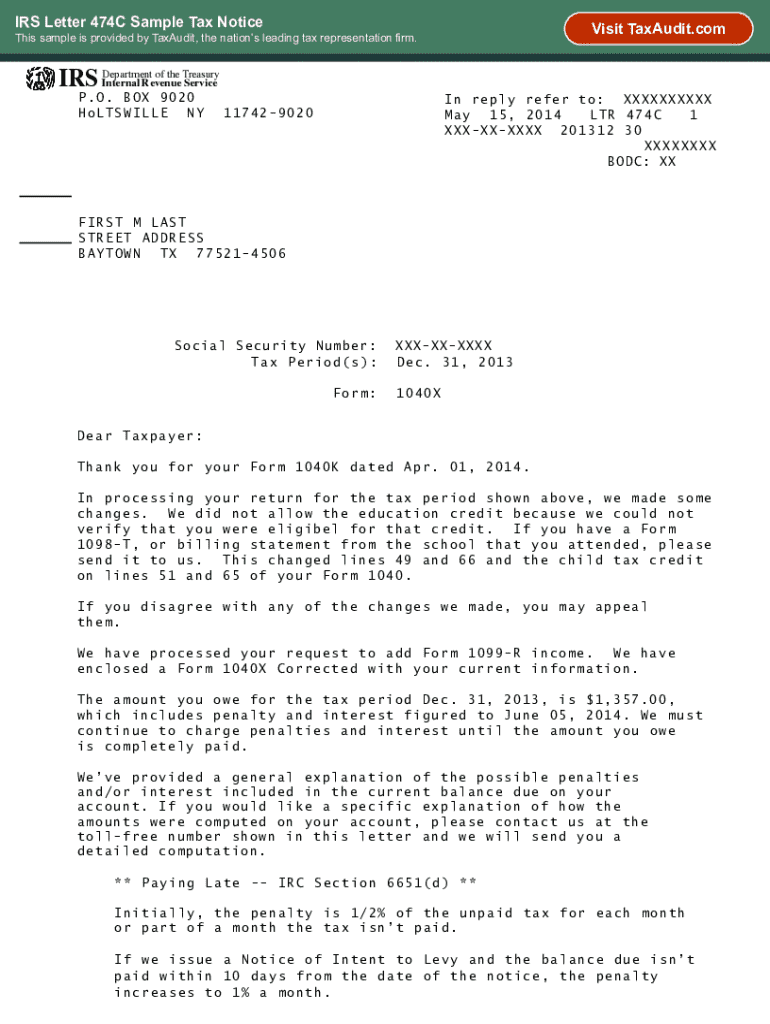

The 474c letter, also known as the IRS letter 474c, is a communication from the Internal Revenue Service (IRS) that typically addresses issues related to tax audits or discrepancies in tax filings. This letter serves as an official notice to taxpayers, informing them of specific concerns regarding their tax returns. It is essential to understand the contents of this letter, as it may require action on the taxpayer's part to resolve any issues raised by the IRS.

Key Elements of the 474c Letter

The 474c letter contains several critical components that taxpayers should be aware of:

- Taxpayer Information: This section includes the taxpayer's name, address, and identification number.

- IRS Contact Information: The letter provides details on how to contact the IRS for further clarification or support.

- Issue Description: A clear explanation of the issue at hand, including any discrepancies or required documentation.

- Response Instructions: Guidance on how to respond to the letter, including deadlines and necessary forms.

Steps to Respond to a 474c Letter

Responding to a 474c letter requires careful attention to detail. Here are the steps to follow:

- Review the Letter: Carefully read the letter to understand the issue and what is being requested.

- Gather Documentation: Collect any relevant documents that support your case or clarify the discrepancies noted by the IRS.

- Prepare a Response: Draft a response that addresses the concerns raised in the letter, including any explanations or additional information.

- Submit Your Response: Send your response to the IRS by the specified deadline, ensuring it is sent to the correct address.

Potential Consequences of Ignoring the 474c Letter

Failing to respond to a 474c letter can lead to several negative outcomes:

- Increased Penalties: The IRS may impose penalties for non-compliance or failure to provide requested information.

- Tax Liens: Ignoring the letter could result in tax liens being placed against your property.

- Further Audits: Non-response may trigger additional audits or reviews of your tax filings.

Legal Use of the 474c Letter

The 474c letter is a legally binding document that taxpayers must take seriously. It is essential to understand that the IRS has the authority to enforce compliance with tax laws. Responding appropriately to this letter can help mitigate potential legal issues and demonstrate your willingness to cooperate with the IRS.

Examples of Situations Involving a 474c Letter

There are various scenarios in which a taxpayer might receive a 474c letter:

- Income Discrepancies: If the IRS finds inconsistencies between reported income and third-party reports.

- Missing Documentation: When the IRS requires additional documentation to support deductions or credits claimed.

- Audit Notifications: As part of the audit process, the IRS may issue a 474c letter to clarify specific issues.

Quick guide on how to complete internal revenue service taxaudit com

Effortlessly Prepare Internal Revenue Service Taxaudit com on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-conscious replacement for traditional printed and signed documents, as you can obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any holdups. Handle Internal Revenue Service Taxaudit com on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Internal Revenue Service Taxaudit com with Ease

- Obtain Internal Revenue Service Taxaudit com and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Internal Revenue Service Taxaudit com to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service taxaudit com

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service taxaudit com

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 474c letter and how can airSlate SignNow help with it?

A 474c letter is a document often used in various business transactions. airSlate SignNow simplifies the process of sending and eSigning 474c letters, ensuring that your documents are securely signed and stored. With our platform, you can manage your 474c letters efficiently, saving time and reducing paperwork.

-

What features does airSlate SignNow offer for managing 474c letters?

airSlate SignNow provides a range of features for managing 474c letters, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your 474c letters are processed quickly and efficiently. Additionally, our user-friendly interface makes it easy for anyone to navigate and utilize these tools.

-

Is airSlate SignNow cost-effective for handling 474c letters?

Yes, airSlate SignNow is a cost-effective solution for handling 474c letters. Our pricing plans are designed to accommodate businesses of all sizes, allowing you to choose a plan that fits your budget. By streamlining the eSigning process, you can save on administrative costs associated with traditional document handling.

-

Can I integrate airSlate SignNow with other tools for 474c letters?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage your 474c letters alongside your existing workflows. Whether you use CRM systems, cloud storage, or other business tools, our integrations enhance your productivity and document management capabilities.

-

How secure is the signing process for 474c letters with airSlate SignNow?

The security of your 474c letters is our top priority at airSlate SignNow. We utilize advanced encryption and authentication methods to ensure that your documents are protected throughout the signing process. You can trust that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for 474c letters?

Using airSlate SignNow for your 474c letters offers numerous benefits, including faster turnaround times, reduced paper usage, and improved organization. Our platform allows you to track the status of your documents in real-time, ensuring that you never miss a deadline. Additionally, the ease of use enhances collaboration among team members.

-

How can I get started with airSlate SignNow for my 474c letters?

Getting started with airSlate SignNow for your 474c letters is simple. You can sign up for a free trial on our website, allowing you to explore our features and see how they can benefit your business. Once you're ready, you can choose a pricing plan that suits your needs and start managing your 474c letters efficiently.

Get more for Internal Revenue Service Taxaudit com

- Ca twin rivers district school form

- Pb132 form

- Filesontariocafinalinformationchangeformform 3 information change form filesontarioca

- Wwwhancockcollegeeduasbgdocumentshigh school seniors application for allan hancock college form

- New york pistol license application form

- School uniform price list

- Ontario end tenancy evict form

- Elementary school accountability report form

Find out other Internal Revenue Service Taxaudit com

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word